I am new to stockopedia

one thing I noticed was that stock ranks for the ftse have significantly outperformed US counterparts

Are there any theories as to why this is?

I am new to stockopedia

one thing I noticed was that stock ranks for the ftse have significantly outperformed US counterparts

Are there any theories as to why this is?

One theory is that it is the influence of outperformance of large caps, in particular the FAANG stocks.

In essence, the indexes are weighted by market cap. Stockranks are not. So, with very strong performance of the FAANG stocks, which are very large cap, the overall performance of the US index is dragged up significantly compared to what the “average” company in the US market has done.

I’m not sure if anyone has tried calculating the performance of the US indexes without the mega caps to see how it compares.

If I understand the question correctly, I think you are asking why the stock ranks have performed much better for UK stocks?

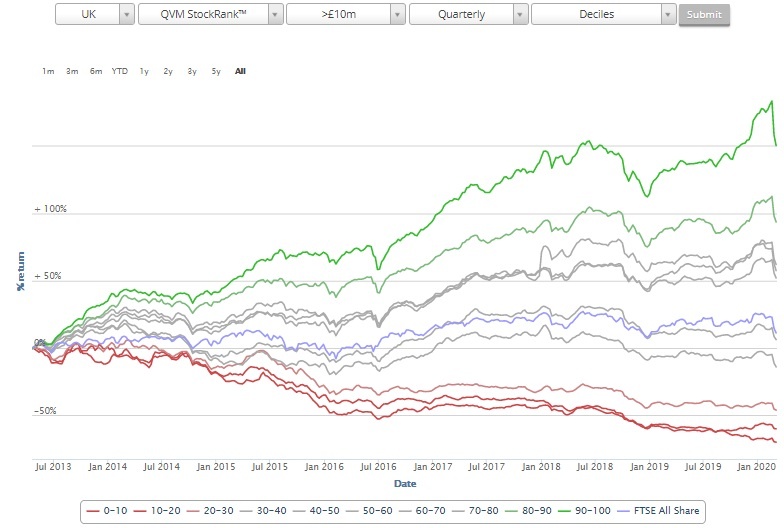

In the UK, the highest decile of QVM stocks has performed best:

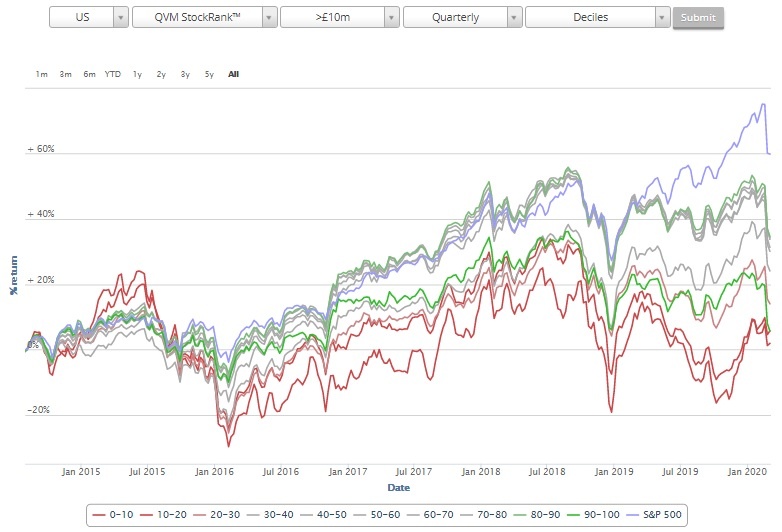

In the US, the performance of the top decile of QVM stocks has been mediocre compared to the other nine deciles:

Graham's explanation above re market cap weights is valid, but only realy applies since 2019 as prior to this the Equal Weight S&P-500 had largely performed in line with the market weighted index :

I think the explanation is that the Value factor has not been working for much of the current US bull market. Amazon, Alphabet, Netflix, Facebook etc have consistently looked expensive on standard valuation measures.

I find strange it that the S&P index has outperformed all the Stockopedia rankings. The 90-100 band has not performed at all well. When I get on the computer later I will have a look at the QM rankings. One thing I have noticed with stockopedia when I checked it worked better on smaller companies so that maybe a factor as us companies are larger than U.K. ones. It worked very well on European shares although I have not checked that in the last year. I don’t subscribe to the US part.

I looked at the US QM performance and the S&P index is still on top but not by much from the 90-100 band, so Howard is correct about the Value factor.