Prudential plc recently announced its 2014 results so I thought I'd take another look at this popular and relatively defensive financial services company.

I think most private investors are vaguely aware of Prudential and what it does, but if not then a super-quick summary would be that Prudential is FTSE 100-listed insurance group, established over 150 years ago and today it consists of the following companies:

I wrote about some of Prudential's more recent history, both good and bad, in an article for the BullBearings website last summer.

In that article I thought Prudential's shares, at 1,400p (June 2014), were probably close to fair value. In turn I thought that outperformance over the next few years would be no more likely than by chance alone.

Now that Prudential has published its latest results the picture has changed and my previous assessment needs to be revisited.

New annual results and more dividend growth

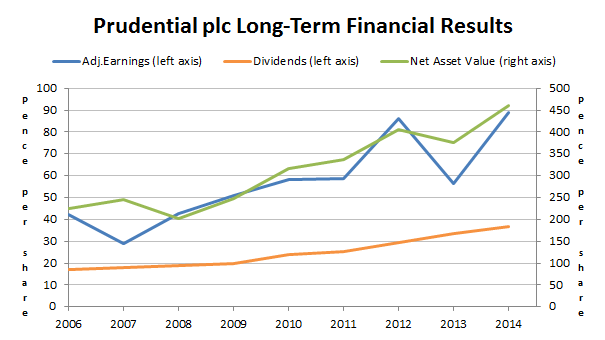

For 2014 the run of success which has characterised the company's performance in recent years continued. Net asset value was up over 20%, basic earnings were up over 50% (from a weak 2013) and the dividend grew by 10%, on a per share basis.

That's impressive in a single year, but Prudential has managed to achieve similar results for many years, as the chart below shows:

Using some key metrics from my stock screen, Prudential's financial performance looks like this:

- 10-year Growth Rate of 10.7% (FTSE 100 = 0.8%)

- 10-year Growth Quality (consistency) of 75% (FTSE 100 = 54%)

- 10-year ROE = 18.5% (FTSE 100 ROCE approx. 10%)

So in terms of results Prudential is clearly an above average company in that it has produced market-beating progressive dividend growth, supported by equally rapid growth in earnings and net asset value.

A strong balance sheet

Life insurance balance sheets can be a bit of a nightmare to analyse for risks, or at least they are for me. After much spreadsheet-bashing I have found a reasonable correlation between a company's ability to maintain its dividend in tough times (such as the financial crisis) and the amount by which it exceeds its minimum regulatory capital.

If you don't know what “minimum regulatory capital" means, it's to do with the strength of the company's balance sheet.

In simple terms an insurance company's balance sheet shows its assets (saved and invested premiums that will be used to cover future insurance claims) and…