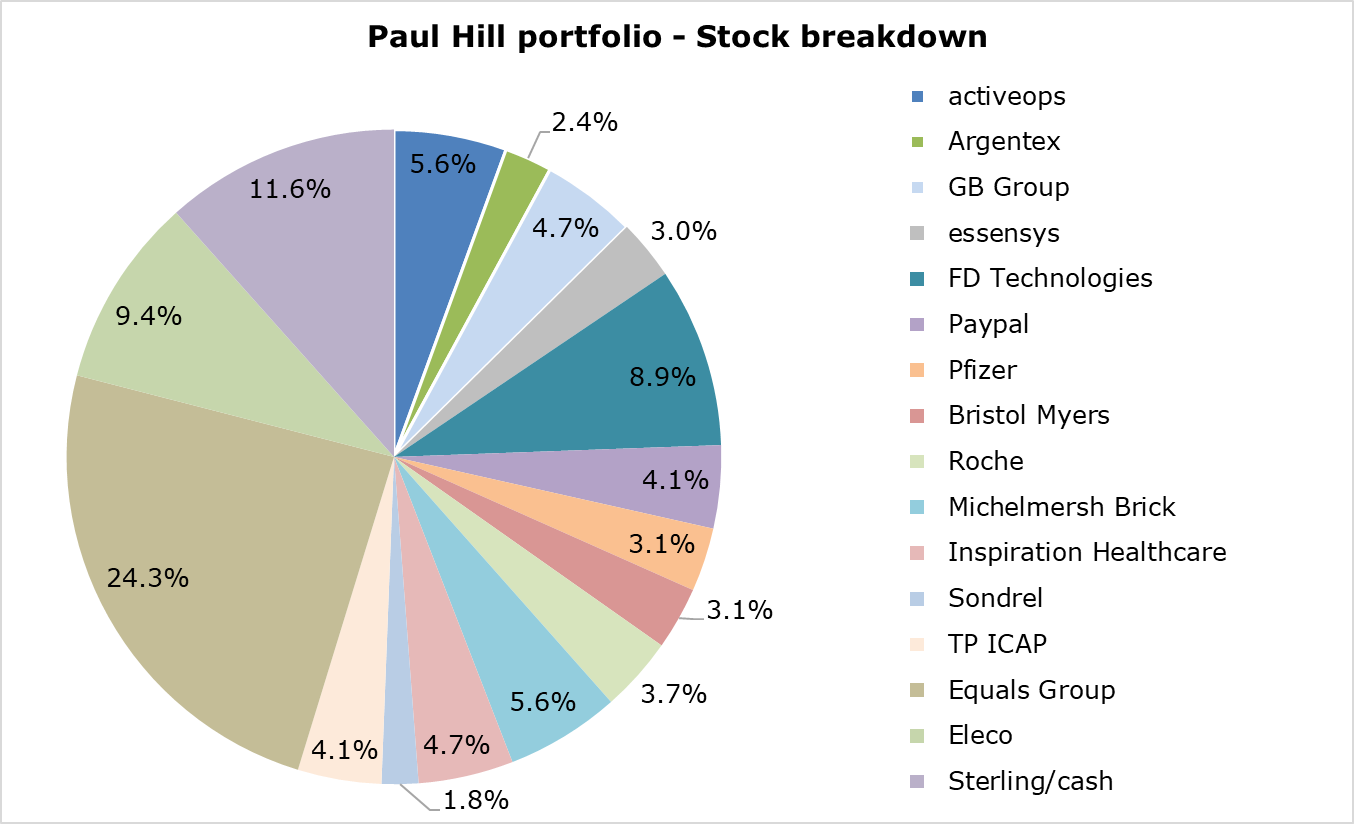

This is probably the $64m question currently puzzling many 'AIM rich' investors like myself (see portfolio split below). So what's the answer?

Well to me, the single most important headwind that has ripped through smallcaps over the past 18 months has been their soaring cost of equity (re risk premium), due to higher interest rates & borrowing costs.

In turn, this has caused a flight to 'lower beta' asset classes (eg largecaps & money market funds), alongside a tide of smallcap fund redemptions. Which has not only crushed shareprices & valuations, but also sucked liquidity out the plumbing.

So when might this reverse?

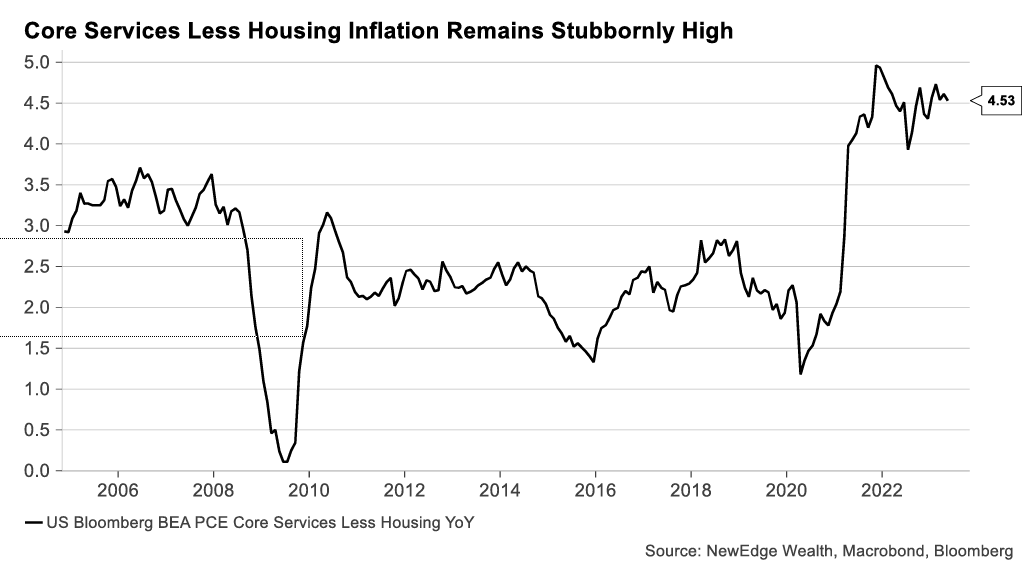

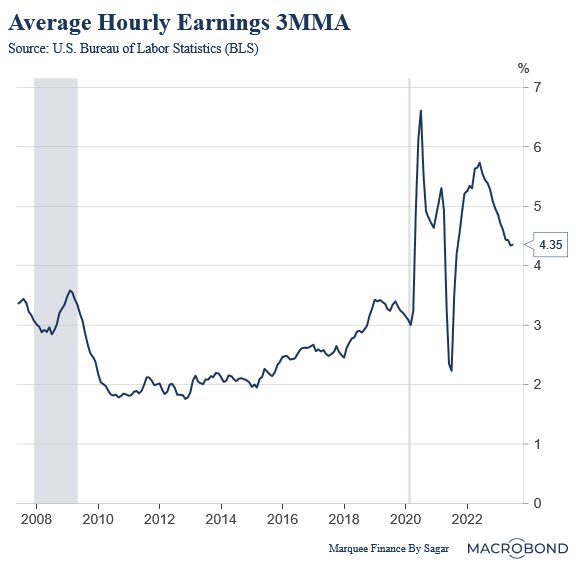

Well it's impossible to say for sure. Albeit my take is that once wage inflation begins to track towards a sustainable 2%-3% level (ie consistent with a 2% core CPI) vs 4.35% in yesterday's US jobs report (see below).

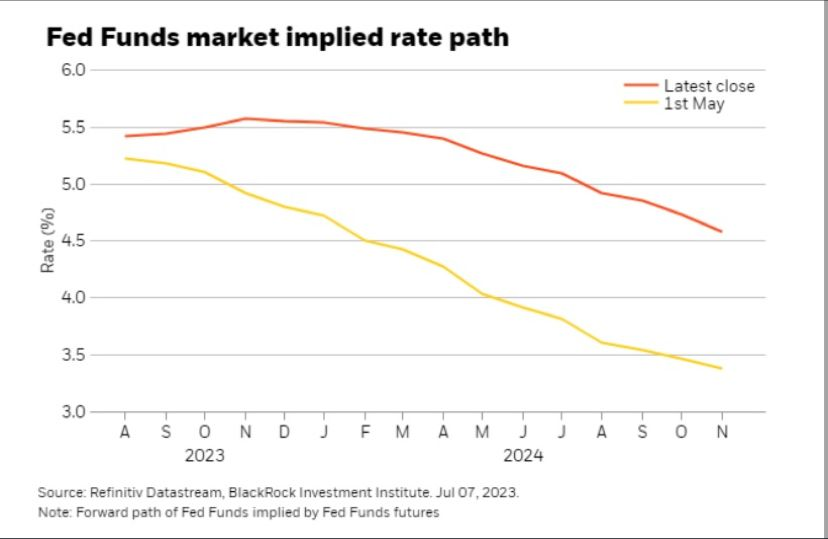

Then this should provide the necessary 'green light' for the Federal Reserve & other central banks to begin cutting rates (Note: US' dual mandate to balance GDP growth & inflation).

Unfortunately however in the meantime, there is still likely to be short term choppiness across smallcap land. Especially as the Federal Reserve is almost certain (93% probability) to hike rates again by 0.25% on 26th July.

Reflecting ongoing staff shortages, disputes & the pandemic's enduring impact on the participation rate. Indeed there's even a chance over the next 6 months or so - of a “full employment earnings recession”. Where tight labour markets continue to encourage corporates to 'hoard' workers, even if sales decline.

Either way though, at this point I suspect central banks will 'blink' - particularly as there are Presidential & General elections in 18 months' time on both sides of the Atlantic.

Meaning with investors typically reacting 6-9 months ahead of economic data - my best guess is that UK smallcaps should begin to bounce back sometime in H1'24.

For me, its better to be early than late. Time to be patient.