In 1996, two young men hunched over a big box computer in a messy dorm room somewhere in America. They were building a search engine called Backrub. Thankfully, they decided to rename it - I much prefer to “Google” things rather than “give them a Backrub”.

Since then Alphabet has soared to incredible heights, providing enormous value to the wider world.

Recently I’ve been looking at Softcat (LON:SCT), following on from VAR peer Computacenter (LON:CCC) 's recent bullish trading updates, but I’ve ended up thinking a little more deeply on the nature of competition and long term value creation.

I like both SCT and CCC. I think they are good at what they do. They are cash generative, liquid, and confident in their short and medium term prospects. Over the past five years, both companies have handily outperformed the market.

Softcat has a history of double-digit growth and market share gains. That said, here’s why I won’t be investing right now (although I can understand why others might).

Strong growth in a fragmented UK VAR market

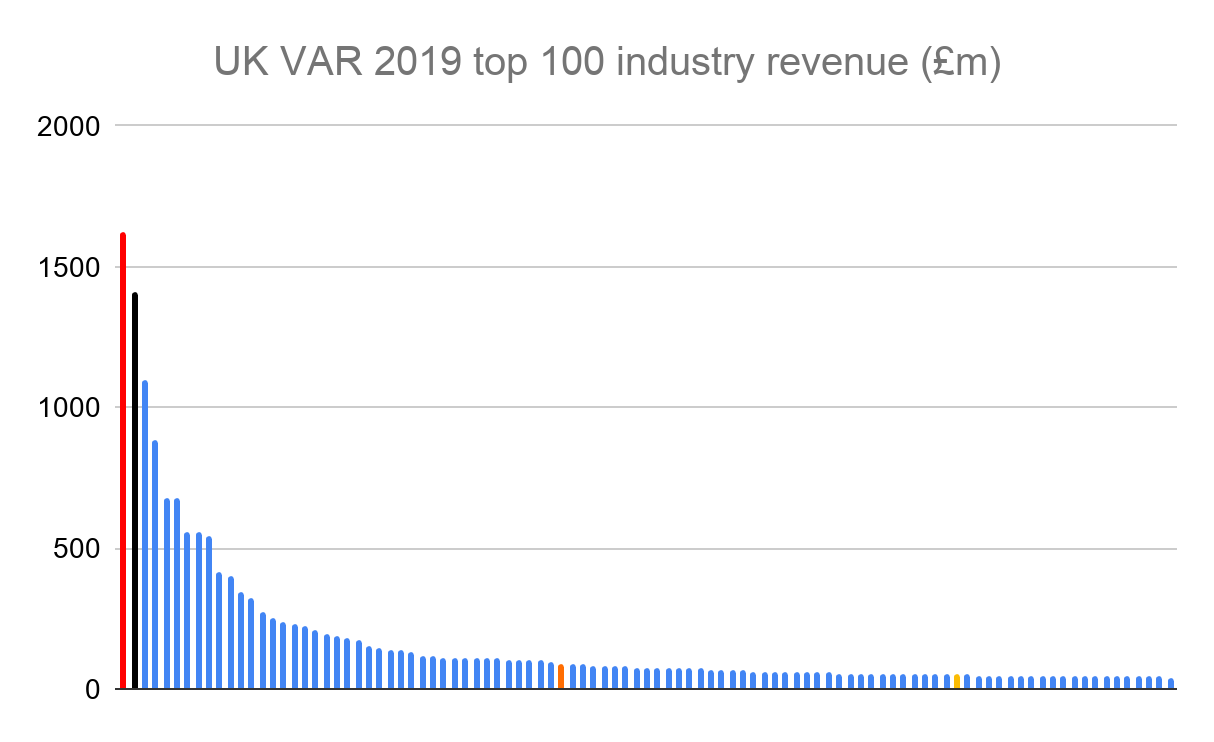

According to Channelweb, Softcat is the number two UK VAR (value-added reseller) by revenue, just behind Computacenter - and it is catching up fast.

The group handles a company’s IT infrastructure and frees them up to focus on their core operations. It has won market share over the years with a simple two-pronged strategy:

- increase revenue from existing customers; and

- win business from new customers.

Here's the top 100 UK VARs by revenue in 2019 (CCC is red, SCT is black. Listed peers Redcentric and Adept Technology are orange and yellow respectively):

Competition is fierce and evolving all the time, but Softcat has a long history of taking market share and it says it continues to be presented with a “vast” opportunity.

Total revenue across the top 100 VAR firms added up to £17.2bn in 2019. Softcat generated just over 8% of this. I’m not sure this qualifies as a “vast” opportunity but perhaps it could still treble revenue or thereabouts before having to look abroad (as Computacenter has done).

Operating margins at Softcat are high single-digits and growing. Revenue is also growing consistently at double digits. When you get margin expansion and revenue growth at the same time,…

.jpg)