Why do buses always come in three’s, SLP, THS, JLP

After a long period of waiting why do buses come along is a common expression and a real-life experience for anyone using public transport. Apparently, the subject is interesting enough for books to be written about the phenomena. See link below.

https://www.amazon.co.uk/Why-Buses-Come-Threes-Mathematics/dp/1861058624

It seems we have the same phenomena occurring in the investment world when three similar investment opportunities come along at the same time. For example, the extraordinary PGM opportunities with Sylvania Platinum (LON:SLP) Tharisa (LON:THS) and Jubilee Metals (LON:JLP) and the raising rhodium price. The question I'm asking myself is which of these buses should I be invested in?

For further information as to why I think the Rhodium price will remain high, read Sylvania Platinum SLP If I hold, there will trouble if I sell it will probably double. The link is provided below.

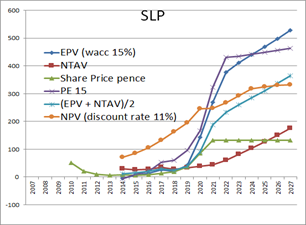

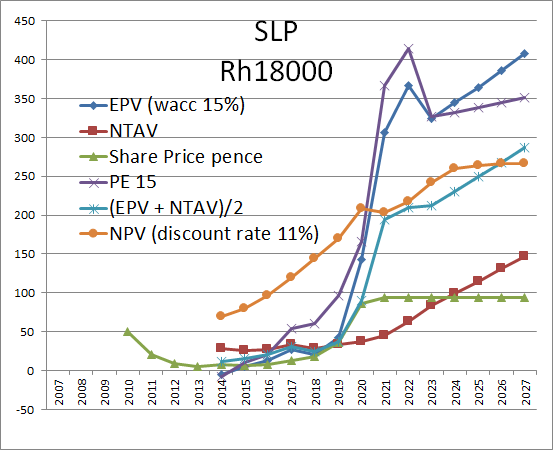

As an investor in Sylvania Platinum (LON:SLP) expecting the raising rhodium price to continue and recognizing Tharisa (LON:THS) and Jubilee Metals (LON:JLP) also offer similar exposure I wanted to think about which opportunities offer better returns if prices go higher and risk mitigation if prices fall. To determine which buses to ride I’ve decided to model Sylvania Platinum (LON:SLP) Tharisa (LON:THS) and Jubilee Metals (LON:JLP) and compared valuations with different Rhodium prices. Assuming the 2021 average Rh price is approximately $18000 per TOz, and prices might fall, stay the same or continue to rise in 2022-25.

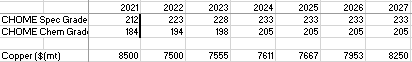

Noting Jubilee Metals (LON:JLP) has substantial exposure to the copper price and Tharisa (LON:THS) has substantial exposure to the chrome price, hence for this evaluation, I have forecasted prices for these commodities as per the table below with only the Rh price changing. Note Tharisa (LON:THS) is the only company committed to increasing PGM production at this point and this is included in the model.

With the current Rh price at $18000, the best-fit valuation (prices investors are willing to hold stock) is probably (EPV +NTAV)/2 hence this is valuation metric is used for all three securities. See graph below.