John D. Rockefeller once said: ‘Do you know the only thing that gives me pleasure? It's to see my dividends coming in.’ Presumably, nothing ruined Rockefeller’s day like a dividend cut. For modern day investors, the threat of a dividend cut can be just as unsettling, especially if the cut is symptomatic of deeper financial troubles.

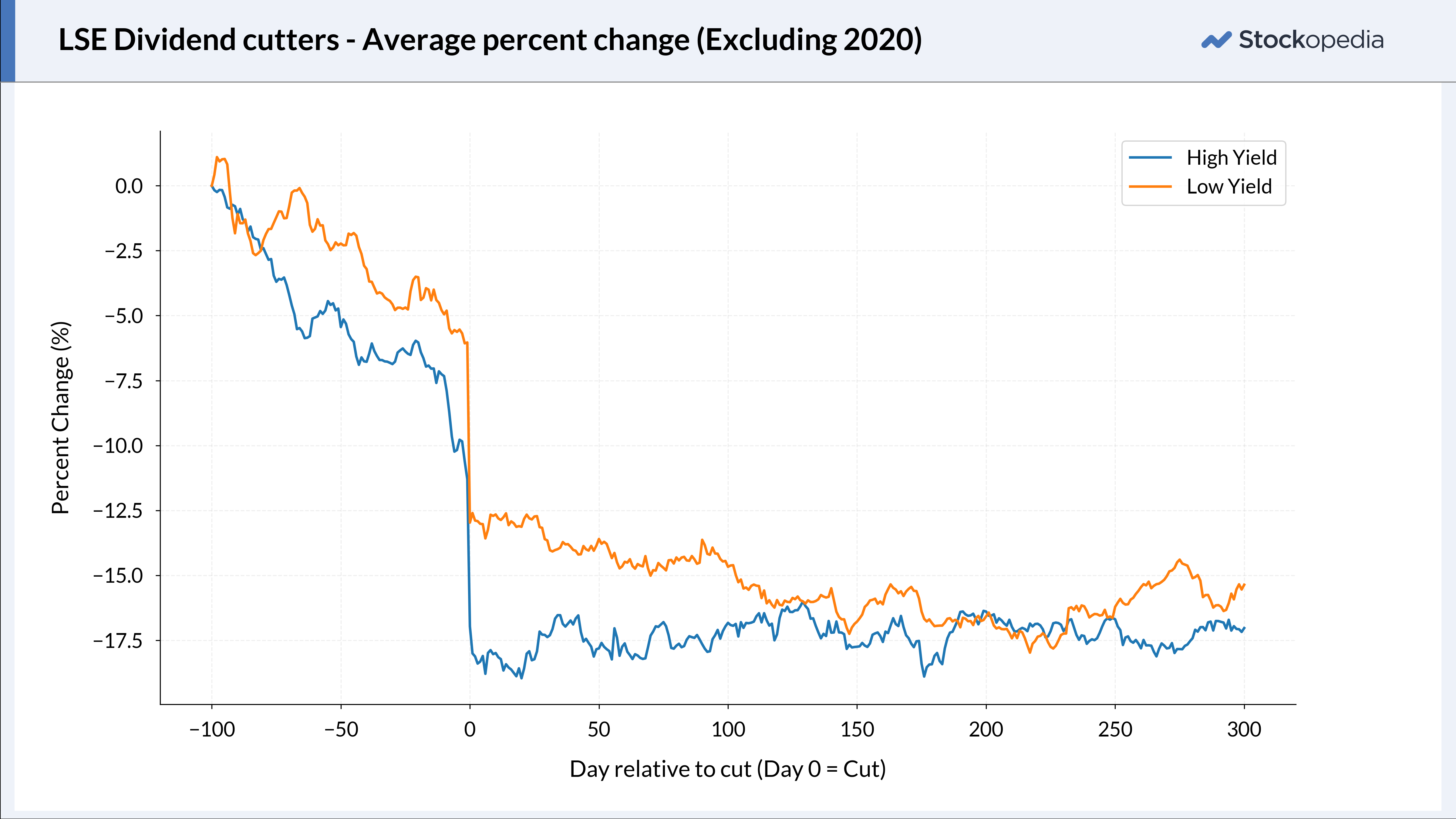

But only in very rare cases do dividend cuts come out of the blue. By evaluating share price trends and key financial metrics, investors can minimise the risk of dividend disruptions. Over the past few weeks, we analysed over 700 dividend cuts that have occurred since the beginning of 2020. Our review included:

- Companies that canceled a specific payment.

- Companies that suspended payments indefinitely.

- Dividends where the cash payout had declined on a year-on-year basis.

- Dividends where the payout was lower than initially promised.

Our goal was to identify red flags that appear before a dividend cut, helping investors align with the base-rates and minimise portfolio risk.

Trust the crowd

Many investors, including Warren Buffet, take a contrarian approach, insisting that investors should be fearful when others are greedy and greedy when others are fearful. The problem is that this mantra may not work all the time. Last week, my colleague Mark showed that the price tends to fall before the dividend is actually cut, as if the market has a collective crystal ball. It could be that the market knows something we don’t. This is perhaps why we should trust the wisdom of crowds…

According to the ‘wisdom of crowds’ theory, the collective knowledge of a large, diverse group is better at making decisions than the knowledge of any single individual. There are a few caveats: the theory assumes that the group is diverse, and that individuals in the group are not influenced by others. This theory is very applicable to the stock market. It nicely compliments the efficient market hypothesis, which argues that share prices reflect all available information about a given stock. Both theories emphasise the power of collective knowledge.

The stock market is made up of investors (i.e., the ‘crowd’). They often make independent decisions using their own information. In turn, the collective action of all these investors lead to stock prices that accurately reflect all available information. Can this collective knowledge foresee a…

.JPG)