Good morning, it's Paul here.

Graham has asked me to point out that he added a big section on Creightons (LON:CRL) to yesterday's report, later than usual. In case you missed it, here is the link to yesterday's completed SCVR.

Also, Graham is intending to write some sections for today's report too, on NAR and HAT, which i will incorporate into this report when he sends his work over to me.

So it should be a bumper report by the close of play!

Please see the header for which companies I'll be looking at today. I think this also incorporates all the reader requests in the comments section, at the time of writing.

Dialight (LON:DIA)

Share price: 346p (down c.30% today, at 10:42)

No. shares: 32.5m

Market cap: £112.5m

Trading update & Directorate changes

Dialight plc (LSE: DIA.L), the global leader in LED lighting for heavy industrial applications today publishes a trading update for the year ending 31 December 2019, ahead of its half year results to be published on 5 August 2019.

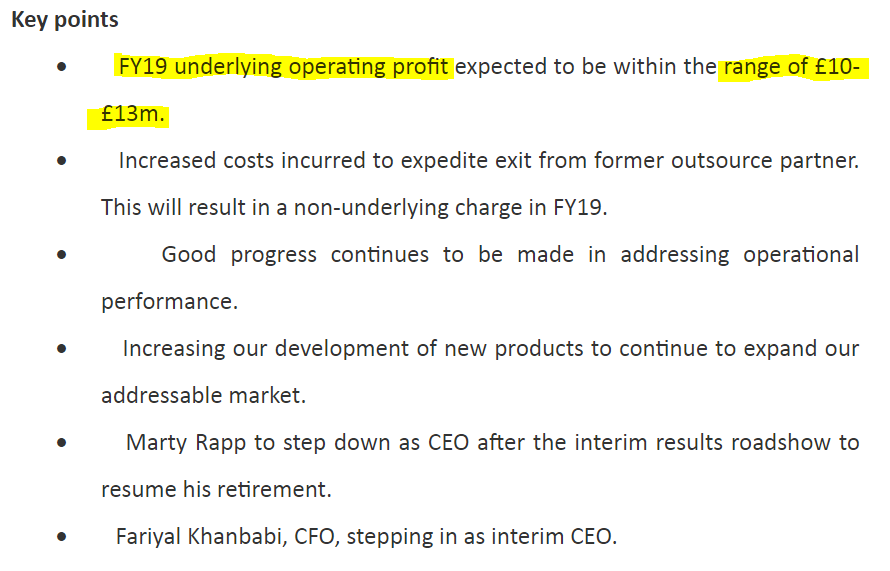

There's a nice clear summary of the key points, which saves me time in having to summarise a load of narrative!

The key question then, is how does the £10-13m range for profit guidance in 2019 compare with previous guidance & broker forecasts? Since the share price is down 30% (a standard profit warning price movement), then I'm guessing it must be well below previous forecasts.

Unfortunately, I cannot find any recent broker research, so am in the dark here. Stockopedia shows a 2019 forecast for net (i.e. after tax) profit of £10.8m, before today's profit warning, which seems fairly close to the revised guidance given today, if we were to take off say 20% for tax, then £10-13m range before tax, becomes £8-10.4m profit after tax revised guidance. Compared with the £10.8m previous post-tax forecast, it doesn't look to be too bad a profit warning (although I'm working on incomplete information).

Balance sheet - I always carefully check the balance sheet of any company which has warned on profits, to see if there might be any solvency issues. We've recently seen how problems at Staffline (LON:STAF) crashed the share price down about 90% from its highs. This was because management stretched the balance sheet, took on too much debt, and hence had no room for manoeuvre when they ran into problems.

Why is it that so many companies make this simple & easily avoidable mistake? Maybe I should run seminars on the importance of a strong balance sheet, for listed company Directors, as so many seem unaware of the unnecessary risks they are taking, by taking on too much bank debt. This is more important than ever at the moment, when it looks like we could be nearing the end of the economic & stock market recovery, which are both very long in the tooth now (10 years).

Back to Dialight. Checking its last balance sheet as at 31 Dec 2018, it looks excellent, with only a small scrap of debt. Hence the downturn in performance reported today should not present any difficulties re solvency.

Although there was a very large build up of inventories last year, which consumed cash. Some work would be needed to ascertain why that happened, and what's being done to fix it, before considering buying any shares in Dialight.

High inventories sounds like an ongoing issue, this issue is mentioned today;

To facilitate our exit from Sanmina we have taken more inventory than we had previously anticipated which has impacted the group in three ways. Firstly, our current inventory levels are higher than expected. Secondly, we have incurred c£4m of additional costs relating to these items in the form of markup, freight and handling charges. These costs will be treated as non-underlying. Thirdly, we expect to have a small net debt position at year end to reflect these additional inventory and non-underlying costs.

Because the balance sheet is strong, the excess inventories don't present any solvency problem. Although I would like to know how the company plans to reduce these inventories in future. Also, excess inventories often require a provision to write-down the valuation, if they're obsolete or slow-moving. So there's an increased risk of another hit to profits from that, in future. Looking back at previous results statements, Dialight has a history of making large provisions against inventories - e.g. £4.7m in 2018 (10% of inventories), and £7.3m in 2017 (a whopping 30% of inventories).

Current trading & outlook - this is baked into the revised profit guidance of £10-13m;

We have seen a weakening in order intake in the second quarter. These trends may continue for the remainder of the year.

After a very strong year in 2018, our Signals & Components business has weakened due to market uncertainty and high levels of inventory in the distribution channel.

Given the potential impact on order intake, referred to above, we now expect our underlying operating profit for the year ending 31 December 2019 to be within the range of £10-£13m. This is before incurring c£4m of non-underlying costs.

The Board believes the Group is increasingly well positioned for FY20, with a stronger operational base, expanded product offering and a wider addressable market.

Again, that doesn't sound too bad to me. The risk is that conditions continue to deteriorate, and another profit warning might come along later this year.

It seems to me that generally, business conditions look to be worsening at the moment. Hence this is probably a time to be seeing the glass half empty, rather than half full (as I would in an economic recovery).

My opinion - this actually looks quite interesting, on a valuation basis.

It sounds like the considerable operational problems are being resolved gradually.

The downturn in current trading doesn't seem to bad, and leaves the group still solidly profitable.

I'm concerned about the excess inventories. Another concern is whether trading is likely to continue deteriorating? There was a sharp fall in UK construction PMI (confidence) data today, here. Actually, that may not be relevant to Dialight, as note 2 in last year's accounts shows that 73% of its sales were in N.America. Only 12% were in Europe, so forget that. It's the health of the US economy which matters most to Dialight, and that seems OK at the moment.

Overall, I think this one looks worthy of a closer look. Today might be an opportunity to pick up some shares in a fundamentally sound company, at a reasonable price, perhaps? Although it has been very accident-prone in the past, so maybe not? I can't make up my mind on this one!

Looking at the chart, 300p seems to be a key support area;

Graham has kindly just emailed me this section;

H & T (LON:HAT)

Share price: 323p (+2%)

No. of shares: 39.7 million (after Placing)

Market cap: £128 million

(Please note that Graham has a long position in HAT)

Graham writes - Quite big news as H&T adds 65 stores to its estate for a cash consideration of £10.6 million. It's big news not just for shareholders of H&T but also for Money Shop employees, many of whom will hopefully be able to keep their jobs.

Money Shop has been shutting down and selling up after a period in which it suffered "an unprecedented number of customer complaints", with the result that trading was no longer viable. It was forced to pay out very large refunds to cheque cashing and payday loan customers.

Ramsdens Holdings (LON:RFX) has been buying Money Shop stores, too, but now H&T has entered the fray with a much larger deal.

Note that H&T does not offer "payday loans"; it offers unsecured personal loans which are paid back in monthly installments over a period of time. See the FAQ on its website. Most of H&T's personal lending does not qualify as "high-cost short-term credit", as defined by the FCA.

So we can expect that the acquired Money Shop stores will, in future, face a lower regulatory risk than they did historically. H&T says that Money Shop stores offer an "almost identical product offering" - pawnbroking, FX, cheque cashing and jewellery retail. But they do not currently offer unsecured lending. They stopped making new loans last year.

Details of the deal

In total, H&T needs £14.6 million for this deal: £10.6 million to buy the stores, and £4 million for working capital.

It is going to come up with these funds by borrowing £8.6 million, and has raised the remaining £6 million via a placing at 316p. The placing is at a discount of 0% to yesterday's closing price. Well done to everyone involved for doing a fair placing!

The share count increases by 5%, i.e. the dilution is very modest even though the total no. of stores has increased by over a third. H&T is also acquiring pawn pledge books from some of the closed Money Shop stores.

Rationale

H&T says it is a "rare and significant opportunity to acquire a complementary portfolio of stores". If I can quote myself for a moment, this is what i said last November when comparing H&T and Ramsdens:

H&T's store count, by contrast, is basically flat. I prefer the strategy of sweating its existing estate. That makes sense to me in a mature industry. H&T can always swoop in and buy up failed rivals whenever the sector goes through another rough patch.

While the sector as a whole is not doing badly, the collapse of Money Shop is indeed one of those unusual opportunities to pick up a failed rival.

Ramsdens has been buying Money Shop stores and opening new stores of its own, in a double-pronged growth strategy, while H&T's existing estate has been unchanged for years, until today.

The expected benefits of this large acquisition are plentiful, and in line with what you would expect. In simple terms, the H&T model and H&T's resources will be applied to what was previously a cash-strapped, less resourced and more limited customer offering. Money Shop stores should improve and be capable of much more, under H&T's ownership.

H&T forecasts a rapid deleveraging with Money Shop stores exceeding H&T's return of capital hurdle rate in the first year (I would like more detail on this point).

My view (Graham)

I'm leaning towards optimism about this deal, though I am anxious to see that the promises are fulfilled.

From a risk point of view, it's great news that just over half of the leases at the acquired stores will expire or be up for re-negotiation within 18 months. As has already been pointed out by others, this could generate an uplift in profitability, if any underperforming stores are closed and rents are reduced in line with market rates.

PBT at the acquired stores in the year to February 2019 was £2.6 million. If that was repeated, it would make for a strong return on the total investment of £14.6 million. This does not include the profits from the acquired pledge loans. I do expect that H&T's infrastructure, being best-in-class, will lead to big upgrades in customer service and product sets at Money Shop stores. Assuming that they are renamed as H&T stores, it will also mean that the brand becomes even more widely recognised across the regions in which it operates.

My primary concern is that there could be an element of cannibalisation versus H&T's existing estate, or needless competition versus Ramsdens. The CEO (who I trust) says that the acquired stores "fill geographical gaps in our UK coverage". It would be good to see this being clearly demonstrated.

Debt: at year-end 2018, H&T had spare capacity of just £10 million on its £35 million borrowing facilities. It is borrowing almost another £9 million for this deal. I do believe that it will succeed in deleveraging, but I can't stress enough how important this is! Its debt levels expanded in line with the growth of its lending activities, and now it needs to start generating some free cash flow to de-risk and be in a strong position to withstand any downturn in trading.

Update - we also get an update that trading is currently in line with expectations at H&T, year-to-date. That's fine.

Overall, I'm happy with this cheap-looking transaction and excited about the potential growth it may enable, while also cautious that the risk levels associated with this stock are currently higher than they have been in recent years.

(back to Paul now)

Funding Circle Holdings (LON:FCH)

Share price: 122.8p (down c.24% today, at 12:39)

No. shares: 347.8m

Market cap: £427.1m

Funding Circle Holdings plc ("Funding Circle" or the "Company"), the leading small and medium enterprise ("SME") loans platform in the UK, US, Germany and the Netherlands, is today providing an update to its Outlook for 2019, as well as H1 2019 financial results and updates to its statistics pages for the three months ending 30 June 2019 (the "Quarter").

Note that this company operates a lending platform - i.e. it acts as an intermediary, and does not take loans onto its own balance sheet.

A friend asked me to look at this share back in April 2019, when it had recently fallen from 400p to 320p. He was waiting for it to go back up to 400p, with a view to shorting it, and wanted my opinion.

After reviewing the figures, I quickly came to the view that FCH has a terrible business model, and is not a viable business. Its only saving grace was a cash pile on the balance sheet - although even that was being burned at an alarming rate. Although we live in strange times, where some tech investors are not concerned about cash burn or profitability. It reminds me very much of 1998-2000, where a similar gung-ho attitude towards risk prevailed. That didn't end well, and nor is the current euphoria likely to end well either, in my opinion. It very much feels like a late-stage bull market in some sectors, especially tech.

Trading update today, summarised by me;

- Revenue growth in H1 was 30%, expected to be 20% for FY - implying a sharp slowdown to c.10% in H2, assuming no seasonal weighting

- Segment adjusted EBITDA at breakeven, whatever that means?

- Adjusted EBITDA loss margin of 25%, which sounds awful

- Reduced demand for loans, and the company has tightened lending risk criteria - hence the slowdown in growth expected in H2

My opinion - when i reviewed the last results, it was clear that Funding Circle has got wildly excessive costs, plus it spends a large amount on marketing too. Hence the cost base is so high, it requires very considerable growth to get anywhere near breakeven, let alone profits.

Hence today's update that growth is slowing to a crawl, is a major problem.

FCH has enough cash for the time being, to continue operating as it is. However, at some point I imagine shareholders are likely to demand a change in strategy, including a radical reduction in costs & cash burn.

I'm kicking myself for not having shorted this share earlier this year.

As you can imagine, the conservative Stockopedia algorithms don't like it one bit, with a StockRank of 8, and "Sucker stock" classification.

Solid State (LON:SOLI)

Share price: 445p (down c.10% yesterday, at market close)

No. shares: 8.5m

Market cap: £37.8m

Solid State plc (AIM: SOLI), the AIM listed manufacturer of computing, power and communications products, and value added distributor of electronic components, is pleased to announce its Final Results for the year ended 31 March 2019.

Key points, which all strike me as positive;

- Adjusted profit before tax up 18% to £3.5m

- Adjusted diluted EPS 16% to 35.9p

- PER of 12.4 - which looks quite good value

- Revenue growth of 22% splits into 10% organic, and 12% from acquisitions

- Order book recently (31 May 2019) is £35.9m, up 56% on prior year. An acquisition (Pacer) contributed most of the increase, but organic growth was still 20%. Impressive.

So why the share price fall? Is there something untoward in the outlook comments?

Outlook - this all sounds positive to me.

Macroeconomic headwinds "continue to be a challenge", but everything else sounds upbeat. It concludes with;

Over the next three years of our five year plan, we will remain focused on securing quality orders as we drive to achieve our goal we set at the beginning of 2017 to double the size of the business through a combination of organic growth and strategic acquisitions.

The Board is confident that the achievements of the last year and the growth in our open order book demonstrate that Solid State is making good progress towards achieving its goals and that the prospects for the Group remain very positive.

Current trading - a slight glitch here, with Q1 (Apr - Jun 2019) has seen a softer than expected order intake. Despite this, the group is still on track to deliver in line with expectations results for 2019/20.

Balance sheet - looks fine to me. Positive NTAV, decent working capital position, and net debt of only £2.0m - I'm happy with this.

My opinion - this looks a good value share, with management seemingly executing well.

It's done 10 acquisitions to date, which usually puts me off, but in this case the balance sheet remains sound, and diversification spreads risk.

I'm not entirely sure why the share dropped 10% on these results, given that they produced EPS slightly ahead of forecast (35.9p vs 35.0p forecast). Maybe I've missed something?

Overall then, this looks quite a nice GARP (growth at reasonable price) share, in my view, although it's not a sector that particularly interests me.

Stockopedia - loves it, a StockRank of 97, and Super Stock classification.

Also, note that this share qualifies for the "Tiny Titans" stock screen, which I've found to be historically a very good screen, picking up some excellent small caps. That screen has a very good long term track record too, so is worth checking.

IMImobile (LON:IMO)

Share price: 324p (unchanged yesterday)

No. shares: 66.9m

Market cap: £216.8m

IMImobile PLC (AIM:IMO), a cloud communications software and solutions provider, today announces its Unaudited Preliminary Results ("Preliminary Results") for the year ended 31 March 2019.

The headlines read well for this international group, e.g.

- Revenue up 28% to £142.7m, of which 17% is organic - impressive

- Adjusted profit after tax up 39% to £10.8m. Whenever PAT is quoted, I always check to see if there's been a favourable tax reduction! Only slightly in this case, as adjusted PBT is up 36% - so it looks like the company cherry-picked the better number for the highlights section

- Adjusted diluted EPS up 35% to 15.1p giving a PER of 21.5 - not cheap, but if growth continues apace, then it could soon grow into the valuation

Outlook comments sounds upbeat;

very exciting stage of development with technology developments creating momentum in the customer communications sector for more automation and use of digital channels. We are ideally placed to capitalise on this momentum and we believe there is no clear category leader in this market and that, due to our leading position in the advanced UK market, we have an opportunity to play a leading role globally.

The financial year has started well with trading in line with expectations. We continue to have good earnings visibility due to our established client relationships and healthy pipeline of new deployments and high proportion of recurring customer revenues.

We are confident in delivering continued organic growth across all parts of the business.

Lots of positives above. I think management has a lot of credibility here, having established a good track record. I've mentioned here in previous SCVRs, that I've met the CEO, Jay Patel, several times and been briefed on the business by him. Each time I came away highly impressed.

Other points;

Note the massive share based payment charge of £8.9m (versus £4.6m last year)

Balance sheet - not great, with negative NTAV - also receivables look extremely high, which would need looking into.

Cashflow - heavy capitalisation of intangibles (probably development spend) of £6.6m. Nearly £20m spent on acquisitions, part-funded by new bank loan. No divis paid.

My opinion - I like management, and the company. I'm less keen on the balance sheet & cashflow statement. So overall, probably not one for me, although it does look interesting in other ways, e.g. revenue & profit growth, sticky recurring revenues, etc.

Stockopedia's view is middling, with a StockRank of 53, but a positive "High Flyer" classification.

Malvern International (LON:MLVN)

Share price: 3.15p

No. shares: 258.6m

Market cap: £8.1m

(at the time of writing, I hold a long position in this share)

This is an education group, with operations in the UK & Far East. It operates language schools, accountancy training, and various similar activities. The story here is all about a turnaround under new management.

These 2018 results were issued in the nick of time, just before close of play on 28 June 2019. Any later, and the share would have been temporarily suspended. I see that as clearly unsatisfactory, and embarrassing for the company, highlighting gaps in the skill set of management. That's been addressed with the recent appointment of an experienced NED.

Apparently, the accounts had been prepared months earlier, but the various international auditors delayed things, and raised queries at the last minute. So the problem was more about the auditors not being well managed by the company, as opposed to the company itself being in a muddle with its figures, which it doesn't seem to be. Even so it's not good enough, and management realise that, so I don't expect this problem to recur, which is really all that matters. Mistakes happen, people have to learn how to do things at micro caps.

I'm philosophical about these things. At an £8m market cap company, you're going to get a few things going wrong from time to time. The more important thing for me, is that management seems focused on the turnaround. The attraction of which is the operational gearing.

To save me time explaining the business model, this video from our friends Tamzin & Tim at PIWorld is a useful introduction to Malvern (filmed at Mello London, in May 2019).

Outlook - sounds positive to me. Although the implication seems to be that the company was ahead of budget up to end April, and then slowed down to be just in line with expectations now. It's not the most clear wording, and could have been better explained, I think. Note the 2nd half weighting is normal, due to summer schools falling into H2;

"Trading in the current financial year has started satisfactorily and is in line with the Board's expectations for the year as a whole.

Trading up to the end of April was ahead of budget. Sales to the end of April plus sales booked for delivery in the remainder of the year stood at £6.9 million (2018: £3.9 million). As in 2018, trading in 2019 as a whole will be second half weighted as revenue in the second half will benefit from summer enrolments in London and Singapore, enrolment of the universities in the second half, and chartered accountants' courses in more demand through the second half of the year in Singapore."

My opinion - there's not really any point in me delving into the 2018 figures, as it was a turnaround year, with restructuring costs, etc.

The interesting numbers should be in 2019, with new contract wins, better focused sales, and restructuring largely done.

I bought at 4p in a placing some time ago, and see this as a 2-3 year turnaround. The current year is forecast to produce £1.1m adjusted profit before tax. If that's achieved, then the share could re-rate upwards, being seen as a successful turnaround.

There have been a few bumps in the road so far, so I'm probably about 50% confident in this share.

That's it for today. Sorry the last 3 sections were late. I've duplicated them in the next day's report, so that everyone sees them.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.