I recently wrote about a screen and a number of stocks that were making 52-week lows. One of the comments on the article series asked a thought-provoking question (reworded for clarity):

Should this type of investing (unhealthy companies and negative trending eps performance) be avoided by new investors?

I thought this was a topic worth exploring further.

Strategies we write about

First up, it's worth noting that we are unlikely to write about losing strategies on Stockopedia. We may write about the warning signs that tend to indicate poor investment outcomes, for example, my Gearing up to Fail article from a while back. However, we tend to avoid writing about shorting stocks (profiting from the share price going down) as this is a very advanced (and often risky) strategy. Hence, we tend not to screen for losers.

If we write about a strategy, in this case, 52-week lows, it is because it has some attractive qualities. Usually, the strategy is backed by academic studies showing outperformance against market averages. For 52-week lows, the seminal paper is one called Volume and Price Patterns Around a Stock's 52-Week Highs and Lows: Theory and Evidence, where Steven Huddart, Mark Lang, and Michelle Yetman found that buying a basket of stocks that hit 52-week lows outperformed the general market.

Of course, academic evidence alone doesn't guarantee outperformance. Sometimes the market adapts. For example, when Richard Sloan published their research into the accrual anomaly in 1996, the effect promptly stopped working. (The accrual anomaly found that stocks where cash flow more closely matched earnings outperformed those that didn't. The thesis was that investors focused too much on accounting earnings and not on cash generation.) It stopped working because, presumably, practitioners read the paper and adapted to focus more on cash flow and not just reported earnings. Momentum is the strongest-performing academic anomaly, yet funds created to exploit this have largely failed to outperform the market. It seems that the impact of costs, or other factors, may mean that a strategy fails to deliver in practice, at least when implemented in line with the academic research..

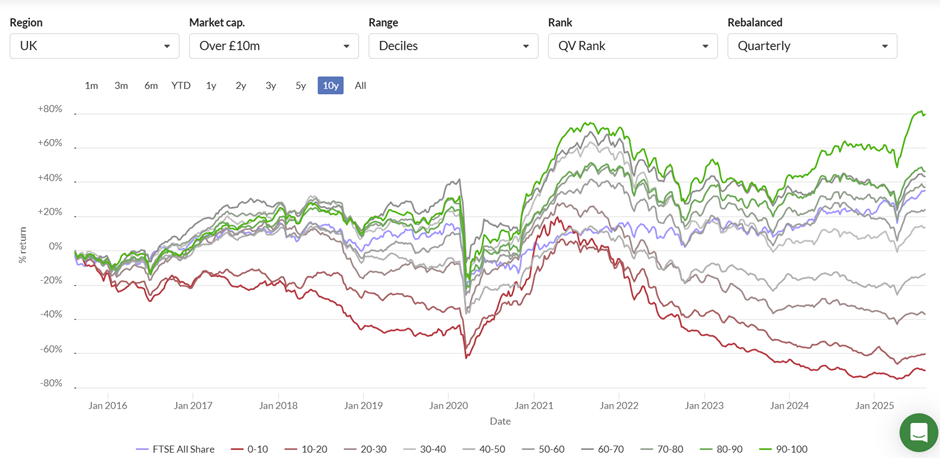

In addition, Stockopedia has tools that show how different strategies perform. For example, the Contrarian style of investing that most closely matches a 52-week low has a good track record of beating the market over the last 10 years:

There are also…