Good morning!

Today I'm looking at:

- Bonmarche Holdings (LON:BON) (in administration)

- Bioventix (LON:BVXP)

- Mind Gym (LON:MIND)

- Begbies Traynor (LON:BEG)

- Trifast (LON:TRI)

- Angling Direct (LON:ANG)

- Watchstone (LON:WTG)

Bonmarche (BON)

There is going to be a lot of politics today, to distract us from the markets.

One story where I'd like to add a footnote is Bonmarche, which is now in administration.

Paul and I covered this stock many times over the years - see the archives.

In September 2018, I noted that it was "cheap on conventional metrics" and "could be worth a look, as a contrarian play", while also noting that the company had no plans to reduce its large porfolio of more than 300 stores. This stance I described as "complacent".

Things went from bad to worse since then, and I grew increasingly wary of the company's outlook.

The Chief Executive has now admitted in a statement:

"We have spent a number of months examining our business model and looking for alternatives. But we have been sadly forced to conclude that under the present terms of business, our model simply does not work," she added.

For my point of view, Bonmarche has (or had) three major problems:

- online sales much too small relative to store sales (c. 12% of total).

- no planning took place to reduce the store estate, if necessary.

- the brand identity doesn't jump out.

For now, the stores continue to trade as normal and the website is still live. No redundancies have been made, according to the BBC. The business is being marketed for sale.

Philip Day's investment vehicle, which owns 95% of BON shares, says it is "disappointed with the result of our investment in Bonmarche."

My view - if Philip Day can get it wrong, and if a company which looked cheap on conventional metrics can go under very quickly, this provides further confirmation to me that we need to be extremely cautious when it comes to the retail sector.

The trend of legacy retailers collapsing shows no sign of abating. I wonder if Marks and Spencer (LON:MKS) might be the next Big Short?

Bioventix (LON:BVXP)

- Share price: £33.90 (-5%)

- No. of shares: 5.1 million

- Market cap: £173 million

Results for the year ended 30 June 2019

This popular and succesful company reports its annual numbers.

It sells "a total of around 10 grams of purified physical antibody per year".

In addition to these sales, it earns royalties from the sale of diagnostic products which use BVXP antibodies. These royalties generate about 70% of BVXP's revenues.

Results

- revenues +16% to £9.3 million

- its key product (used for Vitamin D deficiency testing) saw sales increase 27% to £4.3 million

- PBT +14% to £7 million

Comment on market conditions:

Once again, sales have surpassed our expectations. Despite this pleasing news, we are increasingly sure that price pressure (i.e. $/test prices achieved in the downstream market) is balancing the increase in market volume leading to a flattening total market in US Dollar terms.

This is clearly evidenced by a number of our vitamin D customer revenue streams which, after a period of significant growth now appear to have reached a plateau.

Currencies - most income is in dollars and euros, and BVXP has no plans to hedge. Therefore, with the pound sterling recovering (and in my view, likely to continue strengthening), this could act as a headwind to the reported numbers in future periods.

No capitalised research - BVXP doesn't capitalise its research expenditure, and highlights this in the commentary today. So on that basis you could view the accounts as "conservative" - i.e. underestimating the value that the company is creating.

Cash/Dividends - the company says that it only needs £5 million, less than its current £6.5 million cash balance. It therefore announces a special dividend, to distribute some of the surplus cash. Good shareholder orientation.

Future developments - the company is working on troponin tests (I'm not a doctor, no point in asking me to explain this!). It says:

There are no antibodies in the future pipeline that are comparable to troponin in clear potential value and the ability to influence revenues in the next few years.

The success or failure of this project is therefore of major importance!

More competition?

The CEO describes some additional competition which has arrived and may be coming:

We are aware that rabbit monoclonal technology – a competitive antibody technology – does exist at some of our customers labs and this is likely to have resulted in some lost opportunities for our SMA technology. In addition, the steady development of “synthetic” antibody technology (known in the industry as “library” or “display” technology”) has continued. This technology is perhaps not so directly competitive but is useful for targets which are fragile and liable to dissociation upon immunisation into sheep.

My view

Those who've been invested in this company for many years have been very handsomely rewarded, and it remains profitable and cash-generative.

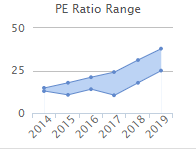

As its success has become more widely known, the valuation has really taken off. And this valuation is currently very rich:

The CEO's commentary today, while still positive on many fronts, explicitly highlights negative pricing pressure and new competitive threats to BVXP's business.

So I suppose investors in this might want to ask whether the high valuation multiple continues to be justified, despite the mixed tone of these comments.

I don't have a strong view on this one, and am reluctant to speak bearishly on a company which is so successful, but there are clear risks:

- the troponin project might not work out as hoped.

- negative pricing pressure and competition might persist, dampening revenue growth.

- GBP might continue to strengthen, reducing the value of BVXP's foreign income.

I've never invested in this business, and will continue to stay away on the grounds that I lack industry insights. The medical field is outside my circle of competence.

Historically, the correct thing to do has been to back Bioventix, and that might still be true today. But I am going to stay neutral on it at current levels.

Mind Gym (LON:MIND)

- Share price: 133p (+9%)

- No. of shares: 99 million

- Market cap: £132 million

This is a training business. I covered its admission to AIM last year.

H1 has gone well:

Reported revenue is expected to be c.24% ahead of the comparative period last year having grown to around £23.9 million. On a constant currency basis revenue is expected to be c.20% ahead of the comparative period last year, with both the US and EMEA regions performing well and as a result, on a full year basis, we expect revenue to be slightly ahead of expectations.

It is focusing on repeat revenue from existing clients, and a greater share of revenue from its top 25 customers.

Note that when a company's customer base is becoming more diversified, this is generally touted as a good thing.

In this case, the reverse situation is being described positively, i.e. "Our strategy to focus on deepening key client relationships is paying off". But at least revenue is going in the right direction!

Outlook is in line with expectations when it comes to profitability:

The Board expects H1 adjusted PBT to be broadly consistent with the same period last year and remains confident of meeting market expectations for the full year.

My view - browsing this company's website, I must admit that I like its approach to training.

For example, under "management development":

No one loves middle managers. From "The Office" to "Horrible Bosses", in popular culture, managers are portrayed as buffoons or beasts".

You can browse all of the topics under this heading. Modules include "Buddy to Boss" (when you get promoted ahead of your friend), "Create your own luck", "Fleeting meetings", etc.

Mind Gym claims that team performance soars whens managers take its courses (of course it would!).

Does it have a competitive moat? Maybe it does, in the form of its reputation and the business model of having self-employed trainers?

I require a little bit of convincing when it comes to that question but overall this seems like a decent addition to AIM.

Begbies Traynor (LON:BEG)

- Share price: 85.85p (+1%)

- No. of shares: 126 million

- Market cap: £108 million

The insolvency practitioner Begbies has bought the business agent Ernest Wilson.

The price is £4 million (of which £3 million is in cash), plus contingent consideration of an extra £1.6 million, "with full payment only payable in the event that significant growth targets have been achieved".

In FY July 2019, Ernest Wilson made PBT of £0.7 million. So the valuation multiple is modest.

It's not hard to imagine that there could be strong synergies between an insolvency practitioner and a company which organises the sale of small businesses. So I'm happy to give this deal a big thumbs up.

From Ernest Wilson's homepage, you can see the categories of business that it typically deals in: bakers, butchers, cafes, hotels, pubs and bars, restaurants.

With financial distress having picked up, and particularly on the High Street, it would not surprise me if there were busy times ahead both for Begbies and for EW.

Trifast (LON:TRI)

- Share price: 165p (-14.5%)

- No. of shares: 122 million

- Market cap: £202 million

This is "a leading interational specialist in the engineering, manufacturing and distribution of high quality fastenings to major global assembly industries".

I've previously found it difficult to get excited about this company. Here's the dramatic corporate video from 2017.

Kudos to Paul, who highlighted back in April that Trifast's automotive exposure was a worry.

The company today says:

The challenging market environment highlighted in our Annual General Meeting update on 24 July 2019 has continued into Q2 of FY2020, with end markets across a number of sectors remaining weak, particularly in the automotive sector. This has led to some reduced volumes to existing builds across the UK, Europe and Asia. As well as lead times on production schedules moving out on a number of new business wins.

Trifast notes that its cost base is "semi-fixed", i.e. there is reverse operational gearing now at play.

Thankfully, it quantifies the new expectations in the RNS (all companies should do this). It now expects underlying PBT in the current financial year of "approximately £22 million".

I can see an existing forecast of £24.2 million, so we have an approximately 10% miss on that measure.

The price dropping back by more than 10% suggests that investors think this is more than a temporary blip.

But the company remains confident for the long-term future:

Notwithstanding the current high levels of uncertainty, we are pleased to report that our pipeline of new wins remains reassuringly solid and activity levels around the Group continue to be encouraging across all sectors. Both our USA region and our latest UK acquisition, PTS, have continued to perform exceptionally well in the first half of the year, comfortably delivering double digit revenue growth.

M&A - it is looking for acquisitions, with the help of an £80 million banking facility, and notes that opportunities are starting to increase thanks to the economic uncertainty.

My view - I have a good impression of management here. As discussed in my previous note, they focus on efficiency through the ROCE metric and believe that they achieved underlying ROCE of 18.8% last year (Stocko puts it at 12.9%, using statutory numbers, which is still an acceptable level for this type of business).

On the other hand, I doubt that these shares would offer much protection against a global economic recession. The company was unprofitable in 2002 and in 2009-2010. Given that it has a "semi-fixed" cost base, I assume that it will be unprofitable again when the next major economic cloud arrives.

It's hard or impossible to time these things, however. So I could understood someone who preferred to own these shares now, rather than stay on the sidelines in fear of tough economic times which may or may not occur in the short-term.

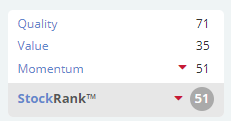

Stocko gives it an average rating. I'm neutral.

Angling Direct (LON:ANG)

- Share price: 61.8p (+0.5%)

- No. of shares: 65 million

- Market cap: £40 million

A short announcement, that Angling Direct opened its new store in Rotherham on Saturday, bringing the total number of stores to 32.

Located in a hugely popular fishing area, with a large angling community and a series of lakes and river venues, such as the river Don, the store is the only fishing tackle "destination store" of its kind in the area.

I maintain my view that this company, while far superior to Fishing Republic (FISH), still has a lot to do, to justify a £40 million market cap.

Watchstone (LON:WTG)

- Share price: 154.64p (+44.5%)

- No. of shares: 46 million

- Market cap: £71 million

Settlement with Slater & Gordon (UK) 1 Limited

Brilliant news for Watchstone, formerly known as Quindell (QPP):

Under the Settlement, which is made without admission of liability by either party, all of S&G's claims or potential claims for alleged breaches of warranty, deceit and fraudulent misrepresentation against Watchstone its present and former directors officers and agents relating to the historic sale of the Group's professional services division ("S&G Claims") in May 2015 have been unconditionally withdrawn.

The price of the settlement? £11 million.

Watchstone had put £50 million in escrow, in relation to the matter. £39 million will now be released back to it.

I note also that Watchstone reached a confidential settlement with former CEO Rob Terry last week.

A mountain of cash

Watchstone sold its Canadian healthcare business for £22 million last month (see the SCVR).

At June 2019, it had cash of £41 million, excluding the £50 million in escrow.

And it now has an extra £39 million to play with. So it could have a very large cash pile at this stage, bigger than the current market cap.

It also still owns Ingenie.

For the first time ever, I'm tempted to pick up a few of shares of this, on speculation of a generous capital return. It will be interesting to see how management choose to reward shareholders for these recent wins.

All done for today, thanks for your feedback everyone!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.