It goes without saying that 2020 has been a difficult year for everyone and the disruption caused by the COVID-19 pandemic looks set to continue into 2021.

This is equally true for the business world; while some companies have experienced an uplift in financial performance during COVID-19, many more have struggled to stay afloat.

This extraordinary situation has been reflected in the world’s stock markets, where share prices dramatically fell in March 2020 and have yet to fully recover.

After witnessing the volatility of the London Stock Exchange this year, we began to wonder: how has COVID-19 affected business performance at a regional level?

To answer this important question, we analysed our internal databases to compare the average stock performance of publicly listed companies in the biggest UK cities over the course of 2020.

Here’s what we discovered…

Where have public companies in England performed the best in 2020?

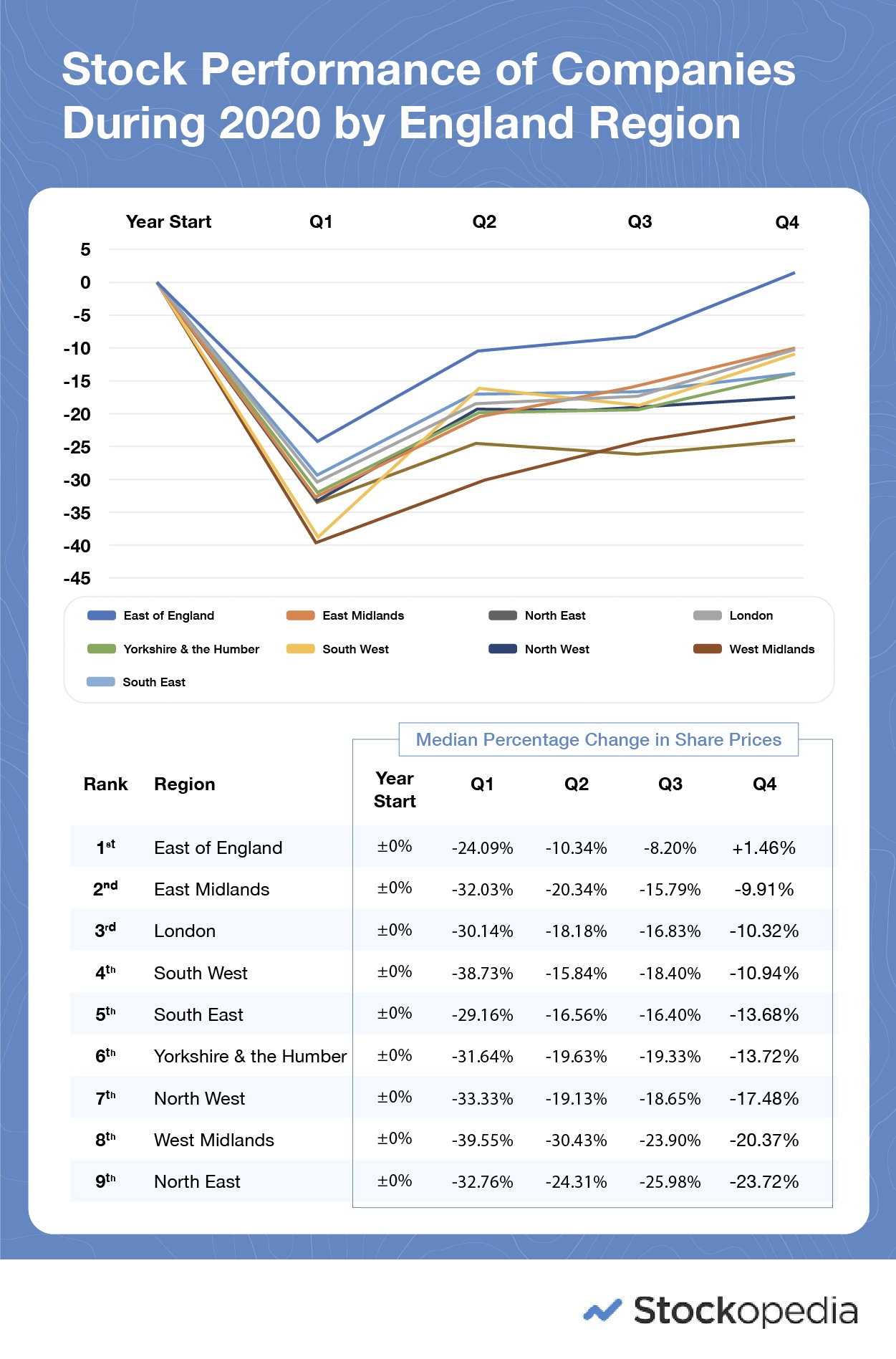

We began by taking a look at how the public companies in each of England’s regions have performed on the stock market over the course of the 2020.

The only region to have stronger returns in Q4 versus the start of the year is the East of England (with a small improvement of +1.46%). Since the initial drop of -24.09% in Q1, its recovery has been strong - the region’s numbers have gradually increased since Q1 end and it is now outperforming its year start levels, leaving the East of England far ahead of the rest of the country. Before the UK Government’s announcement of a second national lockdown in England in November, most of the East of England was categorised as Tier 1 with minimal restrictions on businesses, apart from hospitality. Additionally, the region is home to companies like Tesco and Ocado Group, both of whom saw a lot of growth due to the boom in online shopping since the start of the pandemic.

Interestingly, it seems that many of the North of England’s listed companies haven’t fared as well as their southern counterparts, with many experiencing a far slower return to pre-pandemic share price values. The country’s worst hit region is the North East: although it has seen some improvement since the end of Q1 (going from -32.76% to -23.72%), the…