I have a pretty simple approach to investing; look for good companies at good prices. It’s not exactly rocket science, but it does require looking at the bigger picture, and the guts to back your own opinion over the market’s.

So what is a good company? Again, that’s pretty simple really. It’s one that’s profitable rather than not profitable, returning cash to shareholders (paying a dividend) rather than not, and growing rather than shrinking.

For most people, if you’re interested in a shrinking, unprofitable and cash-consuming business rather than a growing, profitable and cash-dispensing business, you may be better off finding someone else to manage your money.

Of course I’m stating the obvious. Most investors want good businesses, but what separates the successful from the unsuccessful investor is usually the price they’re willing to pay.

My general rule on price is to buy low and sell high; insightful I know. More specifically, I mean buy when the price is low relative to other investments with similar characteristics (in terms of growth, profits and dividends), and sell when the opposite is true.

So let’s take a look at Whitbread and see where it leads us.

Whitbread – The UK’s leading hospitality business

Whitbread (LON:WTB) is made up of a group of leading brands which most people will have heard of. Most of the sales and profits come from Premier Inn (the UK’s largest budget hotel chain) and Costa (the largest and fastest growing coffee shop chain in the UK), with the remainder coming from restaurants, including the famous Beefeater Grill.

These are strong, market leading brands, but what has the company managed in terms of financial results?

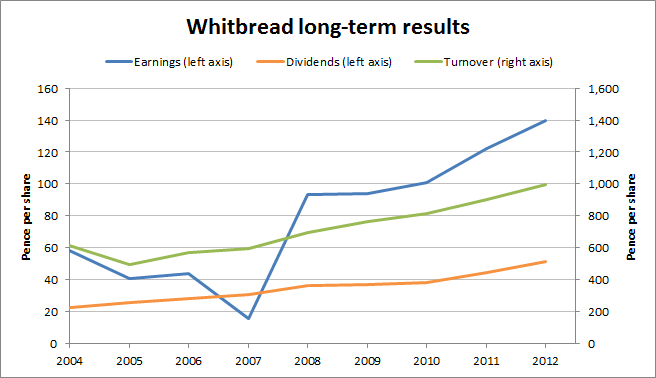

This is exactly the sort of results I like to see; a relatively steady march upwards over time, at a rate of something like 9% a year. The dividend has been progressive, despite the initial downward trend in earnings, which the company has since reversed. Sales have been more steady, and overall the picture is one of repeated success.

2007 was a year of substantial change, with the company selling its interests in both Pizza Hut and TGI Friday’s, along with some 239 pub restaurant sites. The turnaround strategy since then certainly appears to have worked, with sales and profits up substantially.

Although the company appears financially strong,…