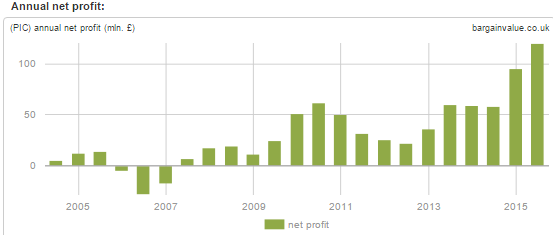

I can't understand why Pace (LON:PIC) is so cheap after 3 years of EPS growth of at least 36% per year. Value rank of 75, Graham formula Margin of Safety of 100%, ROCE is 16.5%, Dividend has been increasing rapidly. What are your thoughts on why the share price is so low? Is it a screaming BUY?

I think Pace is in one of those industries that every fund manager knows is being usurped by the internet so nobody wants to own it. I mean we are all using iTunes, Netflix, Apple TV, Amazon Prime... why should anyone need a Pace set top box ? The stock is an easy sell - who'd want to be seen owning it ?

But of course, Halfords is in the same position - and I remember in 2012 it was at the top of everyone's sell list... but it became ridiculously cheap, started passing loads of screens on Stockopedia and rebounded strongly - more than doubling since. There's a lot of companies being usurped by the internet, but consumer habits, and business models can take longer to change than many think.

I notice Pace is a 98 StockRank stock. I've always said the StockRanks tend to highlight unpopular, difficult to buy stocks. Maybe Pace is a classic example of this - a boring, cash generative business model with a cheap valuation reflecting future problems...

I note the brokers are having to upgrade their numbers, so it may be picking up some momentum. Perhaps a lot of value has been left on the table here? Have dumb heuristics taken over here ?