Like last year, 2024 is shaping up to be another ‘game of two halves’. Poor H1, followed by a H2 catchup.

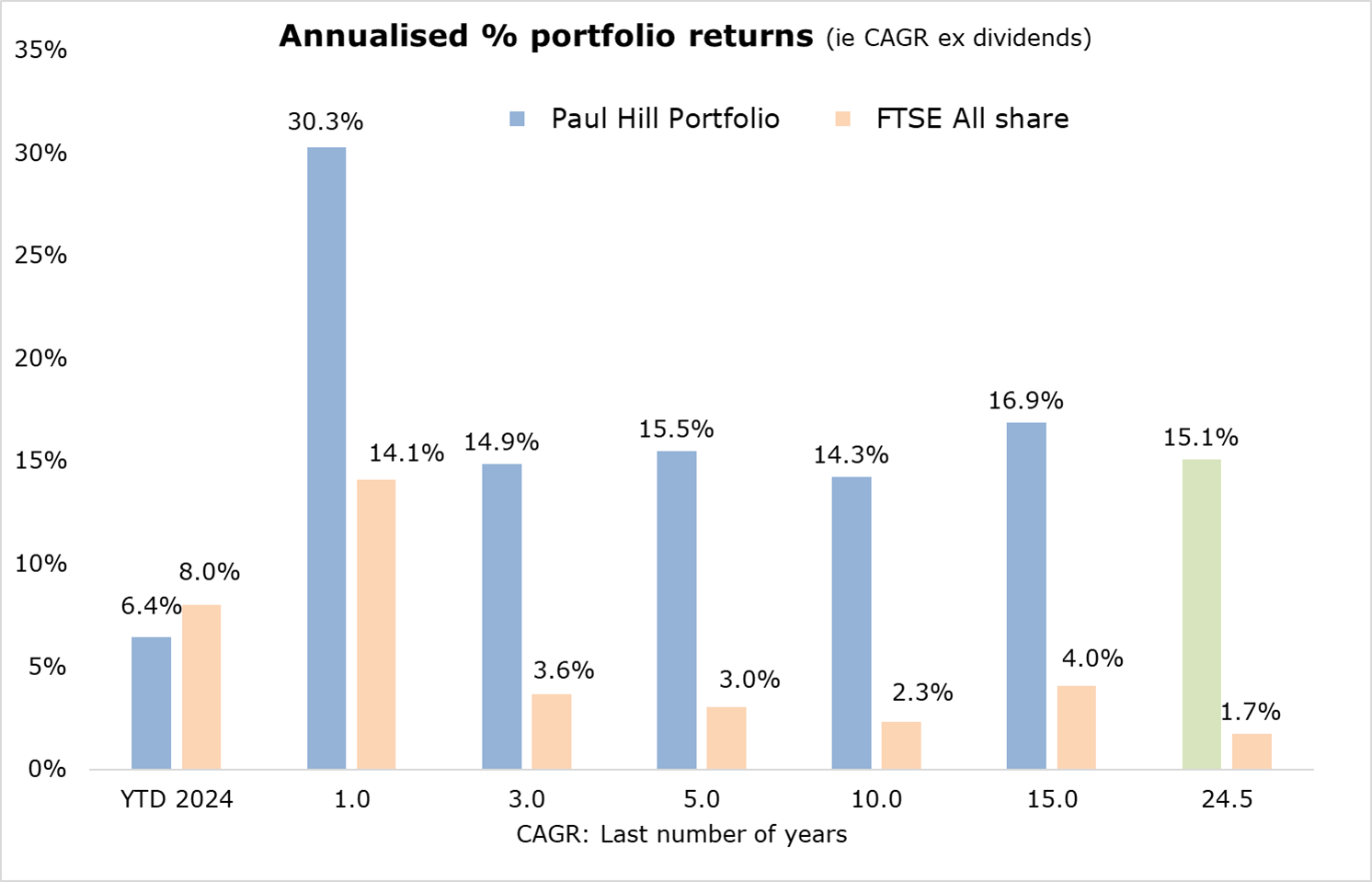

In fact despite falling more than -5% in the 1st 6 months, my portfolio has since recovered (+6.4% YTD), and is today only just shy of the FTSE All Share index (+8.0%).

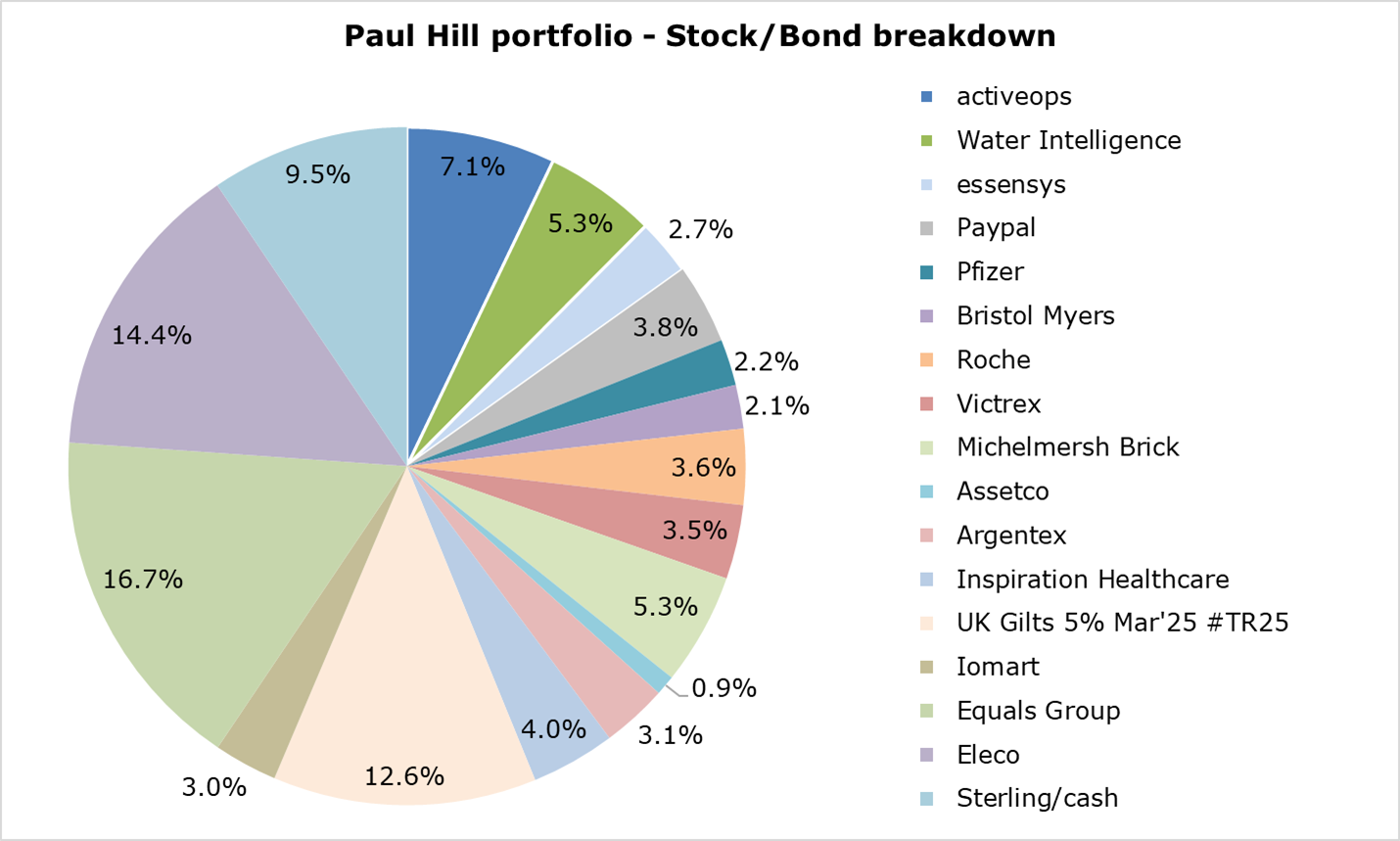

This turnaround reflects a couple of major losers (re Inspiration Healthcare & Essensys) coming off life support and now being nursed back to health on the hospital wards. On top, July-August has seen strong performances from Saas Buildtech firm Eleco and staff optimisation software developer Activeops - alongside a welcome bounce back for Roche, Paypal, Pfizer & Bristol Myers after reporting better than expected quarterly numbers.

More importantly though, is what will happen for the rest of the year?

Well its impossible to tell - albeit I suspect there'll be tons more volatility. Probably centred around the US Presidential election (5th Nov), trade wars, geopolitics, UK tax increases (Budget 31st Oct) & idiosyncratic risk.

That said, this is normal for investors - so we’ll just all have to accept it.

“Most people have the brainpower to make money in stocks. But not everyone has the stomach.” Peter Lynch