‘You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.’ — Warren Buffett

Another day, another Warren Buffett quote... He's right though. Successful investing can be relatively simple. Nowhere is this more obvious than in the persistent outperformance of relative strength strategies, where investors buy companies that have outperformed the wider market over a set period of time.

Imagine: investor A gets home from work, studiously notes up financial statements, trawls through the footnotes, follows the cash flows, makes the adjustments, finds the value, and places his bets. Investor B wakes up, turns on her computer, and simply buys what's gone up recently.

The evidence over the years suggests Investor B's portfolio is likely to motor ahead.

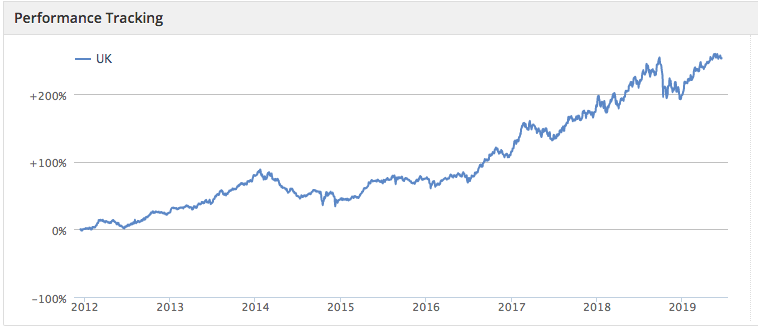

No surprise then, that Stockopedia’s Price Momentum Screen is one of the top-performers over multiple timeframes. The screen is up 45% over two years and has staged a strong recovery so far in 2019, up nearly 25% since the start of January.

The screen itself is as simple as they come: take companies with positive six-month and one-year relative strengths and a negative one-month relative strength, and then sort the results in descending order of one-year relative strength. Investor B would be proud.

Here are the top ten companies with the strongest one-year relative strength and a market cap of over £100m:

Name | Market cap | RS 1yr | RS 6m | RS 1m | Sector |

162.4 | +141.3 | +81.2 | -15.7 | Energy | |

355.2 | +128.8 | +7.35 | -0.65 | Energy | |

537.9 | +119.2 | +51.9 | -2.98 | Consumer Cyclicals | |

167.5 | +65.0 | +47.4 | -2.59 | Consumer Cyclicals | |

1,309 | +61.8 | +31.7 | -1.48 | Basic Materials | |

176.1 | +61.3 | +45.3 | -4.19 | Energy | |

21,172 | +56.9 | +15.5 | -0.25 | Consumer Defensives | |

198.1 | +55.7 | +28.5 | -1.13 | Financials | |

727.4 | +51.4 | +26.2 | -4.41 | Consumer Cyclicals | |

297 | +50.4 | +29.3 | -2.18 | Financials |

One thing to note about this screen is that, depending on the conditions, the very fastest moving stocks can sometimes be speculative and unpredictable. As a result, you can see slightly more exotic small-cap energy and technology names. But it can also pick up fast moving, higher-quality plays as well. Some of those currently include stocks like AB Dynamics, Churchill China and 4imprint.

It’s no surprise that relative strength is a measure that’s appealed to some very successful investors over the years...

The legendary British investor Jim Slater, generated ‘spectacular’ results by using relative strength in conjunction with his signature PEG and a price-to-cash flow measure in Beyond the Zulu Principle. Over a six month sample period, his relative strength screen returned…

.jpg)