Good morning!

Company news is dead today so let's circle back and look at a few miscellanous things from earlier in the week.

In the end, I covered:

- Begbies Traynor (LON:BEG) (today's news)

- C&C (LON:CCR)

- Vianet (LON:VNET)

- Goco (LON:GOCO)

Begbies Traynor (LON:BEG)

- Share price: 87.8p (+3%)

- No. of shares: 126 million

- Market cap: £111 million

Another acquisition by inslolvency practitioner Begbies, hot on the heels of the one on Monday which I commented on.

Monday's target was a business agent, Ernest Wilson.

Today's target is ALJ, a London-based "insolvency and business recovery practice." Would it be fair to think of it as a "mini-Begbies"?

Here is its website. There are 23 individuals on the "Our people" page.

Terms

The price is £2.35 million up front (mostly cash), and then another £4 million in defcon over five years. Max defcon will only be paid "in the event of significant growth.

Comparison to earnings: ALJ earnied PBT of £0.9 million in the most recent financial year.

CEO comment

"This acquisition is in line with our strategy to increase the scale and market share of our market-leading insolvency practice."

Outlook

Since July, Begbies has raised £8.3 million in a placing and acquired three companies. Begbies thinks that the aggregate impact of these actions will be earnings enhancing, both in the current financial year (FY April 2020) and in future years.

My view

Begbies is picking up companies on the cheap - good news for shareholders.

I don't think this acquisition will change anybody's view. It's a continuation of the existing strategy.

So if you are comfortable investing in this sector and/or you think that the economy is going provide a lot of work for insolvency practitioners in the next few years, then this share could be of interest.

I continue to view this share as an interesting hedge against recession.

It gets rated as a High Flyer by the algorithms.

C&C (LON:CCR)

- Share price: 377p (-0.4%)

- No. of shares: 311 million

- Market cap: £1,173 million

Half-year Report (yesterday)

Please note that I have a long position in C&C.

A quick warning that the algorithms can't handle this share right now. It recently cancelled its listing in Dublin, and changed the denomination of its shares from euros to pounds. This has made statistical analysis go haywire.

It's obviously too big to be covered in this report. But I own shares in it and it's a quiet afternoon, so let's take a look! It's smaller than Tesla, after all.

Background

C&C (formerly Cantrell & Cochrane) owns a wide range of drinks brands. The flagship brands are Bulmers cider (in Ireland, known as Magners in the UK), and Tennent's Scottish beer. It also has a wide range of craft brands, local brands, wines and soft drinks

And it has very significant capabilities in drinks wholesaling and distribution.

Those of you who've been here for a while will remember that I was outspoken on the topic of the late Conviviality (CVR) and its disastrous acquisition spree.

One of the triggers for me to keep a closer eye on C&C was noticing that it picked up Matthew Clark and Bibendum for almost nothing from the carcass of Conviviality.

While those aren't high-quality businesses, they do have some value for investors and buying them out of administration looks like a tactical, opportunistic decision by C&C.

Results

While the CCR share price is a little soft today, it reacted well to these results yesterday.

Some of the things I liked from the RNS:

- Matthew Clark: The key performance indicator OTIF (on-time in-full, measuring whether customers get what they want, when they want it) at has improved from 64% at acquisition to 96% now. What an amazing improvement! Another KPI, "Availability", has improved from 42% to 98%!

- Group H1 operating profit +9% to €64 million (excluding IFRS 16).

- Group like-for-like adjusted diluted EPS up 5.8%.

- Free cash flow of €80.6 million, using the company's own calculation method. The cash flow statement shows €91 million in after-tax operating cash flow, offset by small investing outflows.

- Net debt reduces to €255 million (excluding the impact of IFRS 16), compared to €279 million a year ago.

The core drinks brands are mature and their net revenue growth, as you would expect: +2.7% in Great Britain (despite declining volumes) and minus 3.1% in Ireland (mostly driven by price and mix effects).

Weather and the World Cup were a big help in 2018, making for tough comparators this year. Hopefully Euro 2020 will help to boost next year!

Dividends - there is a small increase in the interim dividend, to 5.5 cents per share.

Buybacks - the company, through its broker, buys back its own shares, to offset the dilution of scrip dividends. €11 million was invested in this way, and the shares bought back were cancelled. I'm not a big fan of scrip dividend schemes, but this is a reasonable way to manage them.

FTSE - thanks to the cancellation of its Dublin listing and the change in the share price denomination, CCR will be eligible for inclusion in the FTSE-250. This will help to drive awareness among investors, and could bring passive investors in, too.

My view

It's a very detailed RNS but I think the big-picture view is absolutely fine.

The core brands are holding up well, despite the long alcoholic drinks market declining in both the UK and Ireland. Market share performance is mixed but mostly stable.

Meanwhile, the acquired distribution companies are seeing their performance improve and are making a meaningful contribution to operating profit.

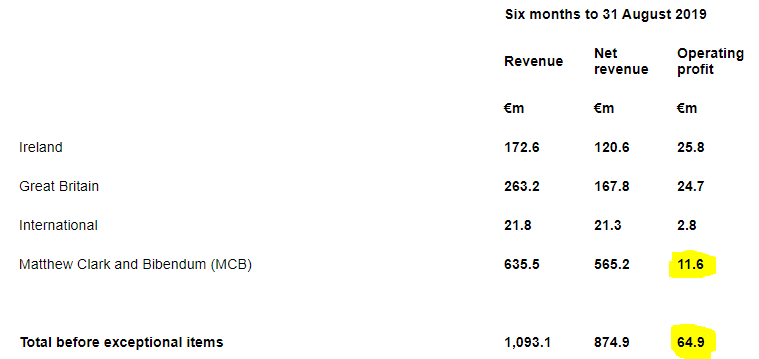

You can see the contribution of Matthew Clark and Bibendum in the table below. CCR wants their operating margin to improve from 2% to 3%, which would be another very nice boost to Group profits (the numbers below are after the introduction of IFRS 16):

Net debt has been a little on the high side, and that's one of the reasons I kept this to a very small percentage of my portfolio.

Thankfully, there are signs of progress on that front. I wouldn't mind seeing a continued reduction in leverage from here. Net debt of €255 million compares with forecast EBIT in the current financial year of €117 million - not too scary.

The market cap is equivalent to about €1,350 million, while annual net income is planned to increase to about €100 million over the next two years.

So while I'm not expecting this share to be a multi-bagger, I do think it offers plenty of value and without too much risk.

The cider brands and Tennent's are two strong franchises, in my view. Craft beers (e.g. 5 Lamps) and wines offer some diversification, and the distribution businesses might be further improved under the responsible stewardship of C&C.

So I think there's a lot to like, and I'm happy for this to be a small component of my portfolio. I might bump it up to a bigger size on additional study or if prospects further improve.

Vianet (LON:VNET)

- Share price: 137p (+3%)

- No. of shares: 28.5 million

- Market cap: £39 million

Trading Update (Tuesday)

This is a "provider of actionable data and business insight through devices connected to its Internet of Things ("IOT") platform".

This PLC has been around for a while - since 2006.

At its heart is the Brulines business, which records the volume of liquid that passes through beer lines.

Trading in H1 is in line with expectations.

CEO comment

The team has continued to make very good commercial progress, particularly with contract wins for our telemetry and payment solutions in the coffee vending and unattended retail vending market, with solid support from our Smart Zones business which is developing new revenue lines. Double digit growth in the period builds on our successful recent track record and further demonstrates that the strategy of leveraging the power of our cutting edge technology to bring game changing business insight to our customers has exciting prospects."

My view

I've just spent some time on the company's website and checking its most recent annual report. I'm very excited by what I've read.

See its investor relations website.

I wanted to remind myself which of its divisions did the beer monitoring, which I understood to be the activity responsible for most of its historical (and present?) profitability.

I was presented with two divisions: Smart Machines and Smart Zones.

Smart Machines:

Hmm. Where's the beer monitoring?

Maybe it's in Smart Zones:

Cloud-based, big data in the Internet of Things. Sounds like the perfect investment, doesn't it?

There is a reference to flow monitoring in the description of Smart Machines, so I guess this must be it.

Ah yes, iDraught:

Another investor keyword: "ecosytem".

So Vianet provides cloud-based, Big Data ecosystems in the Internet of Things.

That's almost everything that I'm looking for in an investment, but I also look for "software as a service".

Alas, I could find no reference to "Saas" on Vianet's website.

It took a little bit of digging but, thankfully, I was able to find a reference to SaaS on vianetplc.com.

Its "Statement of Compliance with the Corporate Governance Code", published last year, dutifully informs us that the company's Directors have the necessary "skills and experience, including in the areas of IOT, b2b, software as a service..."

Boom!

Vianet makes cloud-based, Big Data, software-as-a-service ecosystems in the Internet of Things.

If only it could apply itself to a hot sector like crypto or cannabis, then who could resist investing in it?

My actual view

Vianet looks fairly valued at 14x forward earnings: it has a stable beer monitoring business which is performing ok (even though pubs in general are doing poorly) and other activities which are growing more quickly from a low base.

"Smart Machines" (the growing part of the business) made PBT of nearly £1 million last year. Excluding the acquisition it made, profits in this division were £560k and revenue growth was 42%. Has potential.

Goco (LON:GOCO)

- Share price: 99.4p (+1%)

- No. of shares: 418.5 million

- Market cap: £416 million

Refinancing of Group Debt Facilities

(Please note that I have a long position in GOCO.)

Goco has a credit facility: a 4-year RCF for £105 million, and 4-year term loan for £15 million.

The leverage covenant moves from 2.5x adjusted EBITDA to 3.0x adjusted EBITDA, signalling the banks are comfortable with the stability of the business.

CFO comment:

"The agreement secures an increased and more flexible facility, providing the Group with capacity to deliver against its strategy of accelerating the customer numbers in its AutoSave business whilst maintaining a disciplined cost of customer acquisition.

"I am pleased that we have been able to agree attractive terms with the banks and that they are supportive of our strategy, which we believe will lead to a significantly higher EBITDA margin profile for GoCo Group and be transformative to Group earnings by 2022."

My view

This has been another pleasant holding and I'm glad the banks are supportive. The next task will be to use this facility responsibly and carefully.

Net debt was last reported at £70 million. EBIT is forecast to be £27 million this year, rising to £33 million next year.

Much like with Britvic, I wouldn't mind seeing Goco paying off its debts, but I'm also not overly worried by the existing debt load, relative to the company's profitability.

More customers are signing up for the automatic switching products (I like to call it price comparison-as-a-service), and this could help to boost revenue visibility. And Goco's track record is already pretty good, when it comes to the consistency of profitability. I think it makes good sense that banks would want to lend to it!

Happy to continue holding this one, and there is a chance I could increase position size.

StockRanks are neutral on it - it's held back by the fact that it has negative NAV. This means that P/BV, P/TBV and ROE can't be calculated.

It has negative NAV, and tangible net asset value (NTAV) is deeply negative at minus £75 million.

This doesn't bother me very much, because it's a collection of price comparison websites and services - what tangible assets does it really need? All I care about is that it's profitable and can manage its debt load.

Out of time for today, but thanks for dropping by as always. Have a great weekend - you'll be back in Paul's capable hands next week.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.