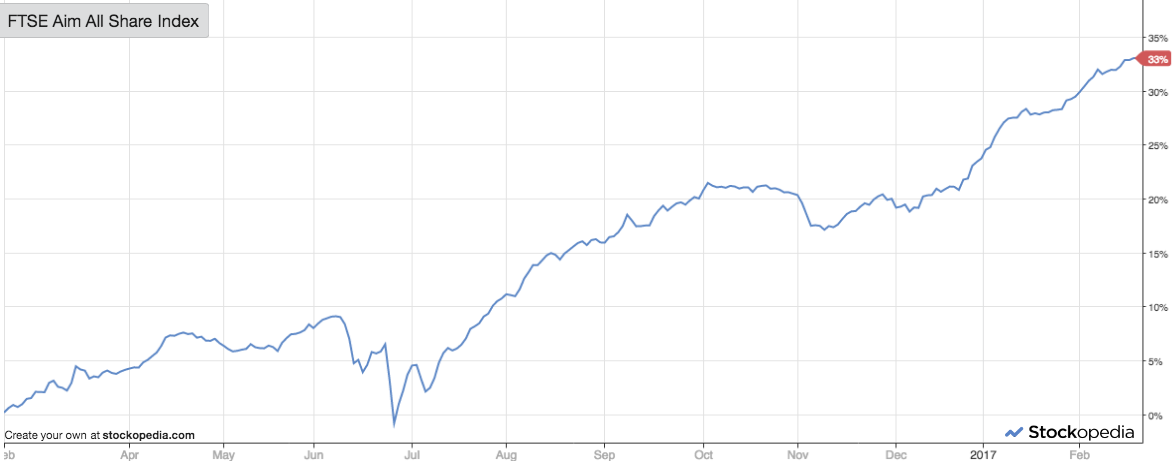

The rise of the FTSE 100 has captured the financial headlines in 2017. But while many blue-chips have done well, that performance has been more than matched right through to the smallest end of the market. In fact there have been some stunning small-cap returns over the past year - especially on the Alternative Investment Market.

For onlookers, this surging pace could at first seem a bit disconcerting. After all, it’s human nature to look for a bargain. And with London’s junior stock index, the AIM All Share, rising by around 33% over the past year, there’s a sense that small company shares have very quickly got a lot more expensive.

So with markets in such a bullish mood in the run-up to ISA season, the conditions call for a strategy that doesn’t fear apparently high prices - as long they come with the best quality and momentum on offer.

On the hunt for high flyers

High quality companies with strong price momentum in their shares can be seen as the market’s High Flyers. You can find them in all indices and sectors. Often they’re the biggest and best known names in investing: think JD Sports, Domino’s Pizza, Hargreaves Lansdowne, Boohoo.Com and Fever-Tree. They tend to have really solid performance histories, making them the stocks that everyone would dearly like to own. Except they almost always seem expensive, which puts many of us off.

The academic and professional support for a high quality, high momentum approach to stocks is wide ranging. In many ways it forms the backbone of strategies used by influential investors like Richard Driehaus, William O’Neil and Mark Minervini.

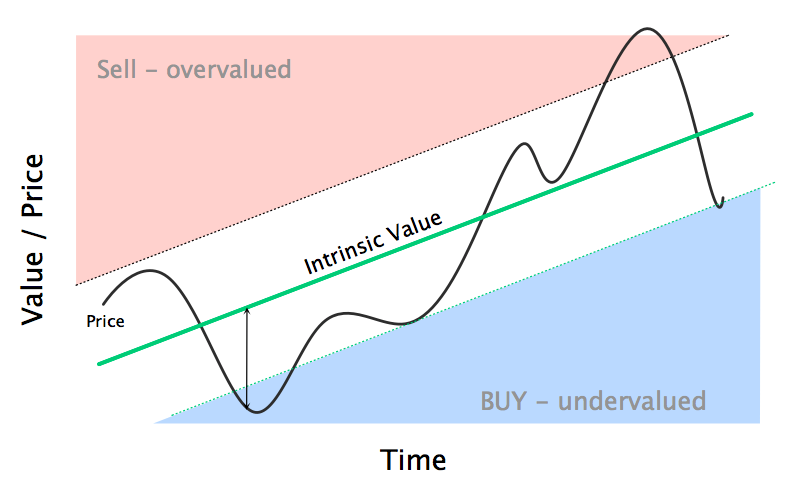

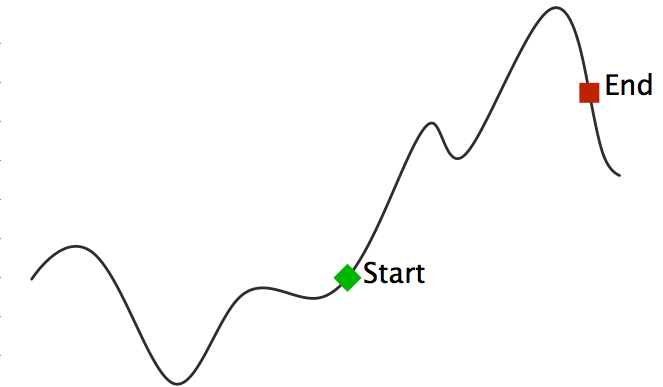

In all cases, valuation is relegated from the stock selection process. As Driehaus explained: “One market paradigm that I take exception to is: Buy low and sell high. I believe that far more money is made buying high and selling at even higher prices.”

Minervini echoed that sentiment in his book, Trade Like a Stock Market Wizard, where he wrote: “Expose your portfolio to the best stocks the market has to offer and cut your losses quickly when you’re wrong.”

What do quality and momentum really look like?

To find companies with strong quality and momentum, there are some straightforward places to start. Generally a quality company is one that’s highly profitable with high industry leading margins, stable, growing…