There are very few stock market signals that catch the attention of investors quite like the 52-week high. Lists of shares making new highs are published in newspapers and on websites around the world every day. But while 52-week high data is easy to get hold of, what does it really tell you and how can you make the most of it?

One of the surprising traits of the 52-week high is that it can have a major impact on the minds of investors - and sometimes that makes it more of a hindrance than a help.

While the information is readily available, evidence shows that it can cause a kind of momentary paralysis in investors that leads to a slow reaction in prices. And when you get the extra kicker of a positive earnings surprise from a stock that’s trading at a 52-week high, this so-called ‘post-earnings announcement drift’ has been shown to be even more extreme. But while all this sounds quite negative, it arguably creates an opportunity for investors who are aware of it.

The lowdown on new highs

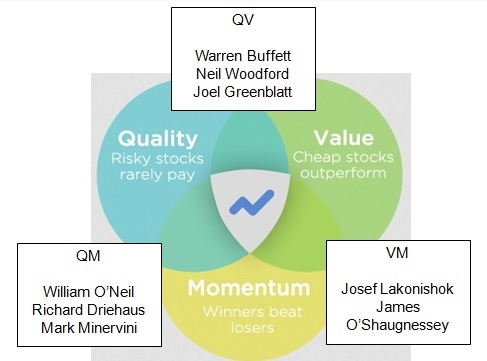

I cover the subject of 52-week highs periodically, and it’s one of those areas that provokes a lot of interest. For a start, new highs have the credibility of being used by popular investors like Mark Minervini and William O’Neil. Yet when you look at the research into new highs, the explanation for why they’re important is quite intricate.

Influential research on them was published by Thomas George and Chuan-Yang Hwang in 2004, which found that they were a major driver of momentum. Momentum is the tendency for price trends to persist over the short to medium term, and it’s often linked to how investors think and behave.

George and Hwang reckoned that investors used the 52-week high as a reference point, or anchor. They found that when new-news comes along about a company, it can take days, weeks or even months for the price to shift upwards because of this ‘anchoring’ effect. In essence, existing investors are simply slow to bid the price higher, while onlookers are reluctant to buy at the new high. This is where the term post-earnings announcement drift comes from.

Now this kind of investor irrationality isn’t restricted to 52-week highs. There are other events that cause investors to hesitate that have also been linked to momentum. One…