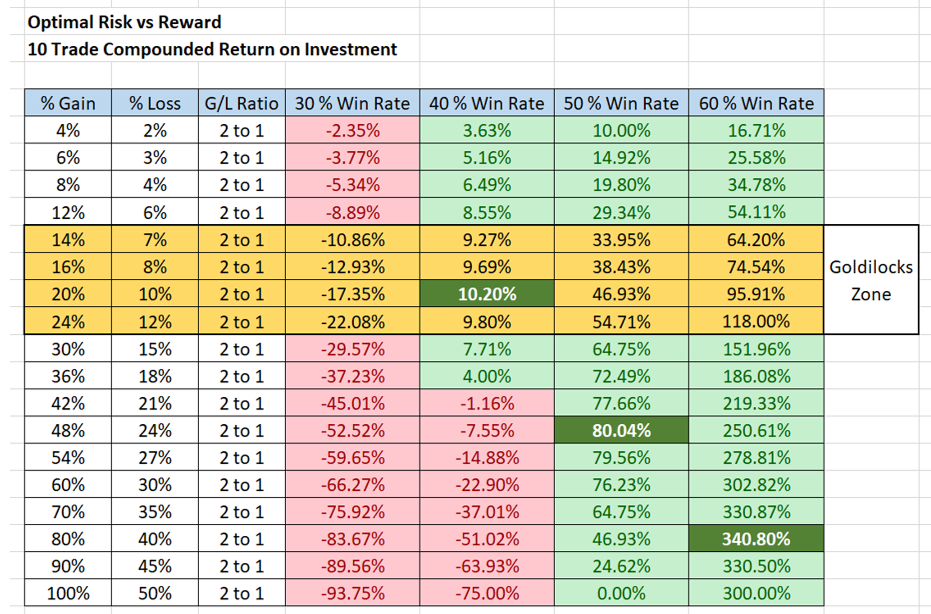

Let's look at what is optimal in terms of average percentage win vs average percentage loss across different win rates, assuming a 2:1 gain vs loss ratio.

Note the table in Fig 1. This table shows the optimal 10 trade compounded return on investment for average percentage win vs average percentage loss assuming a 2:1 gain vs loss ratio.

Fig 1:

To put this table into the context of investing, imagine you went to the horse races and there were 10 races to bet on. A magical genie appears and tells you you're going to win on 4 out of 10 horse races (40% win rate).

The magical genie says to you that you can pick how much you'd like to win in percentage terms (0% - 100%) on your 4 winning races. The only caveat is you'll close half that percentage on the 6 losing horse races (2:1 gain vs loss ratio).

So, what do you pick in percentage terms to win on your 4 winning races... 30% ... 50% ... 100%?

Due to the maths involved there must be an optimal answer.

As you can see on the table in Fig 1, the optimal response to the magical genie would be "I'd like to win 20% on my 4 winning races and therefore lose 10% on my 6 losing races".

The magical genie is intrigued, he asks "that's very specific, why did you pick 20% and 10%?".

You reply "because anymore or less at a 40% win rate with a 2:1 gain vs loss ratio and the results deteriorate from the 10.20% compounded return on investment".

Now we're getting somewhere.

So what does any of this mean and how can you use this new knowledge?

Often times we get confused for when to sell out of a position and lack a clear rationale for as to why. Surely it's a better strategy to target what is optimal and reverse engineer.

By knowing how you can be profitable at a 40% win rate, you can start to build failure into your trading process. I'm not saying you're going to commit 100% of your capital to each trade, that's not sound risk management nor optimal position sizing (which I'll cover in future posts). It is important to start from a place of optimisation.

Remember, the timeframe you trade on…