History has taught us that the market hates uncertainty and Donald Trump is proving to be erratic and unpredictable. Whether this is intentional or he is just a crazed man, no one seems to know. There is however a theory that there is method to his madness.

To explain this, a little understanding of the markets in the 21st Century is needed.

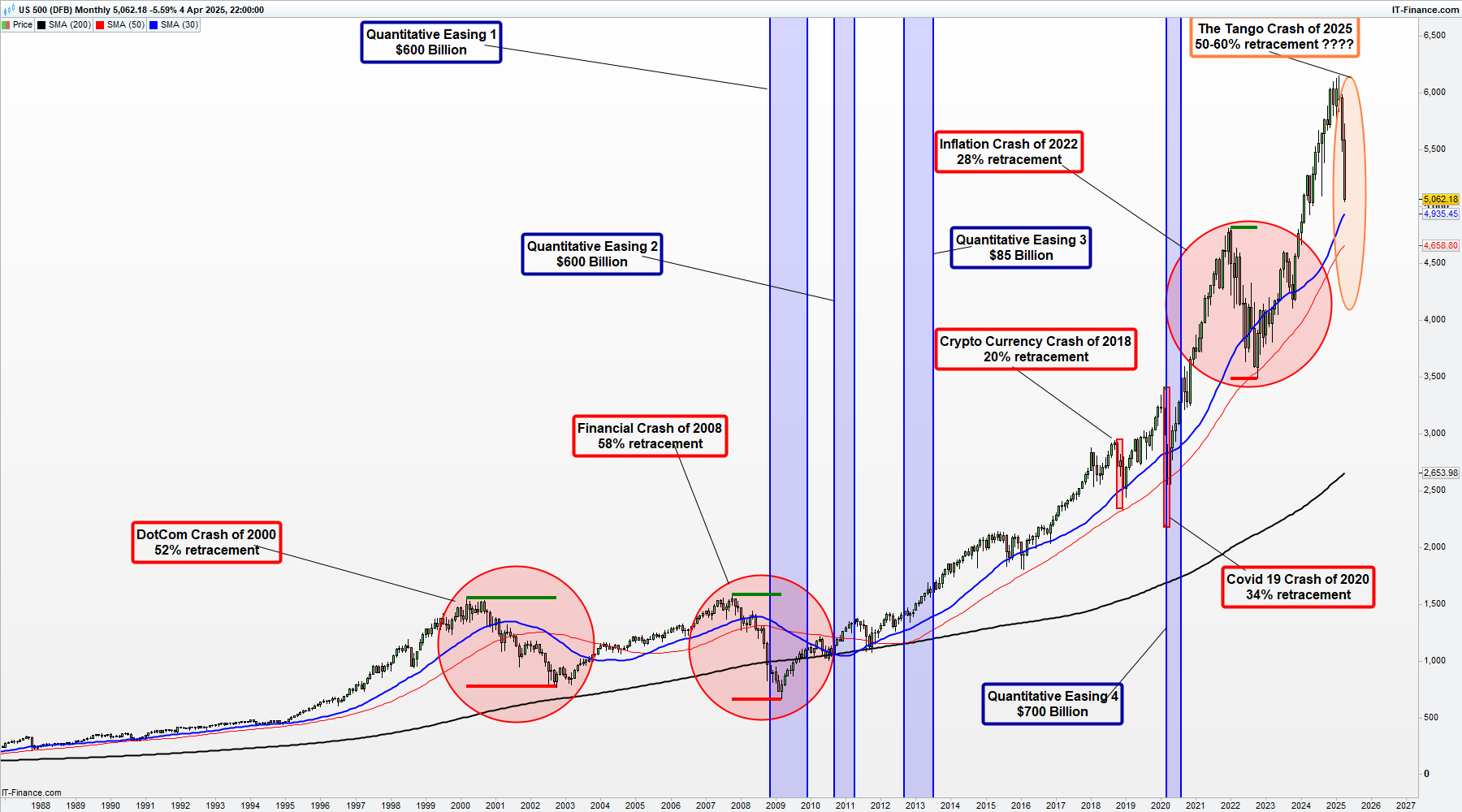

The Crashes

Dot Com Crash of 2000.

The Dot Com started back in 1985, but the euphobia of the internet did not really kick off until 1995 when the internet started to become widely used across the world. A mad rush by companies to get setup on the internet led to investors buying into companies that entered the internet whether they were profit making or not. The S&P more than tripled in the 15 years from 1995 to 2000 when the bubble finally burst. The S&P dropped around 52% over the next 2 and a half years.

The Financial Crash of 2008.

Fuelled by lacks banking regulations the housing market crashed in the US causing many banks to fail. The FED stepped in, believing these banks were too big to allow to go bankrupt. The FED dropped the interest rates, bailed out the banks and started the first program of Quantitative Easing. This became the start of the longest bull run in history.

The crash lasted about 1 and a half years and the S&P lost around 58%.

The Crypto Crash of 2018

Bitcoin and other Crypto bubble burst after a bull run. Bitcoin topped at $20000 and then fell back down to $3200. A far cry from the high in January 2025 0f just shy of $1100000. S&P fell just 20%.

The Covid 19 Crash of 2020

The world markets crash as Covid spreads and the world goes into lockdown. Governments inject money into the economy which saves the economy from further crashing. This was the final QE. S&P falls 34%.

The Inflation Crash of 2022

Inflation across the world rises dues to many factors. War in Ukraine causes a rise in energy prices. Food prices increase partly due to the war and partly from opening up after…