Unilever is one of the most popular stocks among dividend-focused investors. As one of the world’s largest consumer goods companies its products include a huge range of well-known brands, from Dove soap to Magnum ice cream and Comfort fabric softener.

Over many decades the company has grown its dividend above the rate of inflation, which is precisely why it is so popular with investors.

But despite Unilever’s excellent track record, I think the odds are that its shares will not perform as well in the future as they have in the past.

Here's why.

Unilever has a great track record, of that there is little doubt

Any company that grows its dividend for decades on end is likely to have a very strong competitive position, and that is definitely the case with Unilever.

Many of its products have leading market positions and are well-regarded by customers, which enables the company to avoid competing on price alone.

In other words, Unilever can sell its Magnum ice cream at a higher price point than less well-known ice creams, even if its competitors are of equal quality.

Many shoppers will still choose Magnum, despite its higher price, simply because they have seen the glitzy adverts and perhaps even tasted the ice cream before, whereas they have probably never heard of or tasted the other brand.

This allows Unilever to generate higher profit margins than it would be able to otherwise, which in turn allows it to invest heavily into product development through R&D and brand development through advertising.

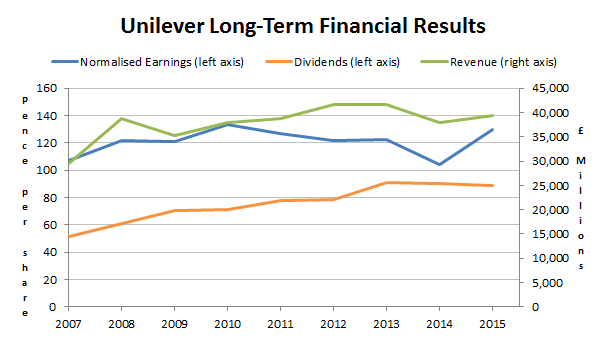

This virtuous circle has driven the company’s growth for decades and continues to drive it today:

- 10-Year growth rate = 3% (FTSE 100 = 2%)

- 10-Year growth quality = 67% (FTSE 100 = 50%)

- 10-Year profitability = 15% (FTSE 100 = 10%)

Unilever manages to beat the FTSE 100 across each of the key financial metrics that I use, so its performance is clearly above average (assuming the FTSE 100 represents the average large-cap company).

Its growth does not require heavy investment in acquisitions or capital assets

As part of my value trap analysis I also look at a company’s capital expenses and acquisitions. My goal is to be especially careful around companies that have to or have chosen to invest heavily in either capital assets or other companies.

In…