Morning, folks. Today I'm planning to cover:

- Porvair (LON:PRV)

- Avingtrans (LON:AVG)

- Countrywide (LON:CWD)

- Marlowe (LON:MRL)

- Mind Gym - Proposed Admission to trading on AIM.

Porvair (LON:PRV)

- Share price: 493.5p (+3%)

- No. of shares: 45.6 million

- Market cap: £225 million

I like how promptly this has been reported. Other companies have only released their annual results for the period ending December in the last few days, while Porvair is already releasing interims to May.

Porvair plc ("Porvair" or "the Group"), the specialist filtration and environmental technology group, today announces its half yearly results for the six months ended 31 May 2018.

I'd give the company a premium rating simply for keeping on top of its accounts so well, and keeping shareholders properly informed!

Financial highlights are good;

- Revenue up 7% to £59.7 million (2017: £55.5 million), 12% on a constant currency basis*.

- Profit before tax up 8% to £5.2 million (2017: £4.9 million).

See how the currency movements were a headwind to revenue. 12% is the measure I would use when thinking about underlying growth rates. Most of the company's revenue originates from the Americas.

ROCE

Encouraging to see the company specifically mention its ROCE performance:

The Group's return on capital employed was 14% (2017: 14%). Excluding the impact of goodwill, acquired intangible assets and the pension liability the return on operating capital employed was 42% (2017: 43%).

It has grown by acquisition and therefore the goodwill and other intangibles are a very significant portion of the balance sheet: £65 million (for context, balance sheet book value is £80 million).

This is why you have such a large discrepancy in the ROCE calculation, depending on whether or not goodwill etc. is included.

14% is the actual number enjoyed by Porvair shareholders (Stocko roughly agrees, estimating Return on Capital at 12.6%).

42% is the company's view of its return on tangible capital employed, also ignoring the effect of its pension deficit. What that says to me is that the underlying businesses must be very interesting in terms of their ability to generate a return for shareholders. Porvair management have had to pay up to acquire them and therefore the return for Porvair shareholders is not as high as 42%. But they are likely to be high-quality businesses.

Outlook Statement

Porvair traded well in the first half of 2018, with a healthy order book for the second half and robust levels of activity. The business is achieving further organic growth through incremental new product introductions and we continue to expand manufacturing capacity to meet demand.

My opinion

Despite considerable acquisitions having been made over time, the company's balance sheet is in reasonable shape with tangible net assets of £16 million and a small net cash position. That's a nice achievement actually - some businesses like this have a tangible asset deficit and a heavy net debt position.

It has an unbroken dividend stream stretching back at least to the mid-1990s. Dividends were cut in 2003 but have been rising again since then.

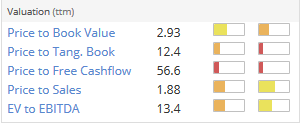

Everyone can see that the shares are on the expensive end of the spectrum. For a ROCE of 13%-14% and a consistent track record, I can see why they are priced at almost 3x book value.

I'll continue to leave this on my watchlist. A nice stock to keep an eye on for share price weakness and a buying opportunity.

Avingtrans (LON:AVG)

- Share price: 216p (+3%)

- No. of shares: 31 million

- Market cap: £67 million

Avingtrans (AIM: AVG), which designs, manufactures and supplies critical components, modules and associated services to the energy and medical sectors provides an update in respect of its financial year ended 31 May 2018.

This is a group of niche engineering businesses, seeking to become a leader in the energy industry (nuclear power, oil & gas, etc).

Results for the year ending May 2018 will be in line with expectations.

What really matters, though, is expectations for FY 2019, the first full year of ownership of Hayward Tyler.

We are getting a boost to these expectations:

Following the successful integrations of Hayward Tyler Group and Ormandy, the Company is pleased to report an improved margin mix and, as such, expects its profit in FY2019 to exceed previous expectations.

A few months ago, with the share price at 226p, Paul predicted this:

... the market is currently clearly assuming that broker forecasts are way too conservative, and that the company will thrash them... Possibly the bar is being set low, to allow the company to out-perform, and put out positive trading updates in future?

Well done Paul!

Brokers have increased their 2019 EPS forecast from 9p to 10.3p. This lowers the forward P/E multiple, at the current share price, from 24x to a more reasonable 21x.

My view - another solid performer. Frustratingly, I again can't see any particular reason to buy the shares at the current level. Brokers point to the company benefiting from a recovery in the oil and gas sector - not something I am keen to bet on myself, but I can see the merits of that argument.

Countrywide (LON:CWD)

- Share price: 59.5p (-24%)

- No. of shares: 238 million

- Market cap: £142 million

Capital Structure, Recovery Plan and Trading Update

This has produced CWD's biggest-ever 1-day share price fall.

Countrywide plc ("Countrywide", the "Company" or the "Group") (LSE: CWD), the UK's largest integrated property services group, today provides an update in relation to: putting in place a long term capital structure; progress on its back to basics recovery plan; and current trading.

The thing is that an equity fundraising was already on the cards. As Paul said in March, investors had plenty of warning that the balance sheet needed to be fixed.

Today, the company says that it wants to reduce debt levels by 50%, using fresh equity financing.

I note the approval of US group Oaktree, Countrywide's largest shareholder. Oaktree's recent involvement in Ranger Direct Lending Fund (LON:RDL) is what initially sparked my interest in that fund (and I currently own shares in RDL).

Doing a little bit of background reading, I am unsurprised to learn that Oaktree built its Countrywide stake via investment in its bonds, not its equity, during the financial crisis of 2009-2010.

Oaktree is a deep value investor and tends to look for situations where the downside is limited and the upside has some potential. It has particular expertise in distressed debt, and it was an Oaktree distressed debt fund which accumulated the position in Countrywide bonds. When these bonds were restructured, Oaktree was left with a large equity stake.

I will be curious to see how much fresh equity, if any, Oaktree decides to put into Countrywide as part of this deal.

Personally, I concur with Paul's assessment from March that the shares are uninvestable, given the ongoing uncertainty over the balance sheet and the scale of dilution required.

Net debt was last recorded at £192 million, so it will need to raise c. £100 million. Once again, it has suffered financial distress as housing market conditions have deteriorated.

This is its description of latest conditions:

The market in the first half has continued to be subdued and we have experienced longer transaction cycles. As previously announced, the Group entered 2018 with our Sales pipeline significantly below that of 2017.

It's not for me due to its cyclicality and lack of barriers to entry. I would only consider it as a potential deep value investment if the balance sheet was strong enough and perhaps, like Oaktree, if I could buy its bonds at an attractive discount to par.

Marlowe (LON:MRL)

- Share price: 417p (+3%)

- No. of shares: 34.5 million

- Market cap: £144 million

Marlowe plc, the UK support services group focused on acquiring and developing companies that provide critical asset maintenance services, announces its audited results for the year ended 31 March 2018.

It looks like I possibly got this one wrong last December, suggesting it was too expensive at 347p.

It's executing a buy-and-build strategy in fire protection, water treatment and air ventilation.

Reflecting my caution toward buy-and-build plays, I was put off by its price to book value ratio at the time.

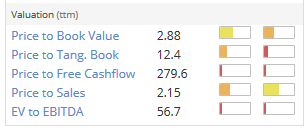

The market remains happy to price this at significant multiples to book:

The market is saying that the underlying businesses are better-quality than I've given them credit for up to this point, and/or that the synergies from combining them will create more value than I would have expected.

Key numbers:

- Revenues up by more than 70% to £80.6 million. Run-rate revenues "approaching £100m".

- Operating profit (adjusted): £6.2 million (up from £3.5 million).

- Actual operating profit: £0 million

The adjustments to operating profit are very heavy, and include £0.7 million of bad debts attributable to Carillion (CLLN).

Total adjustments are £6.2 million. Last year, there were £2.6 million of adjustments. It would be prudent to expect several million of these every year, I reckon. A buy-and-build strategy is complicated and expensive. The goal is that after several years, we will be left with a far bigger business enjoying synergies (e.g. cross-selling opportunities) between its various parts.

Thankfully, its balance sheet is in ok shape, and it has plenty of slack in its debt facilities:

The Group has sufficient headroom on its facilities to continue to fund acquisitions with debt should it so choose.

Outlook statement is confident. Trading is in line with expectations.

My view

Management have executed very well so far, so I can understand some element of the premium in the share price.

I remain to be convinced about the investment merits of these businesses, and why they should trade at a premium rating. Building support services haven't been good to shareholders during my investing career.

In fire protection, the company reminds investors of the "increasing barriers to entry that we perceived, the regulation that drives its growth, high customer retention rates and its attractive earnings visibility

More generally, it says:

Marlowe's defensive market qualities, strong channel to market, organic growth momentum and potential to acquire new businesses strongly position us to continue to create shareholder value.

I understand its high retention rates, earnings visibility and defensive qualities. These are all good things.

My concern is that there are probably good reasons why its markets (fire/air/water services) are highly fragmented: namely, that that it's difficult for these companies to differentiate themselves from the competition.

So I still don't understand why this stock is rated so high.

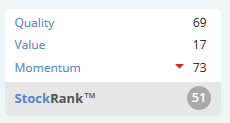

Stocko also doesn't see much value:

Mind Gym - Placing and Proposed Admission to Aim.

Continuing our review of recent and forthcoming IPOs:

Mind Gym is a behavioural science business that uses scalable proprietary products to deliver human capital and business improvement solutions to large corporations.

When I first read this, I feared that it might still be at an early stage of its development, and was prematurely hitting AIM.

It turns out that it was founded 18 years ago and has had dealings with most of the FTSE-100 and S&P-100 companies. Lots of blue-chip clients, then?

The coaches who deliver its live training sessions are self-employed.

On this basis, it includes its live sessions within the category of revenues that "require minimal attention from Mind Gym employees to fulfil", and are therefore highly scalable. It thinks 77% of its revenues are scalable.

The numbers are as follows

In the financial year ended 31 March 2018, Mind Gym generated revenues of £37.0m, adjusted EBITDA of £7.9m and profit after tax of £4.4m.

My view

Seems worth looking into. It may have some valuable IP. I'd consider this a B2B media company, in a similar category to the likes of Euromoney Institutional Investor (LON:ERM) and Informa (LON:INF) (it's much smaller than them for now, of course). I'm generally favourable towards this sector.

Note that the deal will raise no new money for the company. Insiders will sell about one-third of the shares at a valuation of £145 million, or 33x trailing earnings. It may need a profit warning or two to bring it back to a level where a value investor could get interested!

Cheers, that's all for today!

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.