Reckitt Benckiser – owner of many famous brand names such as Dettol, Air Wick and Nurofen – is a company I like so much I’ve invested in it twice.

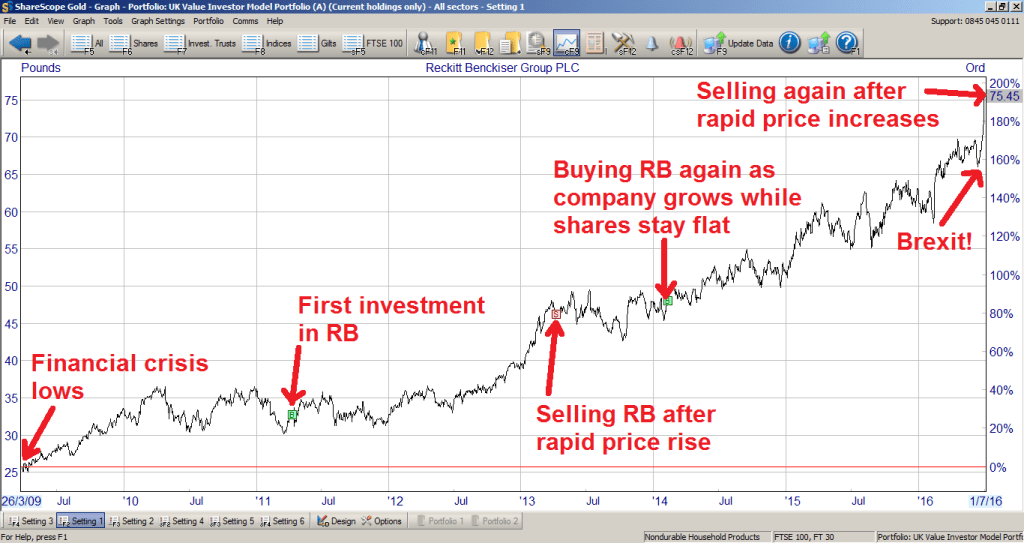

The first time I bought and then subsequently sold Reckitt Benckiser the result was an annualised return of 23% over a period of two years, ending in April 2013.

I then bought back into the company in February 2014 and second time around the results are almost identical, with annualised returns once again of 23% over a period of slightly more than two years:

- Purchase price: 4,811p on 07/02/2014

- Sale price: 7,585p on 07/07/2016

- Holding period: 2 Years 5 months

- Capital gain: 55.8%

- Dividend income: 7.3%

- Annualised return: 23.2%

The continued good results from this stock highlight two underlying trends that have been going on for a very long time:

First, Reckitt Benckiser is an outstanding company and has consistently grown its revenues, earnings and dividends at a rapid pace for many, many years.

Second, defensive companies that sell small ticket, repeat purchase items to consumers worldwide have become increasingly attractive to investors in the aftermath of the financial crisis and, as a result, have also become increasingly expensive.

Buying: An outstanding company at a reasonable price

Reckitt Benckiser is one of those consumer staple companies that have done so very well out of globalisation and the explosive growth of a global middle class.

In this context a useful definition of middle class is that it consists of people who have enough money to care about what brand of soap they use, rather than just buying the cheapest soap they can or not being able to buy a bar of soap at all.

Many of RB’s cleaning products, such as Vanish stain remover, Dettol or Cittit Bang, have very strong brands and as such have become almost the default choice across the globe as more people move away from a price-first mentality to a quality or brand-first mentality.

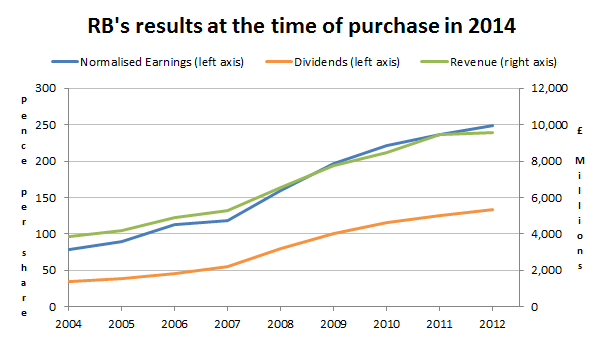

This massive increase in RB’s markets have fed through consistently into its results:

Reckitt Benckiser’s growth was both consistent and rapid

Back in 2014 the company’s revenues, earnings and profits had all more than doubled over the previous decade and so this was most definitely a growth company.

If Reckitt Benckiser was so obviously a good company operating in the sweet spot of globalisation, why was…