After six long years I've finally decided to sell BAE Systems.

In terms of raw numbers, the results look like this:

- Purchase price: 308p on 21st June 2011

- Sale price: 643.5p on 8th May 2017

- Holding period: 5 years 10 months

- Capital gain: 106.7%

- Dividend income: 34.9%

- Annualised return: 18.0%

In this post I’ll cover why I bought it, what happened during those six years and why I’ve decided to sell now.

Overview: Buying on fear, selling on optimism

I bought BAE Systems in 2011 because it was – and is – exactly the sort of large, successful and relatively defensive company I’m always looking to invest in.

However, as a value investor I’m also looking to invest when investor sentiment and share prices are low, and in 2011 BAE was facing major headwinds from reduced government budgets following the financial crisis.

Investors were also worried about US and EU governments defaulting on their debts, which could have triggered another financial crisis. With all this negativity in the air the FTSE 100 stood at just 5700 and briefly fell as low as 5000.

At the time I thought these headwinds would be temporary. I thought they would eventually die down, BAE’s share price would return to normal levels. And in the end, that’s exactly what happened.

Buying a dividend growth stock during a period of uncertainty

The first thing I look for in a company is a consistent record of dividend payments. In addition, the dividend should have grown with support from relatively steady earnings and revenue growth.

In 2011 BAE ticked all those boxes:

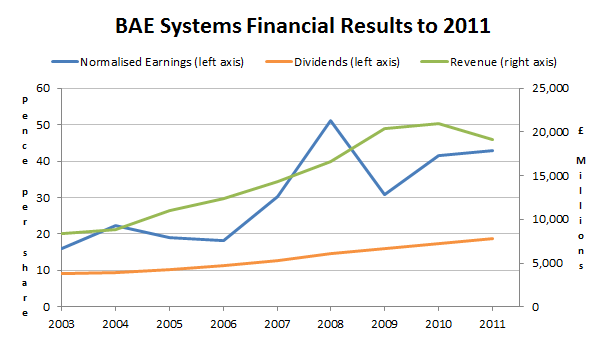

The company’s earnings are perhaps surprisingly volatile, but the overall picture is one of rapid and fairly steady growth, continuing right through the financial crisis. Relative to the FTSE 100, BAE’s track record over the decade to 2011 was impressive.

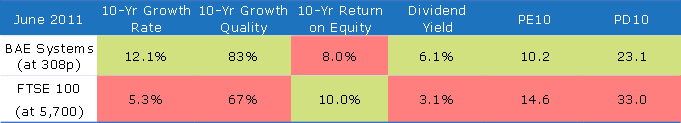

However, BAE was also more attractively valued than the FTSE 100:

Typically the stock market does not offer up companies with high growth rates and 6% dividend yields unless there are substantial risks.

One major risk was BAE’s defined benefit pension scheme. In the 2010 annual report the company’s pension liabilities were more than £21 billion, with a deficit of £3.1 billion. In contrast, BAE’s then-recent average profits were a mere £1.2 billion.

To reduce the deficit, BAE had agreed to pay several hundred million pounds into the scheme each year, which is about as much as the company was paying in interest on its £3 billion debt pile.

Those…