It’s curious how companies change.

Dart (LON:DTG) - the multi-billion pound operator of the bright and bubbly Jet2 leisure travel business - started life in the 1970s as a transporter of flagrant flowers from Guernsey to the UK. Now it is perhaps better known for transporting slightly less fragrant stag parties.

The company's name is also rooted in its past: the type of plane that it first flew was a 1950s British turboprop aircraft called the Handley Page Dart Herald.

Dart’s shares have been a terrific success for many shareholders.

Over a five-year period, Dart’s share price has grown by an average of around 40% every year - and the group’s headline trading figures have kept up, with revenue more than doubling to £3.1bn and operating profit jumping from £33.2m to £222m.

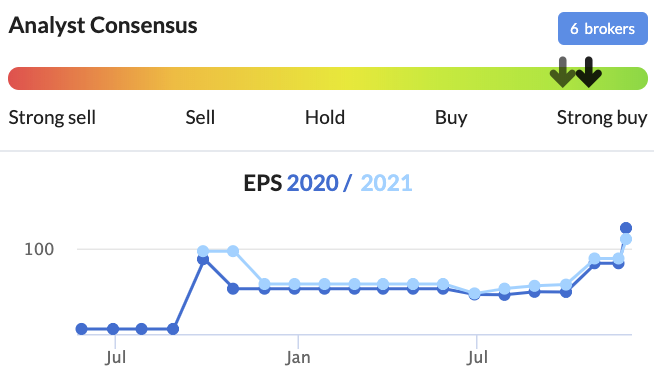

What’s more, brokers continue to view Dart Group’s prospects favourably and have increased forecasts for the next two years in light of Thomas Cook’s collapse.

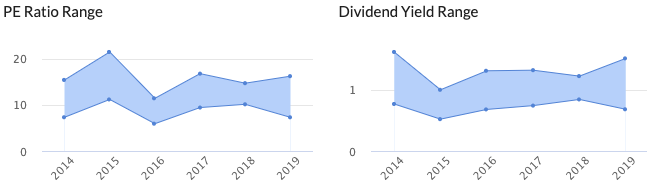

Despite this stellar track record, Dart Group continues to trade on an undemanding multiple of forecast earnings. Even after doubling in the past couple of months, it remains comfortably within its historic PE and dividend yield ranges.

So is there still an opportunity at 1,488p? Dart has gone from a £400m market cap company to a £2bn market cap company. How much bigger can it get?

For several reasons that I go into below, I have to conclude that Dart is not a company with an economic moat. If you disagree, leave a comment.

While there may be barriers to building up a package holiday business or a low-cost airline, the latter in particular is something of a commodity business. As Peter Lynch says, stocks of companies selling commodity-like products should come with a warning label: ‘Competition may prove hazardous to human wealth.’

However, Dart Group has proven to be an extremely competent operator. It is well-run and has enough financial strength and trading nous to continue to gain market share over the next couple of years, especially given the recent high profile bankruptcies of rivals Monarch and Thomas Cook Group.

The group’s chairman has been with the company since 1983 and has a 36% interest in the company. Its CEO came on board in…

.jpg)