Before we assess Randgold’s competitive advantages over other gold producers and the reasons you need to copy its approach to mining, you must first understand the fundamentals of why other people view gold as an investment and preservation of wealth.

Lately, gold has come a long way from its lows of $1,050 per oz. to record its biggest gains in six years, jumping to $1,270 per oz. in a matter of weeks.

We know it has been a weak investment if you measure the performance of home prices, stocks, and bonds in the last century, but this century belongs to gold.

You may have heard of the “China’s Century”, or the “Indian Century,” all it means is that this century will be the “Golden Century” (no pun intended)!

Here’s why

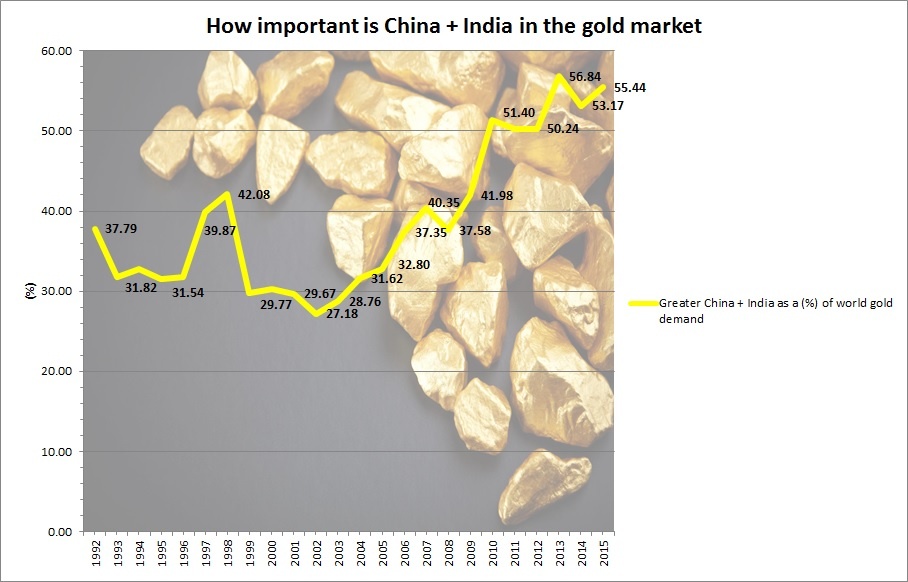

Source:Gold.org.

As you can see, both China and India is beginning to corner the gold market.

With the combination of rising income per capita, changes to government policies and a history of gold ownership in its culture and traditions, you would begin to understand why it’s so much in demand.

But most importantly, increasing income per capita is the key factor in the demand for gold, as I will explain.

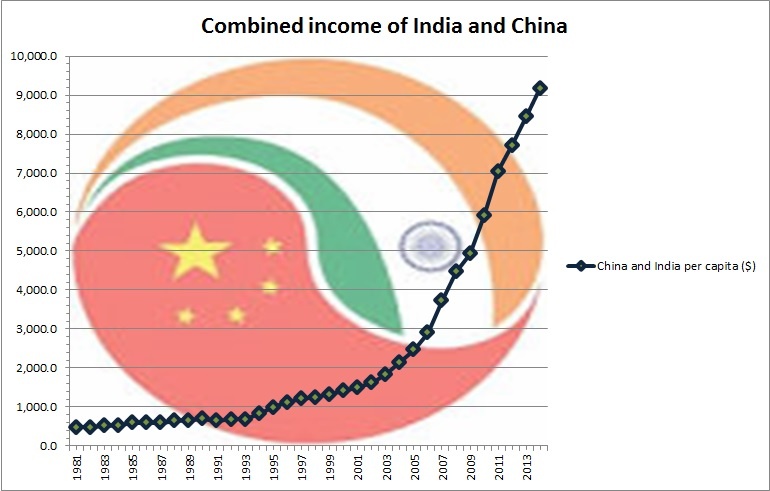

If you combine the income of both India and China “together”, you will get this:

Source: Quandl.com and Quandl.com.

Since 1981, both countries had seen its combined income rising from $471 to $9,171 in 2014.

Meanwhile, gold demand from these countries has doubled!

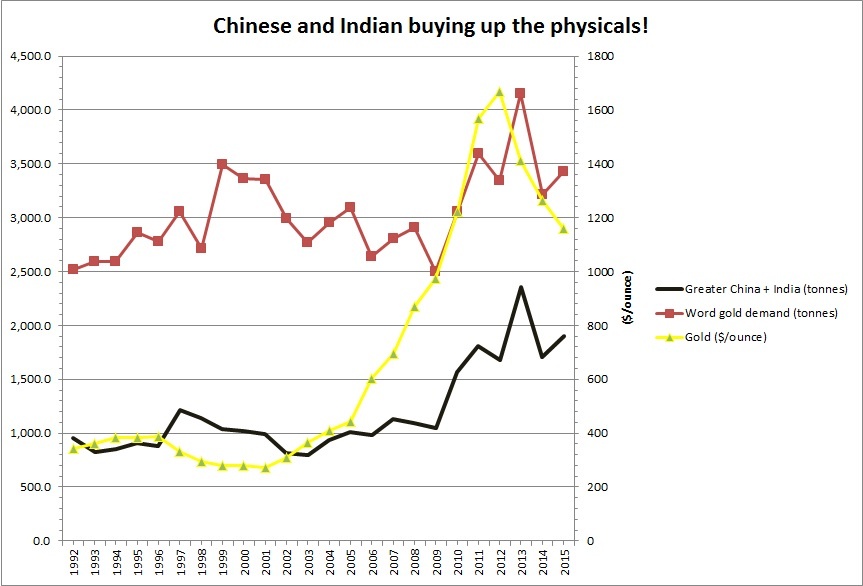

Source: Gold.org.

The reasons why the demand for gold hasn’t “sky-rocketed” at the same pace as income per capita of China and India are:

A). The Chinese government didn’t allow the ownership of gold to private citizens until 2003;

B). Gold price (itself) has appreciated by five-fold, since the lows of 2001;

C). Indian Rupee is continuing to depreciate against the USD, meaning you need more Rupees to buy one ounce of gold.

However, the ongoing prosperity of both China and India means more ordinary people can afford gold. And a projection of the future is as follows:

By 2020, the IMF estimates both these giants will have a combined per capita of $14,526. (The projection of China’s GDP by 2020 is $17 trillion and India at $3.44 trillion. And the population of China and India is estimated at …