Carpetright PLC has been a dog for large part of a decade, as its shares collapsed from the peak of £13/share to as low as £1.50/share. It currently trades above £2/share.

Is there hope for Carpetright or will it end up in the scrapheap?

Brief

Background

This flooring company set up shop in 1988 in Canning Town and

quickly expanded its operations. By 1993, it got listed on the London Stock Exchange.

And in 2008, it bought

Sleepright PLC to expanded the firm product range to include beds.

The story so

far

Looking back at Carpetright’s financial data, you see stagnating sales for the past 12 years. Meanwhile, operating profit took a dive from £74.4m in 2004 to £14.8m today, meaning it was selling more in volume but at a lower price (= lower margins).

But over this difficult period, there are some signs of life as the carpet seller took the liberty to reduce leverage and be cash conservative by stopping dividend payments since 2011.

There could be life in this old dog, if the turnaround plan works.

And it is the reason why it is worth digging deep into retailer for investment opportunities that could turn into a multi-bagger!

So, hang on to your seatbelt!!

Profits

Recovery?

There was a period when Carpetright PLC was making operating losses. It was during 2012 and 2013 that resulted in £3.4m and £4.9m of net loss, respectively, before recovering to earn £14.8m in net profit in 2016.

Like the share price, these profitability ratios looked horrendous from 2006 to 2014, but the last two years saw big improvements, see table below:

Source:

Carpetright’s annual reports. (To enlarge clickhere.)

Some of these ratios such as the Dupont’ ROE and Greenblatt’s Return on Capital are turning GREEN, signalling an improvement in its operations and higher returns on capital invested.

Debt Sorted?

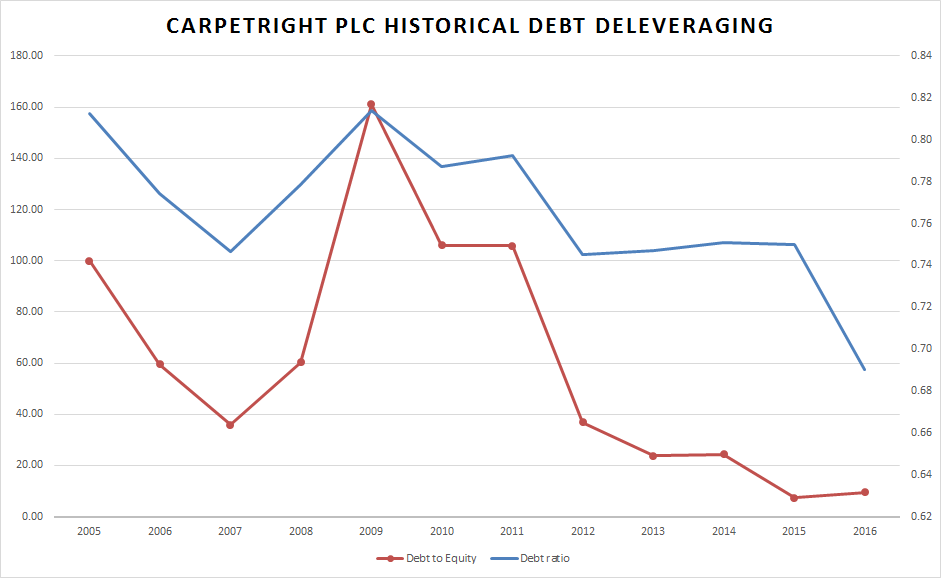

To Carpetright credit, management decides to pay off interest-paying loans which saw debt reduced from £108.3m to £7.7m in seven years. The reduction in debt isn't easy to achieve with the company deciding to ditch some assets (closed or sold off some stores), cancel dividends and hire less staff.

Source: Carpetright’s annual reports. (To enlarge click here.)

Debt to Equity fell from a peak of 160% in 2009 to 10%, while its debt ratio declines to new lows signalling a bigger…