QARP = Quality at a reasonable price

Currently I'm 100% cash delaying re-entry until the tea-leaves indicate that the tide might be rising. For me this will be, at a minimum, when the weekly Heiken Ashi turns green for the various index:

In the meantime though, my 'quality value' instincts are beginning to revert, as in precarious markets I perceive plenty of risks (although it is the event that no one expects, that usually prompts the tumble, and then all the known risks jump to the foreground).

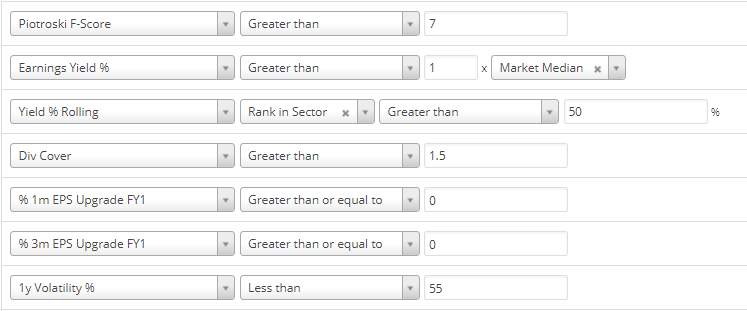

I began to pull together a screen based on what I would feel comfortable with buying (if they too showed evidence of weekly gains). Here it is:

Quality is represented by Piotroski > 7. This captures improving (historic) fundamentals.

Value/cheaper than market median is captured by Earning Yield. This could be against sector, but for now I wanted Market. Rolling PE and/or various PEG measures could also be used here.

Value/downside uses dividend yield. This is relative to sector, as I felt that different sectors had different norms. Dividend cover is here to ensure it is not in danger for a while. As I'm potentially buying 'value', stops make less sense and diversification has to be the proxy for risk management. This incarnation of the screen does not work for that, as it is too restrictive (I'd like 20-30 candidates to be able to rely on diversification for (downside) risk management).

Next is a couple of EPS upgrades not getting worse. Ideally following Piotroski they should be rising, but not getting worse is the next best. Once fundamentals and forecasts are improving price should follow. This is momentum without relative strength.

Finally in the screenshot is Volatility. I like lower as it is easier to live with, however, in reality I only care about portfolio return and volatility; sufficient diversification should take care of the latter.

Here is a link to the screen: https://www.stockopedia.com/sc...There are also some trading criteria (Capitalization, spread, volume, Euro exchanges for European shares, sector exclusions, industry exclusions) all of which can be toggled on/off and/or amended. These reflect my needs/opinions.

Any comments? Does anyone else have a QARP based screen that is weathering the recent…