Bioventix was founded in 2003 as a biotechnology company specializing in the creation and supply of high-affinity sheep monoclonal antibodies (SMAs) for use in immunodiagnostics.

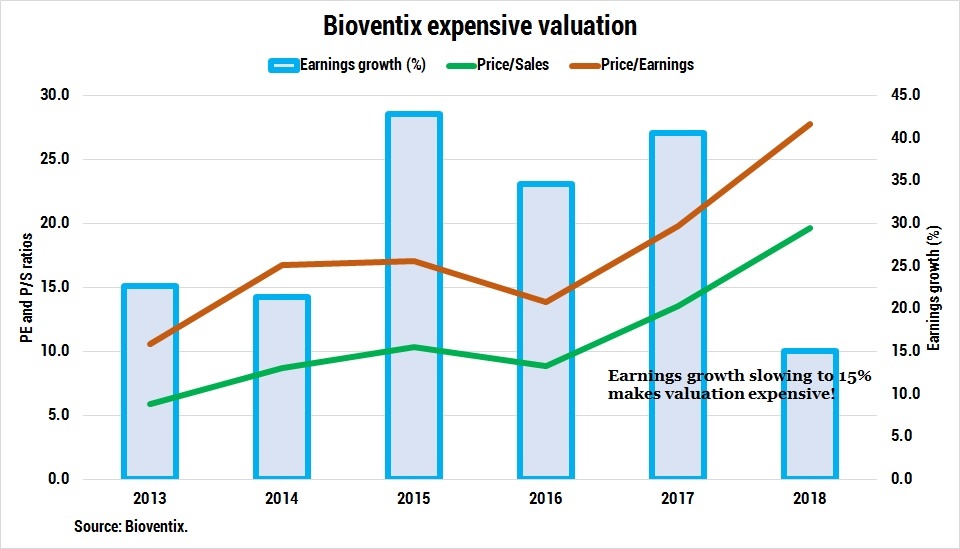

Current year sales came in at £8m (if you ignore backdated royalties of £0.8m), marking their eighth year of sales growth. Net profit came in at £5.7m, an increase of 15%, the growth rate won’t please shareholders because it’s a slowdown from last year earnings growth of 40%.

Bioventix most significant revenue contributor comes from the vitamin D antibody called vitD3.5H10. Sales rose by 23% to £3.4m. The usage of this antibody is for a number of small, medium and large diagnostic companies around the world for use in vitamin D deficiency testing.

Royalties from licensing the technology.

Why the market is loving Bioventix?

The following factors are the reasons why the market like Bioventix: -

1). Unique business model; - Bioventix spend very little on capital investment, therefore, requires little funding to become profitable.

That’s because Bioventix sells their technology to third-parties, who does the manufacturing and product development. In return, it receives royalty payments.

A license and royalty business produce high operating profit margin, which is currently earning 85%.

2). No debt; - Companies with no debt give shareholders more equity of the business, this lowers the probability of bankruptcy to (near) zero.

3). Requires little funding; - With a licensing and royalty business model, Bioventix spends little on manufacturing facilities, marketing and distribution.

4). Low capex; - Bioventix spends between £100k to £200k on capital investment each year, and this manages to generate increasing amounts of sales each year.

Valuation looks too high for Bioventix

Without knowing the market size or its potential, I can’t say whether Bioventix is expensive or cheap.

Apparently, that didn’t faze the market, as there were a host of good reasons for sending this company’s valuation multiple to new highs. Their latest earnings growth of 15% is now below that of the company’s PE of 28 times causing the PEG ratio to rise above one time. Therefore, (despite these positive attributes) Bioventix is no longer a cheap stock for short-term gains!

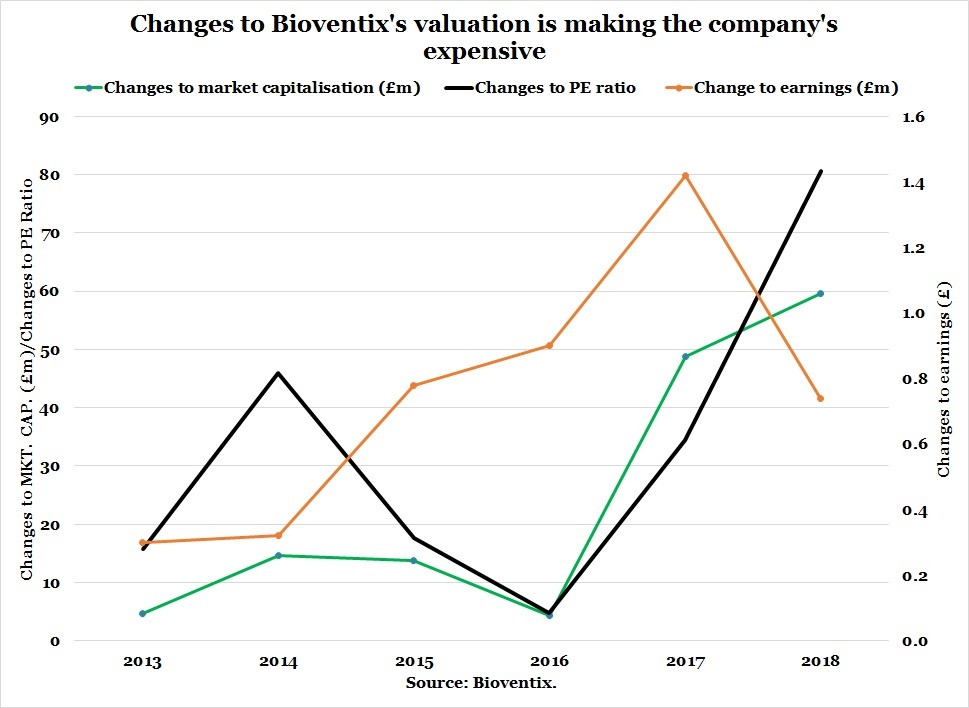

Here is a deeper look at Bioventix’s valuation below:

Last year, the market was…