Good evening/morning, it's Paul here!

These 7am flying starts have been a bit of a shock to my system this week (being more of a night owl), so I'm jolly glad that it's the long Easter weekend coming up, to chill out a bit!

I'm off to Munich for a couple of nights, tomorrow. No particular reason, other than it was a £150 per person special offer from BA, flights and a nice hotel - pretty good, eh! I can recoup a fair proportion of that in the executive lounge before take-off too.

So I'm brushing up on my O-level German. A phrase I remember from school is, "Was?! Du lieber gott! Das ist doch nicht moglich!", or something like that. I'm looking forward to using that phrase, in an indignant tone, if presented with an extortionate bill of any kind.

Let's hope I don't cause a diplomatic incident over Brexit. I've always liked Germans anyway. They make fantastic cars & machine tools, love their beer, and have a wonderful sense of humour.

Early Skim of the RNS

(7-8 am brief reviews)

D4T4

Year end trading update - 31 Mar 2019 - adjusted profit "slightly ahead" of expectations.

Strong pipeline, so confident will achieve market expectations for 31 Mar 2020.

Share price has risen c.60% since end 2018, so good performance looks to be already baked into the share price.

An interesting company, so I will take a closer look later this morning.

Trifast (LON:TRI)

Trading update - for FY 03/2019.

Underlying profit "slightly ahead of management expectations".

New banking facilities agreed, gives headroom for more acquisitions.

Positive outlook, despite macro headwinds.

I'll write an enlarged section below.

Moneysupermarket.Com (LON:MONY)

How are the friendly meerkats getting on?

Q1 2019 trading update today.

Revenues up 19% - driven by more people switching energy suppliers, but growth expected to moderate during the year.

Confident of meeting market expectations. Confirms special divi of 7.46p.

Share price has been strong this year. Price looks a bit toppy to me (fwd PER of 18.4) for an intermediary with no moat. Terrific track record of growing profit each year.

As nearly £2bn market cap, I won't expand on this. Was just curious to see how they're trading, and little other news today.

Funding Circle Holdings (LON:FCH)

Mid-cap, with mkt cap around £1bn.

I looked at this share earlier this week, with a friend who is thinking about shorting it.

Q1 2019 trading update today, confirms it is trading in line with expectations.

Its business model looks absolutely terrible to me. It's burning cash at a prodigious rate (although has over £300m cash pile, from the IPO proceeds). Overheads look way too high, especially very high staff costs, and marketing.

It originates loans, and earns transaction fees on loans advanced to SMEs, and ongoing fees after that. External investors provide the funds, so FC sits in the middle.

It seems to me that, when the next recession hits, default rates on SME loans are likely to be high, which would then lead to transactions drying up. FC would then be high & dry.

At some point I think this could be a cracking short. Just not sure when? No further reporting on this one here today.

RWS Holdings (LON:RWS)

H1 trading update, 6m to 31/3/2019.

Says it has had an "excellent first half", and "performed strongly", but no comment is made on how this compares with market expectations (broker consensus is anticipating a big increase in earnings this year).

I cannot therefore judge, since this announcement does not give the key information investors need - of actual performance versus market expectations. A thumbs down for this ambiguous announcement. Companies need to be much more clear than this, when reporting performance.

This share has done very well in recent years. High fwd PER of 25.5.

Avast (LON:AVST)

Cyber-security company which floated last year.

£2.7bn market cap. Excellent growth track record. Seems to have a lot of debt. PER surprisingly low (12) for a growth, tech company. Might be worth a closer look perhaps?

Says Q1 performance has been strong.

Dentist - 9-11 am

(including travel there & back)

Walking home, after an uneventful dental inspection, I always try to think of ways to research companies. So today I tried one of the now world-famous vegan sausage rolls, from Greggs (LON:GRG) - what a marketing coup this idea was. It was even mentioned in a recent trading update, as having notably boosted profits.

I can report that the vegan sausage roll looks, smells/tastes exactly like a normal sausage roll. Which left me thinking, do vegans actually want an alternative to meat that tastes & even has the same texture as meat? I was a veggie for 5 years, in the distant past, and I wanted meat alternatives that were nothing like meat.

So maybe these vegan sausage rolls are a lower guilt alternative for meat eaters?

Loungers

Also, I took the opportunity to visit a "Cosy Club" - part of a bar/bistro chain that is soon to list on AIM - called Loungers - intention to list RNS is here. I was really impressed, having had a "breakfast club" cooked breakfast (tasty & good quality ingredients, speedily cooked), and an excellent, if not quite hot enough coffee, in pleasant surroundings, for £8.25;

The coffee was delicious, and had smart Cosy Club branding on the cup & even the sugar cubes;

Why's that gone sideways? Oh well, it works if you tilt your head to the left.

Above is the Cosy Club site I visited today, in Bournemouth. I've walked past it many times, and always mistaken it for an amusement arcade, due to the name, and appearance of the small ground floor facade, which is all red and chrome. Once inside, it's a large 1,2 & 3rd floor emporium, with several bars, a restaurant, private hire rooms, and a terrace on the top floor. A terrific place, nicely decorated, and with good value all-day food offering. Plus drinks & coctails. The top floor would make a nice venue to do investor meetings/socials actually, and it has a lift - handy for people with mobility issues.

So that has whet my appetite to read up more about Loungers imminent launch on AIM. It'll probably be over-priced though, as IPOs usually are.

Main Report

(more detailed sections on shares of particular interest, which might be a little later than usual, depending on how things go at the dentist!)

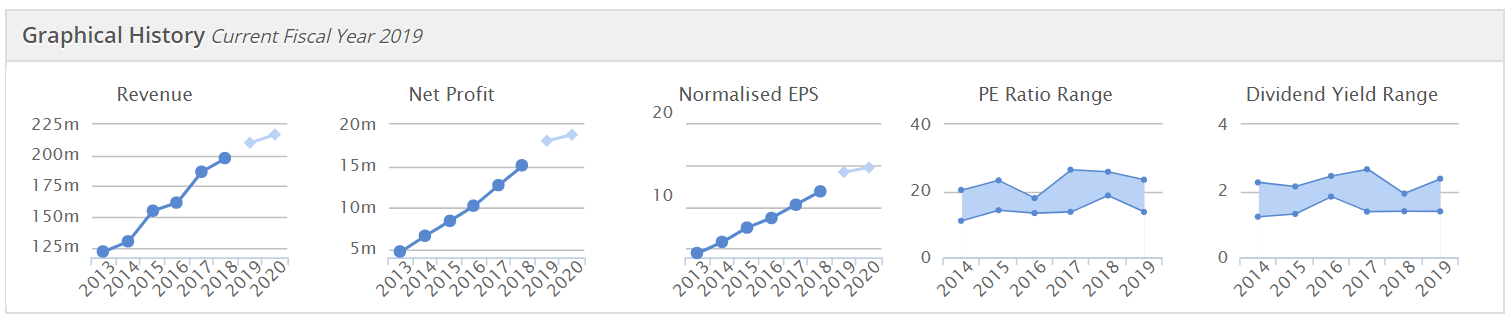

D4T4

Share price: 266p (down 4.3% today, at 11:31)

No. shares: 39.2m

Market cap: £104.3m

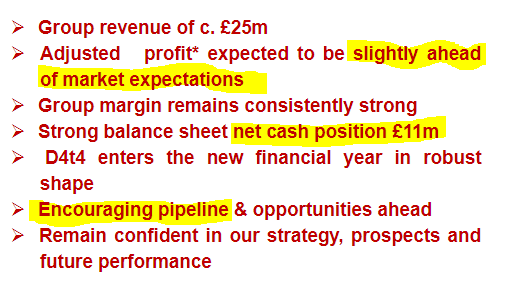

D4t4 Solutions Plc(AIM: D4t4), specialists in data solutions, is pleased to provide the following trading update, ahead of the publication of the Group's final results for the financial year ended 31 March 2019 which are expected to be released in the week commencing 24th June 2019.

To save me re-tying it, the highlights section summarises the key points, in a nice red font;

As I mused above though, the question is whether this positive trading had already been factored into the share price, in the big recent rally? The share price falling 4% today, at the time of writing suggests that, yes the good news is already baked into the share price. Clearly some punters are banking their profits today - which probably makes sense if you have a small position, and think short term, which in my experience is how many private investors (or traders really) do operate;

Broker update - the house broker has published a useful update note, available on Research Tree. This is essential reading, as it flags up some important issues to consider when valuing this share, namely;

- IFRS 15 adoption has skewed results, to the benefit of the FY 03/2019 revenues & profits, if I've understood this issue correctly

- "Exceptionally low" tax rate for FY 03/2019

This has caused fluctuations in EPS. The forecast EPS & PER are as follows;

FY 03/2019 is 13.3p (PER of 20.0)

FY 03/2020 is 13.4p (PER of 19.9)

The underlying increase in EPS is greater, as the FY 2019 EPS figure is flattered by the two issues in the bullet points above. Hopefully that makes sense!

Balance sheet - I've reviewed the last reported balance sheet, and it looks fine. With net cash of £11m reported today (as at 31 Mar 2019), that's down from £12.2m reported at 30 Sep 2018.

With good overall working capital - a current ratio of 2.22 when last reported at 30 Sep 2018, and no long term debt, this is a very soundly financed company. Shareholders can relax, even if it were to go through a patch of bad trading (which it did e.g. in H1 of FY 03/2018)

Directorspeak/outlook - sounds upbeat;

"Our strategy continues to deliver and is reflected in our strong overall growth. At the same time we continue to innovate our product, grow geographically and deepen our relationships with our strategic partners.

The business enters the new financial year in robust shape after closing a number of significant contracts in the second half year, these contracts will have an impact on 2018-19 and on subsequent years, and we are encouraged by the opportunities and outlook for the business in the coming year.

Consequently, as a Board we are confident of delivering results in line with expectations for the financial year ending March 2020."

That's a solid update, so it sounds as if the company shouldn't be at risk of a profit warning for a while.

My opinion - I don't really understand what this business does. It seems to be a software company specialising in managing data, not something I understand. Hence it's difficult for me to assess the shares.

Yes the company is doing well, but the PER of 20 already reflects that.

Historically, its project-based sales have been very lumpy at times. So I'm not willing to pay top dollar for a business that could potentially run into problems again in future, with contract lumpiness. The narrative does talk about increasing recurring revenue though.

It would be interesting to find out more about this company though, as it's clearly performing well, so the products must be good. We saw with Sopheon (LON:SPE) how a software company that gets onto a roll, with increasing sales, can be very lucrative.

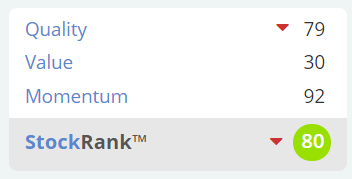

What do the Stockopedia algorithms think? Strongly positive - "High Flyer" classification, and a strong StockRank - neatly encapsulating that this seems a quality business, with good momentum, but it's pricey;

Trifast (LON:TRI)

Share price: 229p (up 6.5% today, at 15:58)

No. shares: 121.9m

Market cap: £279.2m

This is an acquisitive, international, industrial fastenings group. It updates us today, for the year ended 31 Mar 2019.

The market clearly likes this trading update, with the share price up 6.5% today - although there are only 50k shares traded so far today. There could possibly be some delayed (larger) trades printed after the close of play.

A solid finish to the year, leaves Group underlying profit slightly ahead of management expectation...

Helpfully, the house broker has quantified this, as an increase from 14.1p to 14.3p - giving a PER of 16.0 times.

Forecast for FY 03/2020 is a rise to 15.0p, giving a forward PER of 15.3

I'm struggling to think why the rating should be any higher than that?

Outlook - comments seem upbeat throughout, despite macro headwinds.

Recent contract wins and a solid pipeline across the business bodes well for the future...

I like that these specific reasons are given, rather than the more usual "well placed" type of outlook comments that many companies give us.

Balance sheet - I've checked the most recent balance sheet, and it's fine - quite strong actually.

It looks to me as if Trifast has done a good job in maintaining a sound balance sheet, despite making acquisitions.

New banking facility - new £80m facilities give it £40m headroom for organic expansion (capex presumably), and acquisitions.

Is this the right stage in the economic cycle, to be gearing up? I'm a bit wary about that.

My opinion - this group seems to have done a really good job in growing profitably. Indeed, the graphs below look almost uncannily smooth;

Maybe there could be more upside on the share price? It doesn't strike me as obviously undervalued though - the valuation looks about right to me. Sentiment could take it higher though.

Exposure to the automotive sector worries me a bit too, although that doesn't seem to have hurt TRI to date.

I've also reviewed the Loungers "intention to float on AIM" document. I'll report back to you with my views once the price is set, as it's all meaningless until we know valuation. It will provide a very interesting comparison to Revolution Bars (LON:RBG) (in which I hold a long position), so I'm looking forward to crunching the numbers on this one in future.

Have a lovely Easter break!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.