With a quarter of the year gone, it feels like a lot has happened in the world, with far-reaching consequences for equity markets. I thought it would be interesting to see how the StockRanks have faired during this time.

Long-term performance

We know that the long-term performance of the StockRanks, rebalanced quarterly, is very good in the UK:

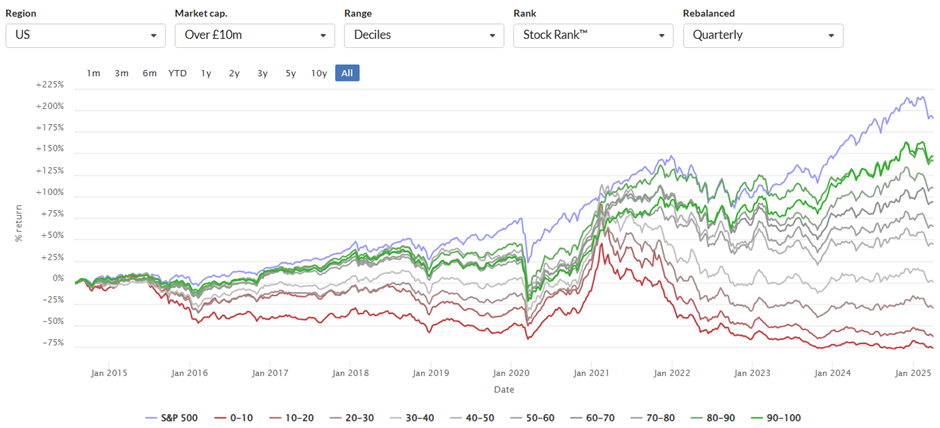

However, something strange has happened in the US. The same long-term outperformance of Super Stocks over Sucker Stocks exists over there. However, even the Super Stocks have been beaten over the last decade by the most popular passive index, the S&P500:

So what is going on? We have seen a similar effect in the UK over the last few years. Even the Super Stocks have only just beaten the rather tepid returns of the FTSE100 (on a price return basis). The median StockRank decile has massively underperformed:

Large vs Small

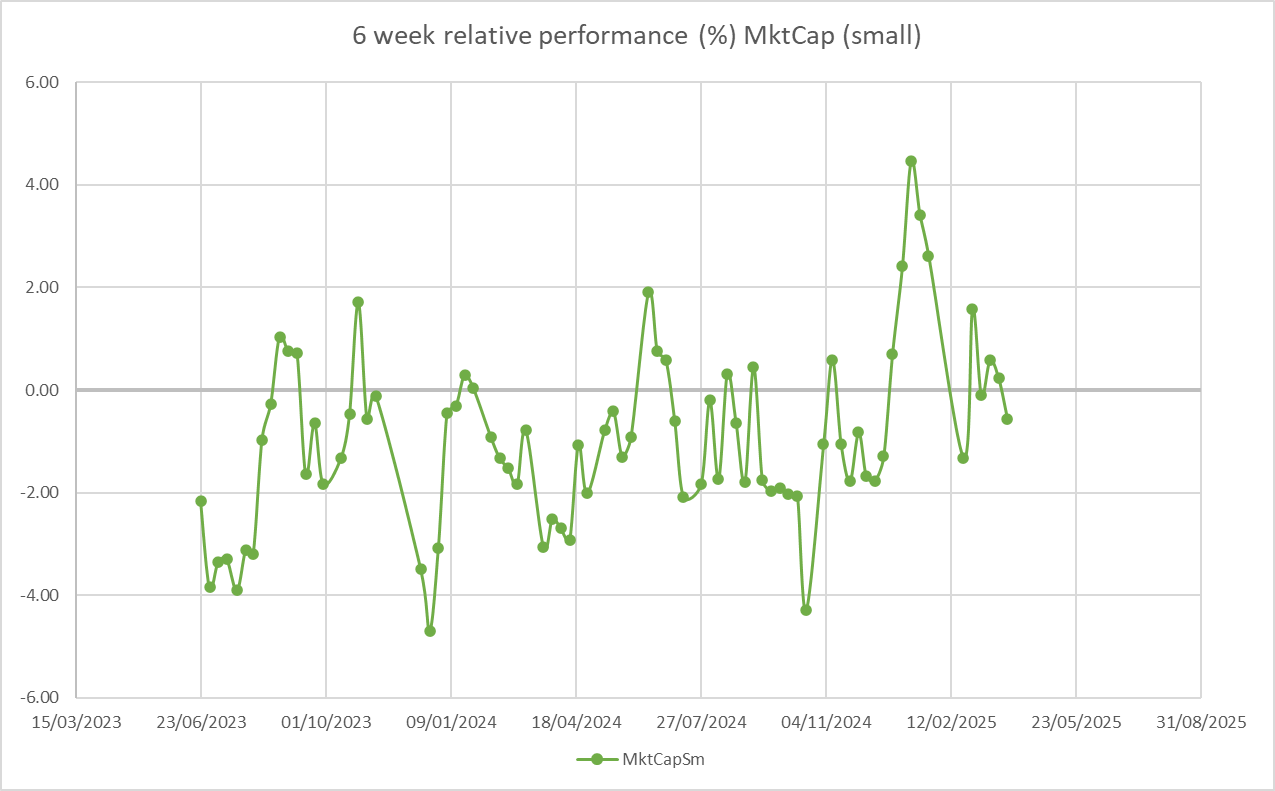

In both cases, this is because the largest stocks have significantly outperformed the smallest. What we are seeing is the difference between an equal-weight Stock Rank portfolio, which calculates the average return of the stocks in a particular decile, and the market-cap weighted index, which invests in proportion to the size of the constituent companies.

For many years, smaller companies outperformed larger ones. The reason is simple: smaller companies have much more scope for growth, which is also typically reflected in higher multiples. However, over the last few years, that orthodoxy has been turned on its head, with the largest companies significantly outperforming and being given a premium rating. There are strong arguments on both sides as to whether this is a rational adjustment to a tech-driven world or an irrational bubble caused by trend-seeking passive flows. Whether this change makes logical sense or not, one of the outcomes is that market-cap-weighted portfolios have outperformed equal-weighted ones with the same portfolio constituents.

The data is noisy due to the lack of stocks in each bucket, but when I concentrate on the largest stocks only in the UK, both the 80-90 and 90-100 deciles outperformed over the same 3-year period:

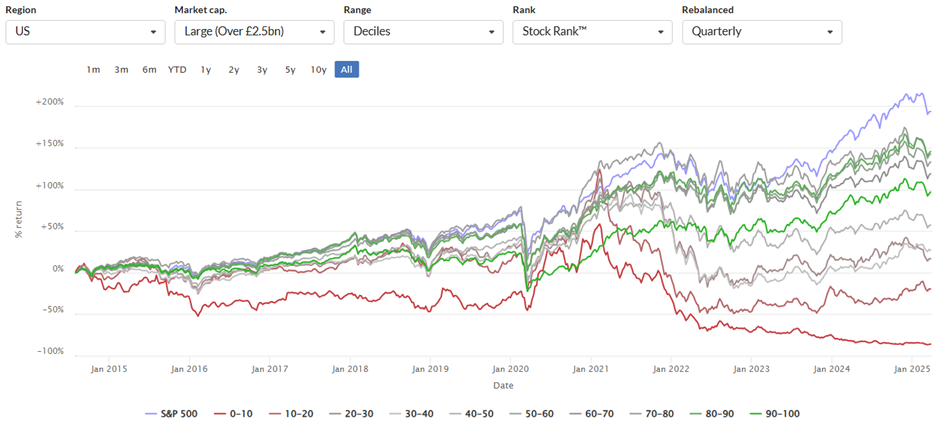

However, in the US, this same effect doesn't happen:

The issue here is that the £2.5b cut-off isn't high enough to capture the large cap effect in…