IB Times Video: Why the sugar tax is potentially good for Tate & Lyle, Pure Circle, Whitbread

In the recent UK budget, Chancellor George Osborne set out plans to introduce a tax on companies producing and importing sugar-sweetened drinks, in a concerted effort to reduce childhood obesity. It will be levied in two bands ? one on drinks containing 5 grams of sugar per 100 millilitres, with a higher rate for those with more than 8 grams. At the higher tax level, this will amount to an extra 24p per one litre of soft drink.

The tax will take effect in 2018 and is targeted to raise £520 million ($733m, €656m), which will be used to fund a programme of after-school sports for the UK's children.

Something needed to be done

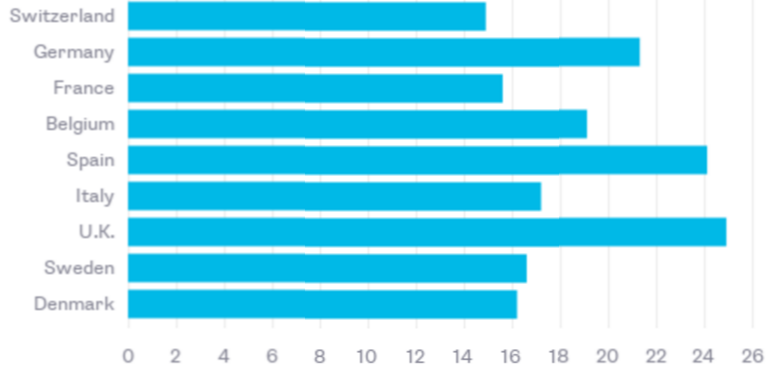

Chart 1: The UK is top of the European obesity chartsUN Food & Agriculture Organisation, 2013

Chart 1: The UK is top of the European obesity chartsUN Food & Agriculture Organisation, 2013One fact is clear: obesity is already a fast-growing health epidemic in the UK. Obesity and related illnesses, such as type 2 diabetes and heart disease, today cost the National Health Service (NHS) over £5 billion per year.

What is worse, the UK has the highest rate of obesity of any major European country, at almost 25% of the adult population as of the last comparable figures back in 2013 (Chart 1).

The UK is not the first country to tax unhealthy food and drink

Other European countries have already imposed taxes on unhealthy food and drink. Finland put extra taxes on sweets, chocolate and ice cream back in 2011. France introduced a tax on all soft drinks with added sugar or artificial sweeteners in 2012, with an added tax on energy drinks added a year later.

In the US, the states of New York and California both introduced taxes on sugary drinks in 2014.

A sugar tax worked in Mexico

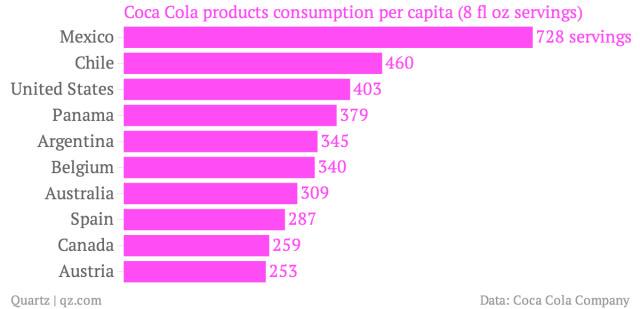

Chart 2: Mexico is by far the largest Coca-Cola market per personQuartz/Coca Cola Comapny

Chart 2: Mexico is by far the largest Coca-Cola market per personQuartz/Coca Cola ComapnyWe can even examine whether the type of soda tax that Chancellor Osborne…

.png)