StockRanks improve your odds, but they don't remove risk. The most common mistakes come from misunderstanding how to use them effectively.

A frequent error is over-concentration - putting too much weight on a single stock or sector. The rankings work best when spread across a diversified portfolio of 15 - 25 stocks, with each position limited to roughly 3 - 7% of your capital.

Another is false precision. Small differences in rank aren't significant; a stock ranked 99 isn't meaningfully better than one ranked 90. The ranks are designed to guide you toward higher-probability opportunities, not deliver exact predictions.

Behavioural mistakes are also common—selling winners too early, holding on to losers, or chasing the latest market fad. Following consistent, evidence-based rules (like the 90/70 guideline) helps counter these impulses.

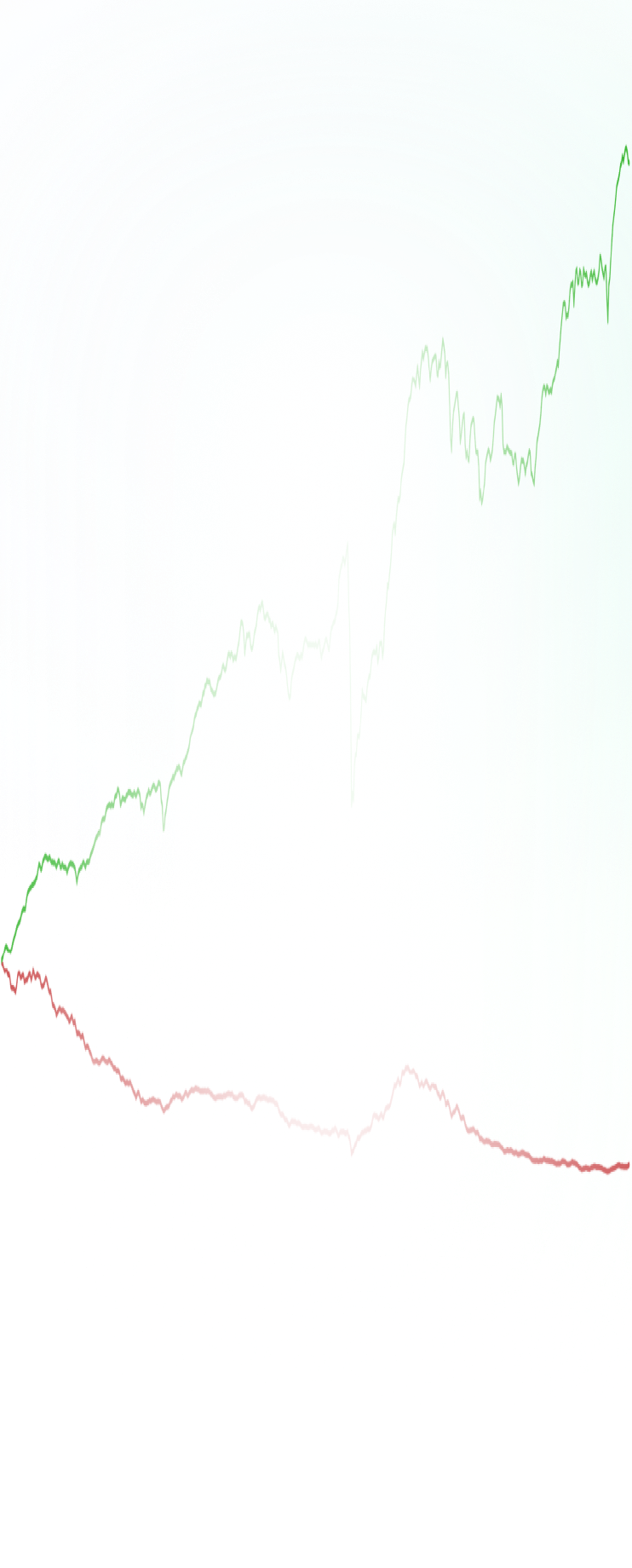

Finally, some investors forget that the StockRanks are factor-based, and factors don't perform equally in all markets. Quality, Value, and Momentum each shine at different times, so short-term underperformance in one area is normal within a long-term strategy.

In short, use StockRanks as a research compass, not a crystal ball - combine them with discipline, diversification, and sound risk management to give yourself the best chance of success.