"I understand that I should buy quality, value, momentum shares and the StockRanks are a good guide to this... but I've still got a major problem when should I sell?"

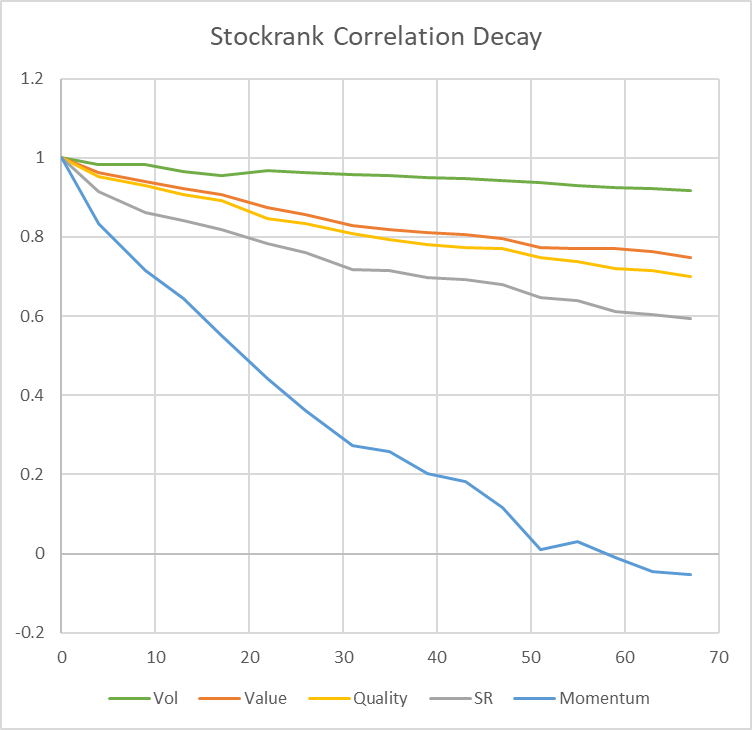

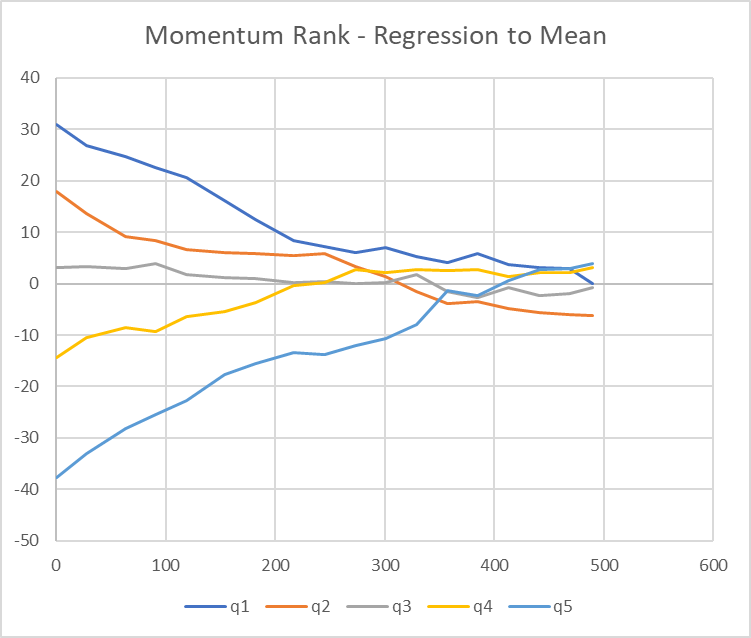

It's a very good question. It's all very well thinking "90+ StockRank shares tend to beat the market" and buying 90+ ranked shares accordingly - but managing a portfolio of shares on this basis poses real questions. The rank for a high ranked share will tend to fall over time, so it's highly likely it will cross below the 90 level within any reasonable investment timeframe - often within weeks or months. When is the right time to sell?

I'll cover two approaches to answering this question using the StockRanks in fully invested portfolios - periodic and threshold rebalancing. I'll introduce some key rules of thumb from a fascinating recent research paper that anyone can apply. What I won't cover is sell rules used by more active strategies - such as stop losses, timing indicators or other fundamental sell signals.

Periodic Rebalancing

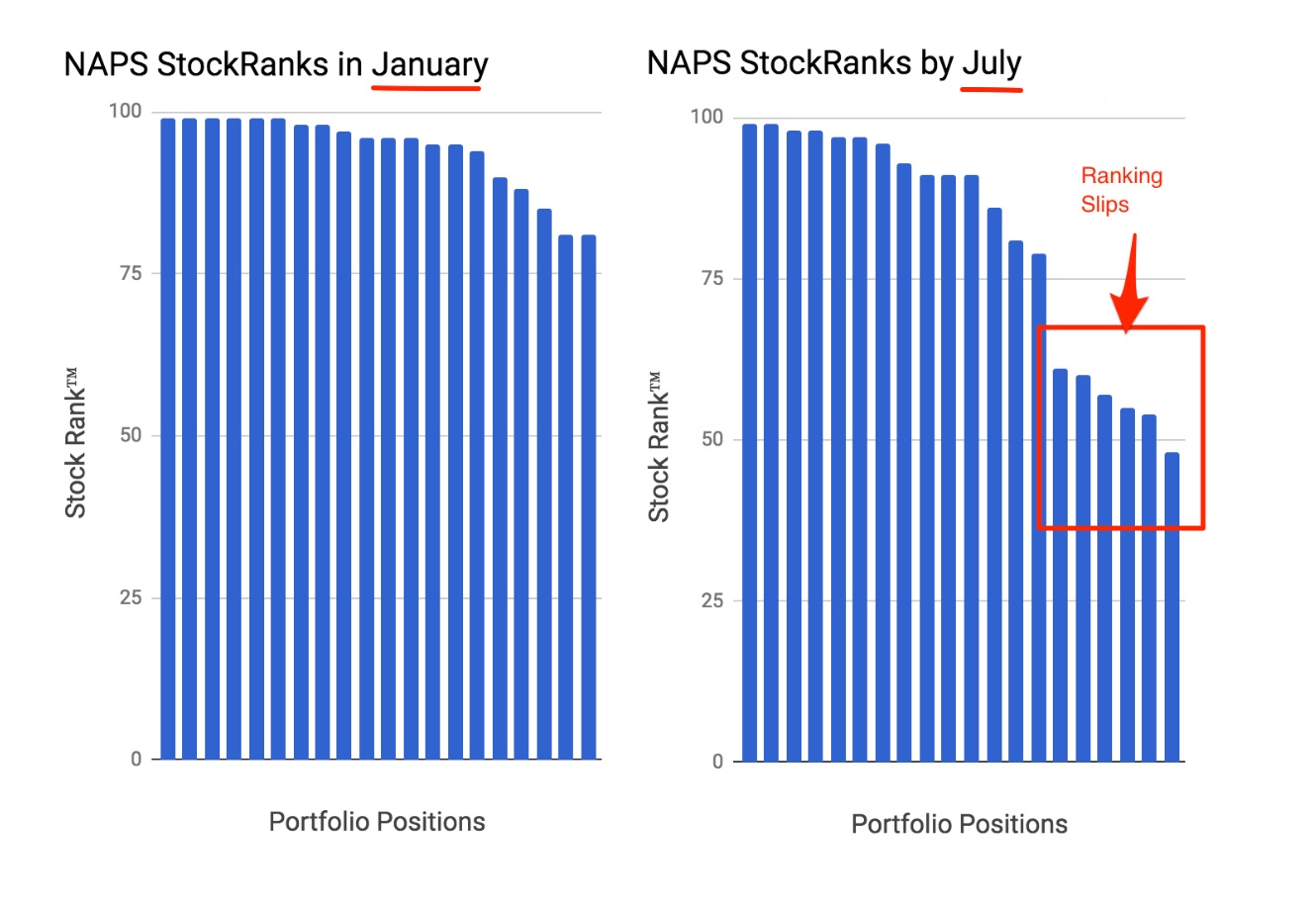

One solution I've long promoted is to use periodic rebalancing which ducks the question of when to sell by waiting till a point in time. The slow moving "NAPS" investment process buys a portfolio of high ranked shares and rebalances them annually, ignoring any ranking movements in the interim. What tends to happen is that the ranks of the holdings drift downwards as the year progresses. Even at the half year mark you see a significant fall in the average ranking. This year's portfolio has already about 20% of the portfolio below a 55 ranking. But if you are rebalancing annually, you just ignore all this and wait.

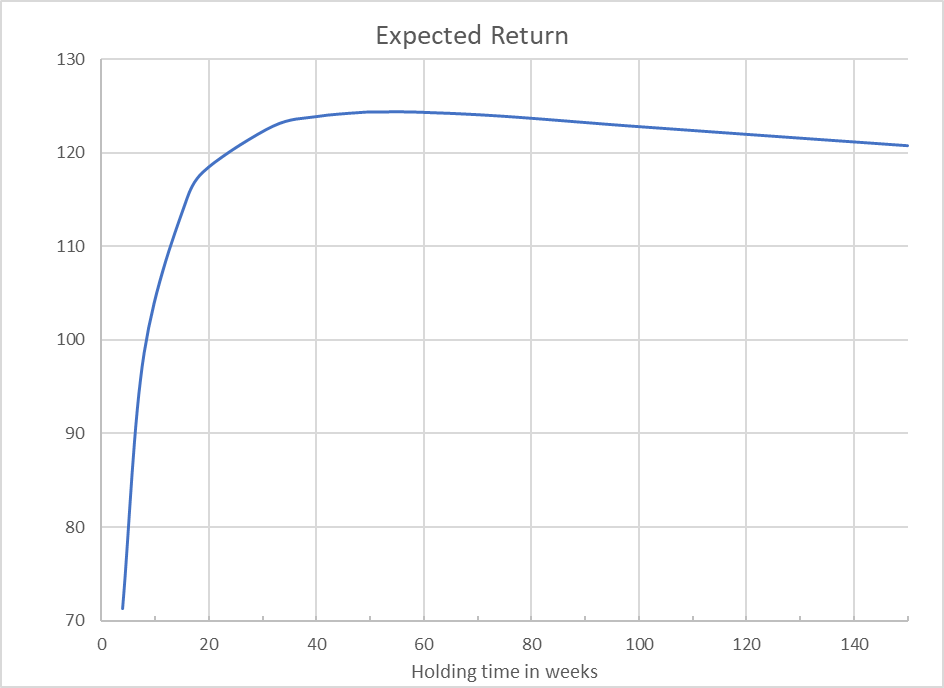

I'm working on some research to investigate the optimal rate of rebalancing vs transaction costs which I'll share in future, but in essence annual rebalancing is very hard to beat.

But what if we want a more active approach to sell rules?

Threshold Rebalancing

The alternative is to use threshold rebalancing. To select a lower StockRank threshold at which to sell shares to free up funds to invest in higher ranked alternatives. Our own staff Investment Club had some discretionary set 'guard rails' within which Club members could pitch shares. We set the buy threshold as a minimum 75 StockRank and a forced sell threshold whenever the StockRank fell…