Over the past fifty years, the average holding period for quoted shares has fallen from around eight years to barely eight months. There are various reasons for that, but one conclusion is that many investors have switched from thinking long-term to chasing growth wherever they can find it. While that strategy may work for some, it risks missing out on the powerful compounding effects of long-term capital and dividend growth. If that sounds a bit unexciting, take a look at the returns from a strategy which follows that approach and you’ll find it’s anything but boring...

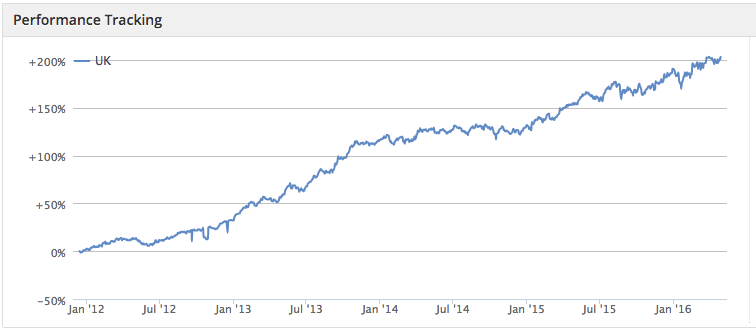

Of all the investment models tracked by Stockopedia, none have a smoother upward trajectory than Winning Growth & Income. This is a strategy that’s generated a 28.9% annualised gain over the past two years. In recent weeks - some four and a half years after we started tracking it - the capital gain on the quarterly-rebalanced portfolio has topped 200%.

Of course, as with all our guru screens, trading costs aren’t taken into account, which would take a lump out of that eye-catching gain. But neither are dividends, and in this case the presence of a high yield rule means that total return could have been much better. For example, the median yield of the 12 companies currently qualifying (which excludes dual-listed stocks) is 3.9%, and it’s been at that level fairly consistently.

What makes this a winning strategy… so far?

The guru-inspired strategies can be a useful barometer of what has and hasn’t recently been working in the market and how that changes over time. The consistency of Winning Growth & Income seems to be a simple set of rules that touch on three very influential drivers of returns - Quality, Value and Momentum, with the added bonus of above average yield. It’s a strategy inspired by work by US investment analyst Kevin Matras in his book, Finding #1 Stocks.

In terms of Quality, the screen looks for companies that are generating profits by looking for an above average Return on Equity and below average levels of debt. In the Valuation stakes, the shares should be trading on a below average rolling price-to-earnings ratio. And for Momentum, companies need to have seen recent analyst upgrades to their earnings forecasts for the next financial year.

In addition, the minimum market cap rule is set at £20 million, which opens…