I must confess that one of my cars is currently insured with Admiral Group, but that's not the reason why the company's shares sit at the top of my stock screen.

The real reason is that Admiral and its shares have all the features I look for in an investment to a greater extent than any other (or at least any other from the FTSE All-Share).

Admiral is a very successful but somewhat unusual insurance company

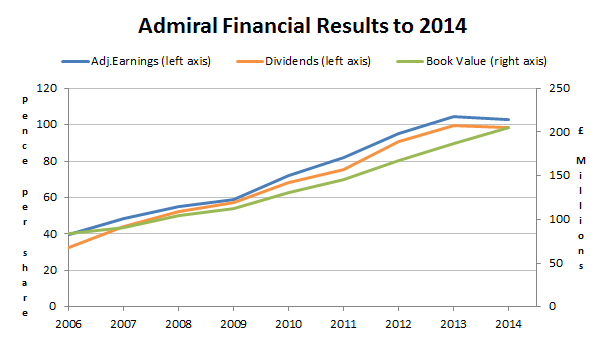

What do I mean by successful? In simple terms I'm looking for a combination of outstanding profitability and consistent, profitable dividend growth. On the growth front, here are Admiral's results for the last few years:

In terms of the various financial ratios and other metrics I'm most interested in, the company also looks extremely good:

- 10-year unbroken record of profitable dividends

- 10-year average ROE = 53.6% (FTSE 100 approx. 10%)

- 10-year Growth Rate = 13.3% (FTSE 100 = 1%)

- 10-year Growth Quality (i.e. consistency) = 91.7% (FTSE 100 = 54.2%)

- 5-year average Combined Ratio = 89.6% (market average over 100% according to Admiral)

- Operational debts to 5-year average earnings ratio = zero (I think anything below 4 is reasonable for a cyclical company like Admiral)

The ROE figure is incredibly high. In fact it's suspiciously high and the reason is that Admiral is a very unusual insurance company. It's unusual because over the last 10 years most of Admiral's profits have come not from insurance, but from something which the income statement calls “other" profits.

Most of Admiral's profits come from non-insurance income

These “other" profits are made up primarily from “additional products and fees", which includes breakdown insurance, car hire, personal injury insurance, instalment charges and fees for things like cancelling mid-term or sending out replacement documents. All of those are sold to or charged to its car insurance customers, boosting income per car by something like £70 a year.

On top of that there are profits from Confused.com and other international comparison websites (which Admiral owns) and perhaps in the future there will be profits from the sale of BRIAN the Robot toys as well.

These “other" profits are an area that Admiral focuses on to a much greater extent than other direct insurance companies.

One way to look at Admiral then is as a lean, low-cost insurer with the primary aim of …