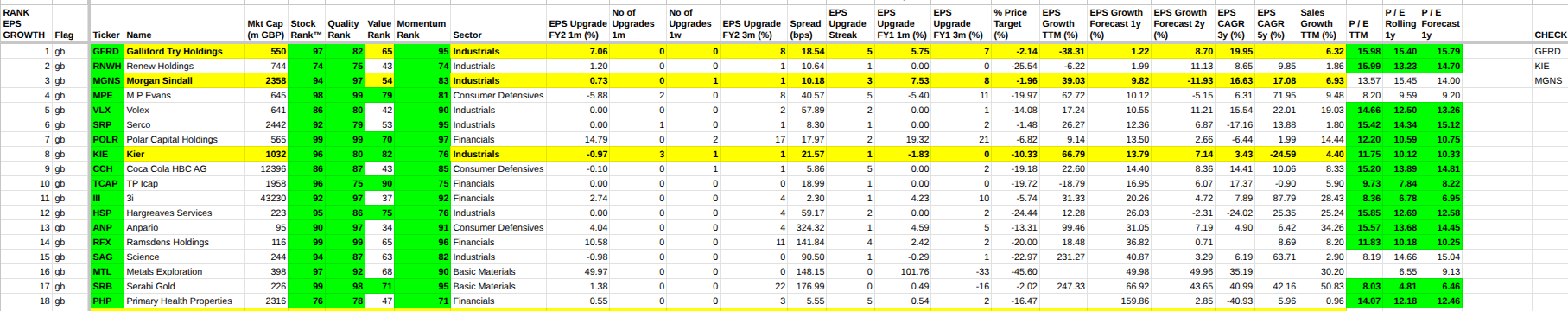

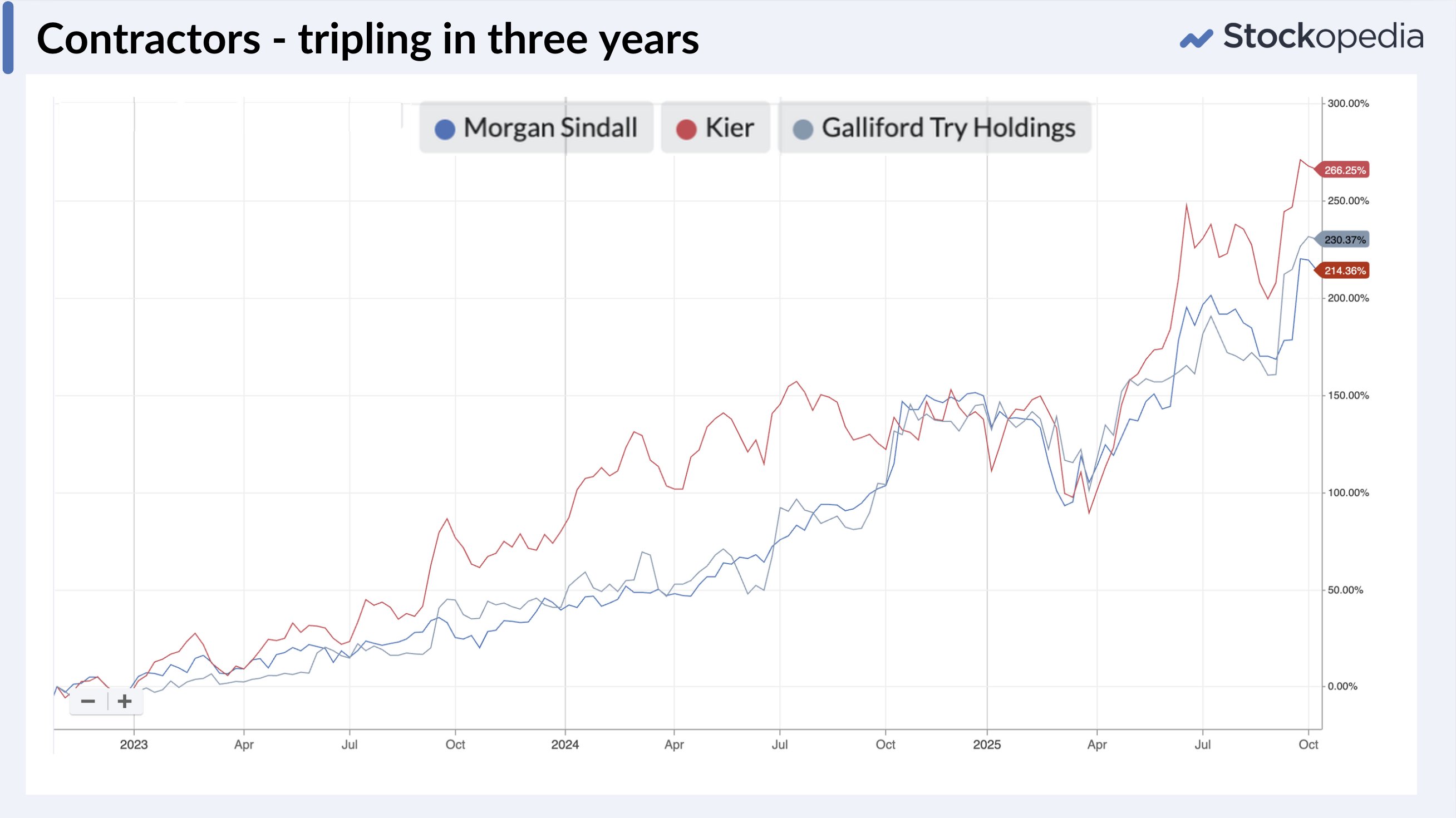

In last month’s results season webinar, Graham and I discussed the surprising recent strength of UK contractors - names like Morgan Sindall (LON:MGNS) , Kier (LON:KIE) , and Galliford Try Holdings (LON:GFRD) - all of which have been quietly and consistently beating expectations for years.

These stocks have carried high, 90+ StockRanks throughout their multibagging runs, but I anticipate they may have been significantly under-owned by Stockopedia subscribers.

Why? Because whenever you looked at their StockReports in recent years, your eye would have been drawn to their earnings growth forecasts and those forecasts have almost always looked flat or uninspiring.

Everyone knows that earnings growth is a fundamental catalyst for share price acceleration. Jim Slater’s Zulu Principle taught us to look for high forecast earnings growth and moderate P/E ratios - growth at a reasonable price right? So, buying shares that show no forecast growth - or worse, negative growth - feels completely alien. Who wants to own a share without earnings growth?

But that’s exactly where the opportunity lies.

There’s far more power in the unexpected

I’ve been rattling on for much of the last year about the power of “ahead of expectations” announcements (see here, here and here). What really drives share prices isn’t forecast growth - it’s unexpected growth. Prices move the most when companies surprise to the upside - and brokers are forced to upgrade their numbers, which often leads to the P/E ratio expanding.

Let’s take Morgan Sindall (LON:MGNS) as a case study. Right now, brokers are predicting negative earnings growth over the next year. But, if you look at its track record, the company has repeatedly delivered significantly higher actual earnings growth than expected.

Go back in time through the last few years (using the rather handy “print” function on StockReports), and you’ll see the same story: earnings growth forecasts were low (less than 4% per year), but realised growth was strong (at nearly 17% annualised). The market was consistently surprised to the upside. It’s those earnings surprises - not the forecasts - that have powered the share price higher.

The StockRanks have long told the same story

This isn’t just a Morgan Sindall phenomenon. In a broader data study across a decade of UK market data using…