Good morning, it's Paul here.

Many thanks to Graham for covering last week's reports, which gave me the opportunity to grab a relaxing & enjoyable week in the sun, in Malta - highly recommended by the way, if you've not been there before (sunny, friendly people, low crime, food & accommodation much cheaper than Greek islands, mosquitoes not too bad, interesting history/culture, everyone speaks English, and they drive on the left).

Estimated completion time of today's report - I'm starting early today, so should be finished by lunchtime. EDIT at 13:12 - it's taking longer than expected, so I'll carry on writing this afternoon. Revised completion time, 5 pm. Actual completion time: 23:39 - there we go. Does it actually matter?

Today's report is now finished.

Thomas Cook

Talking of which, the really big story today seems to be that Thomas Cook appears to have gone bust, according to press reports. The BBC is saying it's gone into liquidation (i.e. ceased trading), rather than the more usual administration process (where an insolvent business continues trading for a while, as a buyer is sought for its viable parts).

It's been obvious for several years that the shares were worthless, because the group was very clearly insolvent, with vast, unrepayable debt. However, its day-to-day operations were supposed to have been in the process of being rescued by a bail-out from its major Chinese shareholders.

Press reports this morning are saying that the group has ceased trading with immediate effect, leaving huge numbers of holidaymakers stranded. What a mess. The Government, CAA, etc, are apparently hiring large numbers of charter planes to repatriate massive numbers of stranded holidaymakers. That sounds like a gigantic undertaking, difficult to manage due to its sheer scale.

Here's the 7 am RNS, confirming liquidation.

Let's hope the repatriation process is not too gruelling for its customers. Although I did read an article in the Telegraph yesterday, claiming that Thomas Cook customers in a Tunisian hotel were essentially taken hostage - locked in by security guards, if they refused to pay the hotel directly for holidays they had already paid for through Thomas Cook.

What read-across might there be for other shares? I imagine that TUI AG (LON:TUI) could see positive sentiment, as a major competitor goes bust. Although it depends if any parts of Thomas Cook might continue trading in some form? Sometimes it's possible to save the viable parts of a large group.

Dart (LON:DTG) could be a possible beneficiary for the same reason, as its relatively new packaged holiday business has been growing fast. DTG is on my watchlist as looking attractively good value, for a decently growing business, that appears to be well managed. It's more attractive today, now that Thomas Cook is out of the frame. That's over £9bn of revenues to be re-allocated amongst competitors, if no parts of Thomas Cook are rescued.

On The Beach (LON:OTB)

Share price: 403p (up 6% today, at 13:14)

No. shares: 131.2m

Market cap: 528.7m

Statement re Thomas Cook (profit warning)

... the UK's leading online retailer for beach holidays

I would have thought that OTB would benefit from the disappearance of a large competitor. However, from this announcement today, it sounds as if OTB must be re-selling Thomas Cook holidays, hence is going to suffer some financial fallout from its collapse over the weekend.

... The Board anticipates that there will be a one-off exceptional cost associated with helping customers to organise alternative travel arrangements, and lost margin on cancelled bookings.

The Group expects to be able to recover the costs of the cancelled flights via chargeback claim (as was the case for the Monarch failure in 2017).

This one-off exceptional will be booked in the current financial year.

The Board is currently evaluating the potential effects of the failure on its forecasted performance for the year ending 30 September 2020, and a further update will be provided when appropriate.

That's not terribly helpful, as it doesn't give us anything to go on, in terms of the size of the financial impact on OTB.

My opinion - none, as I don't have any figures to work on.

All we can do is to await broker updates, and a further update from the company in due course.

EDIT: note that the share price initially fell, but has now moved into positive territory. It must be that investors are seeing through the one-off costs of Thomas Cook going bust, and instead seeing a bigger market opportunity for OnTheBeach to grab some extra business longer term.

Sosandar (LON:SOS)

Share price: 17.0p (up 5% today, at 13:16)

No. shares: 162.9m

Market cap: £27.7m

(at the time of writing, I hold a long position in this share)

AGM Statement (trading update)

... Sosandar plc, the online women's fashion brand ...

This is a pleasing update today, if a little over-the-top in how it's phrased.

Shareholders and commentators might be understandably sceptical about gushing prose, because the last trading update on 7 July 2019 sounded so positive, but delivered a bombshell that Q1 sales were only up 23% year-on-year. Whereas the forecasts for this year needed over 100% growth for FY 03/2020. This smashed the share price over the summer.

However, it sounds as if things are back on track. The most important bit is this, which shareholders should find reassuring;

We are pleased with the recent performance of the business, which has been in line with management expectations...

The current house broker forecast is for £9.5m revenues this year, up 116% on last year's actual of £4.4m. Earlier this year, I asked management if their expectations are the same as the broker's, and they confirmed yes this is the case.

Other points made in today's update;

Increased marketing spend, following £7m recent placing (at 15p). Note that Sosandar now has more cash than at any point in the past, so it can afford to really go for it, in terms of increased product ranges & broadening the marketing spend in to new areas like local TV, and tube stations (escalator digital panels)

Autumn season has started well;

The important Autumn period has only just begun but results for the first half of September have been very strong, and midway through September revenue has already exceeded that achieved in September last year.

This is so important. The company has heavy seasonality towards Sept-Dec inclusive. Given that it had a disappointing Q1 (Apr-Jun 2019), partly weather-related, it absolutely has to deliver a really strong autumn/winter season, to stand any chance of hitting the full year forecast numbers.

Management was absolutely adamant in the summer that the ambitious growth forecasts could be achieved, and gave good reasons to justify that optimism - mainly a big expansion of product ranges (in particular new buyers having been recruited to specialise in denim, footwear & accessories). These categories are favourable because they have lower customer returns rates than e.g. dresses, which have high returns due to the more complex fit on different shaped bodies.

We've seen before, e.g. with Asos and BooHoo, that during the early stage growth, expansion of product ranges fed through directly to increased sales growth. So the much wider product range (number of styles is being roughly doubled) for this year's autumn/winter season, should feed straight through to greatly increased sales.

Add in a bigger than ever marketing budget, and I'm reasonably hopeful that forecast growth for this year ending 03/2020 is achievable.

Third party platforms - Sosandar's original intention was to just sell through its own website. However, this year it has decided to sell through third party websites too. That's an extra avenue of growth, albeit lower margin, and makes complete sense.

The increasing product range has also contributed to third party platform interest. Sosandar is now successfully trading with Silk Fred and opportunities are presenting themselves to work with other interested parties...

Watch this space then. Joining one of the big online platforms (e.g. Next), could prove lucrative in the longer term.

My opinion - I'm pleased with this update. I've mentioned this before, but it's a critical point - the initial customer reaction to new autumn/winter products launched in September tends to be a key indicator of how the whole season is likely to pan out. That was my experience from my 8 years working in this sector. If the new product in Sept sold well initially, then I bumped up my full year forecasts. Repeat orders can be quickly placed, for the best-selling lines, meaning that you get two bites of the cake. Sosandar has greatly improved its speed to market, and can get repeat product in very quickly, e.g. 4 weeks, when needed.

Overall, today's update reassures me that things seem to be getting back on track, after a not-so-good spring/summer season. Bear in mind that the interim results (Apr-Sep 2019) are likely to look fairly poor, when they're released. It's the full year figures that matter, as they will include the key Oct-Dec trading period, with a big range, backed by big marketing spend.

The company is still loss-making at this stage, so remains speculative. Although it now has plenty of cash to push for fast growth. As the Chairman of Boohoo (LON:BOO) once said to me - there are no barriers to entry in online fashion, but there are huge barriers to achieving scale. If SOS does reach scale, and moves into profit, then the upside could be very exciting. I'm more confident that is possible after reading today's update.

As you can see, it's been a roller coaster ride for shareholders to date, as is often the case for loss-making growth companies. The valuation of such shares is notoriously tricky, as it's based on investor sentiment & expectations of the future. Like a lot of speculative shares, this one tends to overshoot on the upside and the downside, depending on newsflow and market sentiment (which has been diabolical for small caps over the summer this year).

I'm in London today, so will try to get to King's Cross tube station, to take some pictures (assuming that my iPhone is still working - it's acting funny after taking a brief plunge into the bath in a weekend accident) to post here, of Sosandar's adverts on the digital displays flanking the escalators. I could see that working well, given that there are so many professional women going to & from work, that are perfect target customers. Given that one of Sosandar's key strengths is high quality, eye-catching photography (due to the joint CEOs' background in fashion magazine publishing), then this strikes me as a good new route to reach new customers. Tube adverts worked well for BooHoo.

XLMedia (LON:XLM)

Share price: 60p (down 20% today, at 13:25)

No. shares: 206.8m

Market cap: £124.1m

Interim results & full year update (profit warning)

XLMedia (AIM: XLM), a leading provider of digital performance marketing services, announces its unaudited interim results for the six months ended 30 June 2019.

Revenues in H1 are $42.5m, with full year guidance reduced to $80m (implying a further fall to $37.5m in H2). This is about 14% down on the $93.4m forecast for FY 12/2019 shown on Stockopedia (sourced from Thomson Reuters data).

Note this $80m forecast for 2019 revenue is down 32% on 2018 actual revenue, and 42% down on 2017 actual revenues. Clearly something is going wrong, what is it?

Regulation - XLM makes its money mainly from websites that drive customers to gambling websites, i.e. online casinos. The commentary with today's numbers gives a fair bit of detail over adverse regulatory changes in various countries, which have hurt its profitability.

Profitability - despite the large drop in revenues, this remains a highly profitable & cash generative business. The revised guidance today is for $34m EBITDA for FY 12/2019. Note that is a huge EBITDA profit margin, of 42% of revenues.

The key question is whether the still-high profits are sustainable, given the tightening regulatory backdrop?

Dividends - the profit & cashflows are real (whether sustainable, is the key question?), and are evidenced by generous dividends & share buybacks. Despite the profit warning, the interim dividend is actually being raised 5% to 3.1584 US cents per share. Although note that last year's interim dividend was cut by 25% on the prior year. So a 5% rise this year still leaves it well below that of 2 years ago.

Still, the dividend yield (if maintained at say 7 US cents) would be around 9% - very attractive, and the main reason to buy this share.

Balance sheet - this is dominated with intangible assets, so NAV of $161.5m drops to NTAV of $35.1m once we strip out intangibles (Goodwill: $23.65m, Domains & websites: $92.2m, and Other intangibles of $10.57m).

Cash of $40.27m at 30 June 2019 will have dropped by about half due to the £15.7m tender offer buying back 19.7m shares at 80p post interim period end, in August 2019.

At £1 = $1.24, I make that $19.5m to pay for the tender offer, using up almost half the 30 June 2019 cash pile.

With a large cash pile, why does the group also have bank debt of $4.2m?

A new lease liability of $8.76m has popped up in longer term liabilities.

Cashflow statement - looks very healthy. Operating cashflow was a whopping $23.8m in H1, benefiting from the reversal of c.$4m in adverse working capital movements compared with H1 of last year.

The strong cashflows generated are being used to pay generous dividends, and to fund share buybacks.

New CEO starts on 2 Oct 2019.

My opinion - this share peaked at just over 200p in late 2017. It's now only 60p, so disappointing performance has been thoroughly reflected in a reduced valuation.

Despite falling revenue, XLM remains a high margin cash cow, paying a generous dividend yield.

If you think the business has stabilised at lower revenues, or could even recover, then the shares are a bargain.

If you think the regulatory situation is doing lasting damage to the business, then the shares may not recover.

Personally, I've never been particularly attracted to this share, despite the impressive numbers. The reason being that it is one of several Israeli marketing/tech companies where things looked too good to be true. Thus raising the question of how sustainable the high levels of profitability & cashflow would be, in rapidly changing sectors?

The commentary today is open & detailed about the regulatory problems in the online gambling sector. That's the crux of the matter. I think that, in order to form an accurate view on the value of this share, one would really need to do detailed work on the regulatory threats & possible opportunities.

I quite like the fact that XLM has made hay whilst the sun shined re online gaming promotion, hence it must have learned some useful expertise which possibly could be applied to other sectors?

Sosandar (LON:SOS) - advertising on the tube - I couldn't resist the urge to nip to Euston & Kings Cross underground stations this afternoon (as I was in London anyway) to see if I could take some photos for you, of the Sosandar advertising on the escalator digital displays at selected London underground stations.

Incidentally, if you like cycling in central London, which I do, then the relatively new "Jump" bikes from Uber are an absolutely brilliant way to get around. They give an excellent electric assist (much stronger than the competing "Lime" electric assist bikes, which are feeble). Hence one can nip around London fairly easily at 15 mph, avoiding the traditional pitfall of cycling - i.e. turning up at meetings drenched in sweat, which is what tends to happen with normal bikes, especially in summer.

You do have to remember to lock the Jump bike after using it though. I forgot to do this the other day, and was charged £87 by Uber for a 5 minute ride. Some naughty person must have noticed that I inadvertently left the electric Jump bike unlocked, and I later saw from the App that a person unknown went on a 9 hour joyride around several estates in Stoke Newington, at my expense. Uber were very good, and refunded £86 of it to me once I had apologised to them.

Well anyway, I rocked up at Kings Cross station today, and abandoned my Jump bike (after locking it this time) on a traffic island just opposite the station. Then it was time to take some pictures of the digital advertising displays, and hopefully find some Sosandar adverts. This is how it looked - note how good the new digital displays are, compared with the traditional old style adverts;

This was all a bit of an anti-climax, as unfortunately there didn't seem to be any Sosandar ads playing (I took these photos at around 15:30). So after several trips up & down the escalators, and starting to get funny looks from security, I decided to visit Euston underground station too, but no Sosandar there either.

A friend did message me recently to say that he'd seen a Sosandar ad playing on the digital displays at Bond Street underground.

Anyway, after a rather fruitless trip out, I needed a lie-down when I arrived home. Hence why this update is a bit late.

I've just emailed Sosandar's PR person, to ask for some pictures of the Sosandar tube ads, as I'm interested in seeing them, and some readers who take an interest in the company might also be.

Anyway, that's 5 minutes of your life you won't get back, so I'd better make up for it by covering another reader request.

Billington Holdings (LON:BILN)

Share price: 333p (up 5% today, at market close)

No. shares: 12.9m

Market cap: £43.0m

Billington Holdings Plc (AIM: BILN), one of the UK's leading structural steel and construction safety solutions specialists, is pleased to announce its unaudited interim results for the six months ended 30 June 2019.

It's over 2 years since I last looked at this company, so am a little rusty on it (geddit?!)

Stockopedia ranks it as a "Super Stock", and a very high StockRank - which are a good start, although obviously not a guarantee of success for an individual share. StockRanks work best for a portfolio of shares, where the results have been superb - hence why a lot of us like the system to help our investing process.

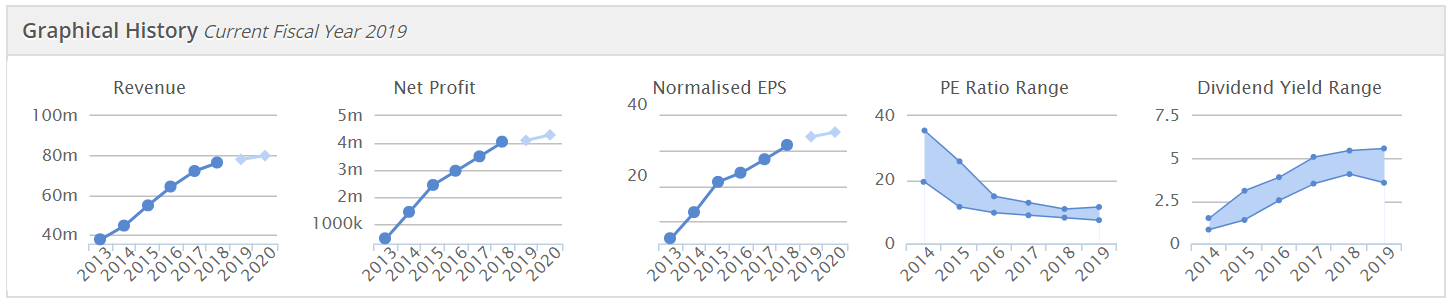

Check out these Stockopedia graphs too, for Billington - everything moving in the right direction, over several years - performance up, but value improving;

Economic cyclicality is something we need to be very careful about right now. If the economy is turning down (press reports seem to be indicating that business & individual confidence is falling right now), then this could be a bad time to buy apparently cheap cyclical companies, maybe, or maybe not. Nobody really knows for sure.

The financial, and summary highlights to today's H1 results look really good;

(apologies for wonky highlighting - am using my left hand for the mouse these days (am right-handed), in order to reduce RSI)

Outlook - sounds good too;

Prospects and Outlook

The Group has had a very busy and successful first half of the year. Whilst the overall market continues to be uncertain, the outlook for Billington remains positive, particularly given the Group's ability to target both the largest and medium contracts, insulating us, in part, from any temporary disruption in the market.

The Group has gained further large contracts during the first half that will be executed in the second half and into 2020. Our order book remains at strong levels and we continue to see a number of significant prospects and coupled with a healthy balance sheet we are well positioned for the future and remain cautiously optimistic.

In closing I would like to thank Billington's Board, employees, shareholders and stakeholders for their continued support, and I look forward to a busy and bright second half of the year.

Economic cyclicality - the above positive outlook is all great. However, previous economic cycles have taught me that when the economy as a whole rolls over into a downturn, then sooner or later, it affects all cyclical businesses. A strong order book can dry up, if the economy shudders to a halt. Therefore I think readers need to think long & hard about this crucial issue.

Over the last 20+ years, I've bought (and/or not sold) cyclical businesses, at the wrong point in the cycle, believing that they would weather the downturn, only to be caught out by disastrous share price falls some time later, when reality hit home, as order books failed to replenish once the economy really tanked. Hence I'm very wary of cyclicals right now, in a time of considerable uncertainty.

Balance sheet - looks fairly good, but not massively strong.

The £10m in cash is partially offset with £1.6m in borrowings, so that's net cash of £8.4m - good for a company with a £43m market cap.

The current ratio is 1.42 - that's a sound position, but not particularly strong, the way I look at things.

My opinion - if the economy pans out fine, then this share could continue to do well.

The PER of about 9, and dividend yield of about 4% look quite attractive, providing those profits & pay outs are sustainable.

This share can also be very illiquid, hence difficult to exit if something goes wrong.

On balance, I'm not tempted to go near anything this cyclical right now.

A couple of quick snippets to finish off with;

Brady (LON:BRY) - I hadn't spotted the profit warning in August. That's mainly because I formed the view some time ago that it just isn't a very good company, making losses in most recent years.

Interim figures today look pretty awful, as does the commentary about carrying out a strategic review.

The balance sheet looks very weak indeed, with a current ratio of only 0.52 - very low indeed. Although software companies do benefit from favourable cashflows - receiving money up-front from customers, which can enable them to operate with apparently very weak balance sheets.

It still seems to be in a net cash position of about £1.0m - so no apparent risk of the bank pulling the plug.

NAV of £17.2m, less intangibles of £25.8m, means NTAV is negative at -£8.6m is weak, but not necessarily disastrous if the company was profitable. The trouble is, that the company is loss-making, hence it's difficult to see how it can avoid a fundraising, or putting itself up for sale.

My opinion - way too risky.

I'll leave it there for today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.