Last week I wrote an article on America’s big tech companies in the wake of their second quarter earnings announcements. The conclusion: Apple, Amazon, Alphabet and Microsoft are fabulous businesses (even the latter two which missed their own and brokers’ expectations expectations in their recent numbers) but remain questionable investments with market capitalisations of over $1trn.

The article prompted a thought provoking comment:

So what is a Poor (relatively) Old (absolutely) Investor going to do? Keep his or her Core Portfolio in these highly liquid stocks or in UK small caps with wide spreads, stamp duty, commission friction, dangers of profit warnings, pumping, dumping, and corporate skulduggery?

It’s a tricky question to answer. High quality companies often come with exorbitant valuations and expectations of continued outperformance. If those high expectations are not met, investor disappointment can send the stock into a downward spiral.

The additional fear with the large cap tech stocks is that their bulk has propped up the US market (and in turn the passive investing universe) for so long that any excess selling could initiate a feedback loop which results in passive outflows and further share price misery. And that fear keeps many investors out of these wonderful businesses.

And so, we come back to the question: what is an investor to do?

Ed offered up a solution in the article he wrote last week. Rather than searching for perfect businesses which have excellent fundamentals, are riding the upgrade cycle but are not ridiculously overpriced, he has suggested investors should build a portfolio of stocks which together form an average which ticks all the boxes.

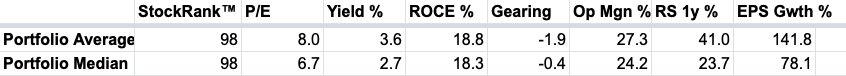

Here are the key statistics from his portfolio of top ranking stocks in the UK diversified across the sectors:

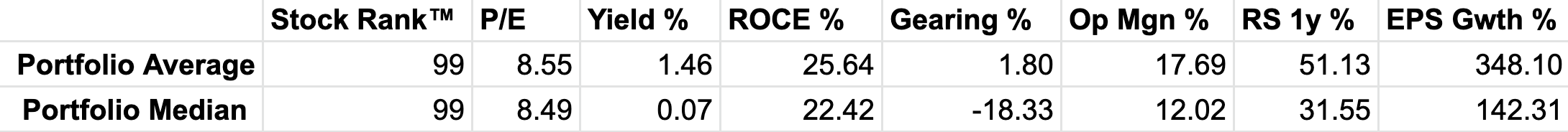

I have generated similar results when applying the same criteria to the US market - the only real disappoint here being the relative lack of yield:

So, in response to investors who worry how to construct a portfolio of wonderful businesses which have genuine momentum and aren’t over priced, the answer is simply to stop trying. Build a well diversified portfolio of decent companies which on average will give you an excellent portfolio.

And yet…

Using simultaneous screening to build a portfolio fails to acknowledge the individual attributes of…