Trifast PLC is a solution business to all things on mechanical fastening.

Here are some real-life examples:

- One car maker was having issues with a fold-back seat on a people carrier. Trifast designed a widget that enabled the seat to recline properly.

- A washing machine needs fasteners inside the drum to make sure it stays in place en route from the factory to the home. Trifast created a single product to fix the drum in place, rather than several fiddly fasteners.

You may think these are one-off problems and aren’t sustainable in the long-term. In fact, the opposite is true when Trifast operates in 27 countries and manufacture 150m fasteners product each day. It can send their goods to over 60 countries.

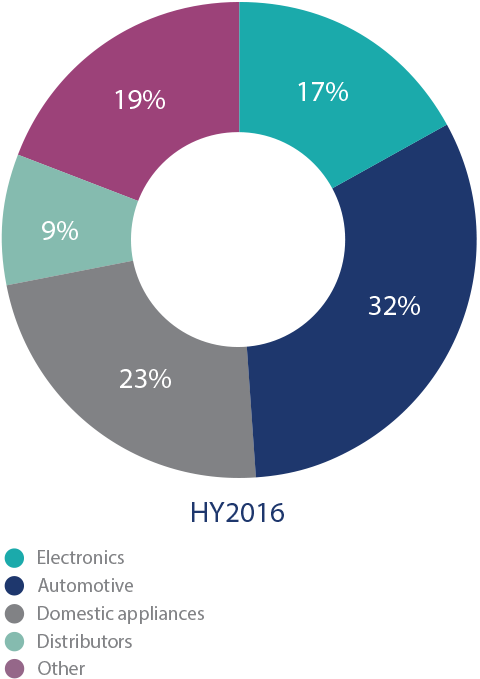

Creating fasteners to solve day-to-day problems aren’t consigned to one particular sector or industry, it is a problem at most industries (think physical goods). Below is a pie chart showing the sectors that need Trifast help:

Now, we know what Trifast PLC does. But is this the time to jump on the bandwagon or put it on your bucket list?

Let’s find out.

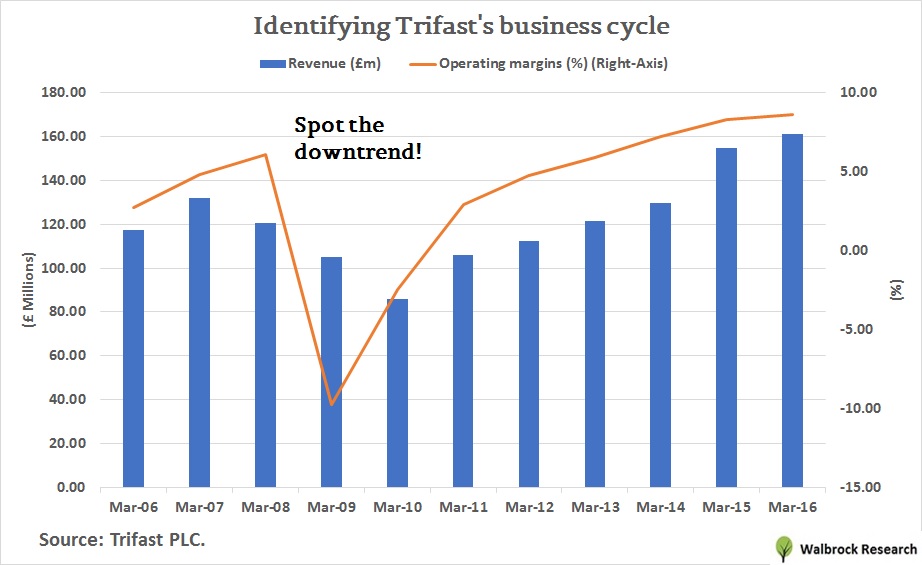

Before talking about valuation, we have to understand the business cycle of Trifast PLC.

The Importance of the Business Cycle

Unlike your Unilevers and your Coca-Colas, Trifast is affected by sentiments and adverse economic conditions.

When times get tough, Trifast business will shrink because demand has collapsed. This was the case in 2008/09 financial crisis when its revenue and operating margins fell pretty dramatically. Also, it took a long time for it to recover.

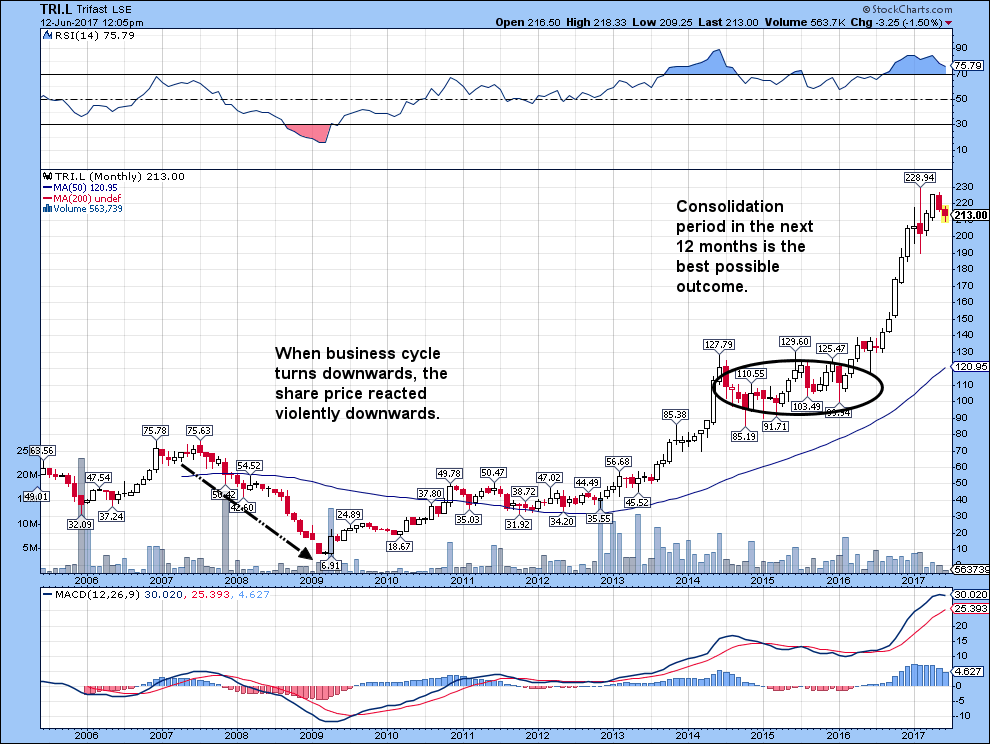

Okay, some of you may not be interested in the business cycle and are more focused on its share price.

But, the fundamentals correlate with its share price, period!

That is evident in the chart below, you can see Trifast share price has lost over 90% from peak to trough between 2008/09.

You may also notice it’s recovery when business starts making money again. Today, the shares are 200% above their previous peak in 2007 of 75 pence per share! So, is the market too optimistic or are the prospects of Trifast PLC were that good?

Let’s see.

Trifast PLC’s Valuation

The average share price is £1.47 per share…