Hi,

It's Paul here. Today I shall be covering results from;

Countrywide (LON:CWD) - results - bank covenant worries - needs a fundraising.

Conviviality (LON:CVR) - massive 59% drop in share price - overdone? Maybe, but Graham foresaw it! So a hat-tip to my co-writer here.

Fulham Shore (LON:FUL) - mild profit warning - horrible sector.

(the above list changed during the day, as profit warnings are more interesting than in line with expectations results)

Just to flag that Tuesday's report, and Wednesday's report, are now finished, with extra sections added. Sorry they were rather slow in emerging.

Countrywide (LON:CWD)

Share price: 83.75p (down 5.8% today, at 14:18)

No. shares: 237.9m

Market cap: £199.2m

This is a large chain of UK estate agents.

The narrative is particularly interesting, as it squarely lays the blame for the group's poor performance at the door feet of the recently departed CEO. The Chairman has taken over for now, rising to Executive Chairman, with a "back to basics" strategy change. Here's a flavour of the commentary today;

Industry expertise in all areas of our business is key. Within Sales and Lettings, the previous strategy resulted in us losing a lot of that expertise.

In the Group, we are fortunate in that we have an industry veteran, Paul Creffield, who has been promoted to the role of Group operations director. His deep understanding of the market and operations means that we have quickly been able to identify what we need to do to begin addressing our under-performance.

I am greatly encouraged by the number of high calibre industry business leaders that we already have within our Sales and Lettings business and a number of similarly experienced and high calibre industry people who previously left us and want to rejoin now that Paul is in this role.

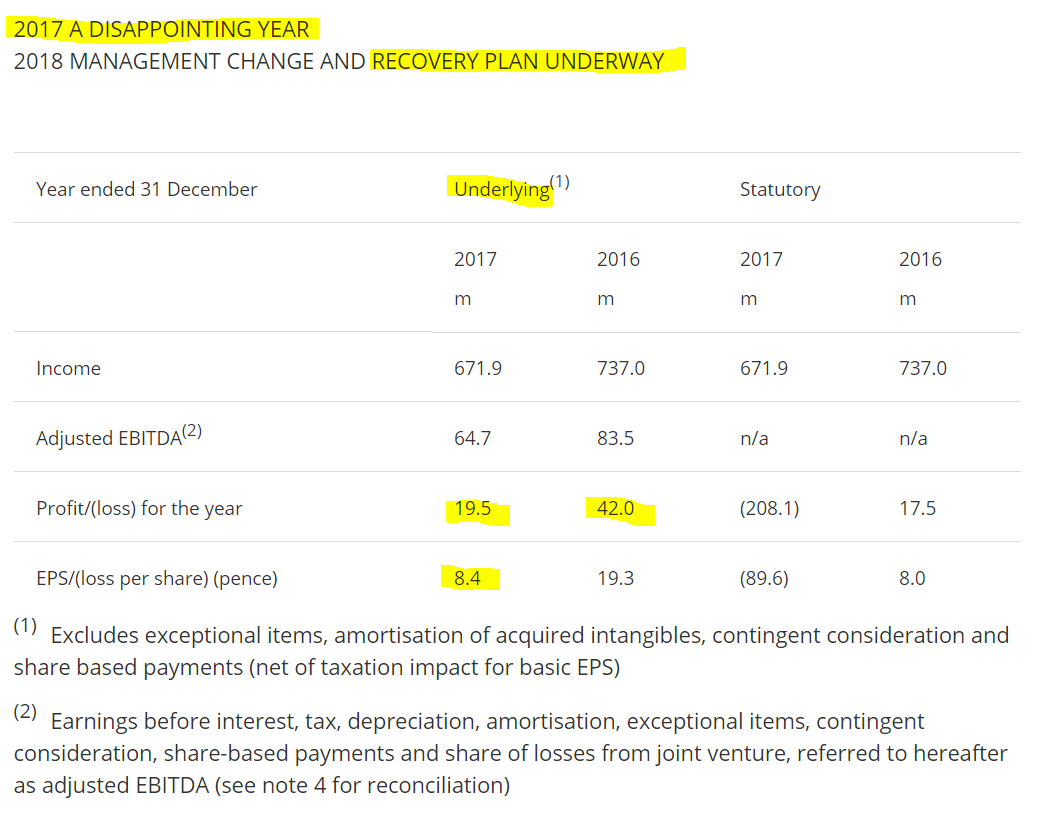

Let's look at some key numbers for calendar 2017;

I've left in the footnotes, so you can see that the "underlying" figures strip out quite a lot of items. However, these are all fairly usual items. It's important to remember what companies are trying to do by presenting adjusted/underlying numbers;

1) Focus us on an inflated profit number, in order to achieve a higher share price!

2) To show the underlying trading performance of the business, stripping out items of a one-off, or non-cash nature.

So whilst a degree of cynicism is useful, and it's always worth reasonableness-checking adjustments at every company, the underlying/adjusted figures do usually serve a useful purpose. The one adjustment I find unacceptable, is share based payments, since this is just part of the remuneration package for Directors & senior staff, so it should be expensed through the P&L normally in my view, and not adjusted out.

The other adjustments here look fine to me, to arrive at an underlying trading profitability figure.

Anyway, as you can see from my highlighting above, the profit after tax has more than halved to only £19.5m.

The full detail is given further down the announcement, and I note that finance costs look very high, at £12.6m - since the group is heavily indebted. However, on the plus side, there is a heavy depreciation charge of £27.7m. So cashflow should be better than profits.

Note also that the statutory profit is a giant loss, of -£208.1m, which looks like a big impairment write-off on the balance sheet. My main concern with this share has always been its weak balance sheet & heavy debt, so let's focus on that next.

Balance sheet - here are the usual figures;

NAV: £309.1m (down from £479.5m a year ago, due to a big goodwill write-off)

NTAV: is heavily negative, at -£191.0m. This is because the balance sheet is laden with intangibles, which when written off, leave a yawning gap.

Something that dawned on me the other day, is that when a company has a lot of intangible assets, there is often a related deferred tax creditor. So when writing off the intangibles, we should also add back the deferred tax that relates to them.

In this instance, note 24 to today's accounts shows that there is a net deferred tax liability within creditors of £23.8m, but it doesn't explain what this deferred tax relates to. It's an obscure point really, so I won't waste any time investigating further, but just to flag up that if we also write off this deferred tax liabilty, then adjusted NTAV is -£167.2m, i.e. still awful, so it doesn't make that much difference.

What does negative NTAV actually mean in practice? It depends on lots of things, but in simple terms it usually means that the business is under-capitalised, hence is relying on creditors (banks & trade credit) to support its business operations. Providing the business is profitable & cash generative, that's not necessarily a problem. However, if profits/cashflow drop, or disappear, then creditors can get the jitters, worry that they won't be paid, and in extremis, pull the plug on the company, forcing it into Administration. Or, they might put sufficient pressure on the company to force it into doing a rescue equity fundraising, which can be very dilutive to existing holders. Overall, it makes a share much more risky, if it is relying on the support of creditors to continue trading. That's why I much prefer a strong balance sheet, with little to no debt. Then the above risks just disappear, which improves risk:reward for investors, making it more likely that we'll have a successful investment over time. Or at least fewer investing disasters.

Looking at working capital, current assets are £125.6m, current liabilities are £114.3m. Divide one by the other, and we get a current ratio of 1.1 - that's a bit on the weak side - I normally like to see a minimum of 1.3, or preferably 1.5+ to feel comfortable.

Long-term creditors is where the problems lie. The total of £273.9m includes £213.5m in bank debt. Overall net debt is £192.0m, which is usefully down from £247.9m a year earlier, but still far too high. Note that the company did a placing at 175p in Mar 2017, which raised £37.8m before expenses, so that seems the primary driver of reduced debt.

It seems to me that the company needs to do another, larger placing now, to shore up its balance sheet & avoid the risk of the banks pulling the plug.

Net debt to EBITDA ratio is 2.97, unchanged from last year. That's getting into danger territory. For businesses like this, which has little to no asset base (there's negligible freehold property for example), then I'd be surprised if the banks would grant a Net Debt: EBITDA covenant of more than 3. Around 2.5 times seems more normal. But I'm forced to guess on that point, because despite searching the 2016 Annual Report, where the word "covenant" appears 16 times, it does not state what the actual covenant figure is, for Net Debt: EBITDA. It seems to me likely that the group is probably hovering very close to this covenant, with very little headroom, but I don't know that for certain. The narrative today reinforces that I'm probably right, especially this extremely worrying going concern note below.

Going concern note - these should always be read carefully, especially at highly indebted companies. There is a very nasty going concern note in today's statement, which for me makes this share uninvestable. It sounds as if there's a considerable risk that the group might breach its net debt : EBITDA covenant in 2018. That could trigger insolvency, or at least an emergency, discounted equity fundraise. Why take the risk of running into that scenario?

Here is an excerpt of the most important part of the going concern note today;

... Failure to achieve one or more of the above would result in lower adjusted EBITDA with a consequent negative impact on headroom of the leverage and interest cover covenant ratios and higher projected net debt.

If the Group's forecast is not achieved, there is a risk that the Group will not meet the Net debt to EBITDA leverage covenant and should such a situation materialise, the banks reserve the right to withdraw the existing facilities.

Without the support of the lender group, the Group and parent Company would be unable to meet their liabilities as they fall due. [Paul: i.e. insolvent]

Given the timing and execution risks associated with achieving the forecast and therefore remaining within the leverage ratio as stipulated by the banking covenants, the directors have concluded that it is necessary to draw attention to this as a material uncertainty which may cast significant doubt about the Group's and the Parent Company's ability to continue as a going concern in the basis of preparation to the financial statements.

That is a stark warning. Ignore this at your peril!

Dividends - as you would expect for a business in financial trouble, there won't be any divi for 2017. That makes sense. Debt reduction is more important.

My opinion - as you've probably gathered by now, I would not consider investing here, as the group is clearly in a precarious situation with its bank borrowings, and probably close to a covenant breach. In that type of situation, I would get the hell out, as quickly as I could, if I owned any shares in this.

The market cap of £199m looks way too high, given the excessive debt, and risk of a discounted fundraising. Small shareholders don't need to take that risk - they can just sell, and watch from the sidelines. Whereas large shareholders are high & dry.

It might well be that the big shareholders support another fundraising. I think it needs to raise about 100m in fresh equity, to reduce risk to an acceptable level. The trouble is, we don't know at what price such a fundraising might occur at. So small shareholders are very vulnerable to potential dilution here. That said, the fund managers who already hold a big slice of the equity, might want to protect the value of their existing holding, so could be co-operative on the price of another fundraising. The key thing is that we just don't know - it's a major uncertainty, so that makes valuing the shares almost impossible right now.

I would definitely look at this share again, as a potential turnaround, once it's fixed its balance sheet. It sounds as if a lot of the under-performance is self-inflicted, by poor previous management (if the Chairman is to be believed - he might just be scape-goating?).

We also have to consider that the housing market seems to be slowing, is wildly over-priced on traditional income to value metrics, and that interest rates seem likely to creep upwards (albeit still historically low) in the coming years. The latest consumer confidence data has been quite soft.

What about internet disruption? There are lots of new online estate agents, the market leader being controversial Purplebricks (LON:PURP) , chipping away at the business of traditional estate agents. Although I've come round to the more bearish view that online estate agents, where customers pay up-front, regardless of whether the property sells or not, could be leaving behind a long tail of dissatisfied customers.

In reality, I think there's room for both - online selling makes sense for experienced property vendors, but people who need their hand holding, or are trying to sell an unusual property, are probably best off using a conventional estate agent.

Tenant fees are set to be abolished in 2019, adding further misery here, although the group is looking to mitigate this - presumably by hiking fees to landlords?

Overall then, this looks a real mess, and is uninvestable for me, until the balance sheet is fixed. It might then be worth looking again, at the turnaround potential.

Conviviality (LON:CVR)

Share price: 123p (down 59% today, at market close)

No. shares: 183.28m

Market cap: £225.4m

Trading update (profit warning)

(issued at 3:07pm today, during market hours)

Conviviality Plc (AIM: CVR), the UK's leading independent wholesaler and distributor of alcohol and impulse, serving customers through its franchised retail outlets and through hospitality and food service, is providing the following update on trading for the 52 week period ending 29 April 2018.

This update has triggered a calamitous fall in the share price today of 59%. It's doubly annoying for shareholders when a profit warning is issued during market hours. Apparently there is a compulsion on companies to issue bad news to the market as soon as they become aware of it. Surely the process could have been managed better by the company - e.g. by calling a board meeting to discuss current trading after the stock market is closed, then issuing the RNS at 7am the following morning? Most companies seem to be able to manage that, so an intra-day profit warning just reinforces the impression that management may not be in control.

A share price fall of 59% in 1.5 hours, usually means there's something seriously wrong. Or maybe it's an over-reaction?

What's gone wrong?

Following a review of current year projections, the Company now expects that adjusted EBITDA for the current year will be approximately 20% below current market expectations.

The previous guidance for net debt of approximately 150 million for the period ending 29 April 2018 remains unchanged.

It very worrying that the company has discovered a shortfall of 20% in adjusted EBITDA at this late stage in the year ending 29 April 2018. That suggests to me that either something serious has gone wrong recently, or that the company has not been correctly reporting its profits earlier this year. Or both.

A 20% fall in EBITDA would normally feed through into a greater % fall in profit before tax. So the underlying problem could be bigger.

Two specific reasons are given;

1. An accounting error, in forecasts, of £5.2m at the EBITDA level.

2. Margins have softened in Jan & Feb 2018. This is assumed to continue in March & April.

What are they doing to fix things?

A number of enhanced controls and disciplines have been introduced to address this and management believes that appropriate corrective actions are in place.

The Company has not seen any material weakness in overall demand and the previously announced cost saving actions remain fully on track.

That doesn't seem particularly bad to me. Not enough to cause the share price to crash 59%.

Broker updates - we'll have to wait until the morning, as this happened too late in the day to be covered today. Thankfully, the house broker contributes to Research Tree, so I've looked up their last forecasts, which were issued in late Jan 2018. They mention a new FD in that note, so perhaps the profit warning relates to newly discovered errors by the former FD? Or the new FD might have ballsed up the forecasting? I'm guessing there.

The old house broker forecast was for £70.0m adj. EBITDA for y/e 04/2018. This would have produced adj. PBT of £53.3m.

Today's update says 20% below expectations, so I make that £56m revised EBITDA (20% down) and £39.3m revised adj. PBT (down 26% on previous forecast).

If we assume that EPS would also be down 26%, then that gives about 17.5p revised adj. EPS for 04/2018. At 123p per share, that's a revised PER of 7.0.

Whilst that seems low, remember that CVR reckons it will have £150m net debt, which is 67% of the market cap, so very significant.

A reader comment below flags up that this might mean banking covenants in danger of being breached. Net debt: EBITDA would be 150:56, which is 2.68 - getting a bit high - and above the limit of 2.5 times (see below). Whereas on the old forecast the ratio would have been 150:70, or 2.14.

The last results statement indicates that the covenant is 2.5 times. So it looks as if the company could be heading for a bank covenant breach, perhaps?

At 30 April 2017 the Group’s net debt totalled £95.7m (1 May 2016: £86.1m) and comprised £95.8m of term loans and £10.7m drawn down under the Group’s working capital facilities, less cash of £10.4m and unamortised banking arrangement fees.

The bank facilities include a leverage and an interest cover covenant. The leverage covenant requires debt (excluding any amounts drawn down on under the Group’s invoice discounting facility) to be less than 2.5 times the last 12 months adjusted EBITDA.

The interest cover covenant requires adjusted EBITDA to be at least four times net finance charges. At the measurement date of 30 April 2017 leverage was 1.6 and interest cover was 11.5.

(excerpt from final results, published 17 Jul 2017)

Therefore, I would say that there is now an elevated risk that the company might need to shore up its balance sheet with another placing.

EDIT (10 Mar 2018) - the house broker has issued an update note, which makes some reference to the bank covenants. Its view (implied, but not specifically stated) is that CVR might remain within its bank covenants, because the £130m invoice discounting facility (of which £61.1m was drawn at the last interim results stage, is outside the scope of the bank covenant).

This is very important information. Why on earth didn't the company flag up its expectations re compliance (or not) with banking covenants in yesterday's statement? I think the company should issue another RNS, clearly explaining the situation with regard to bank covenants, to the market.

Based on the new information from WH Ireland today, it strikes me that I probably don't need to be as worried about banking covenants as I initially was. Hence this update, since new information has emerged. (End of EDIT)

My opinion - I've never been particularly keen on this low margin, indebted business, and have never owned any shares in it, as far as I can recall - although there were a couple of times when it looked tempting, on a low PER & very high dividend yield. I stopped reporting on it in 2016 once its market cap went above my then cut-off of about £300m.

Graham has reported on it more recently several times, being consistently bearish. Indeed, his report recently on 29 Jan 2018, was prophetic, so take a bow Graham, for sticking to your guns, and spotting the potential problems here over a month before this profit warning;

I am a long-time bear of this alcohol wholesaler and retailer, and have generally been on the wrong side of the share price.

Having said that, the last time I covered it, the share price was 386p. Perhaps the tide is turning

Trading is said to be in line with expectations for the full year. But although it isn't explicitly said, there is an implication that H1 did not quite go according to plan, and the shortfall will be made up in H2.

As Graham mentioned in his report of 15 Dec 2017, the problem with Conviviality is that it's "low margin, acquisitive, debt-ridden" - put those 3 things together, and it's arguably an accident waiting to happen. Note that Graham spotted the warning signs, which the computers didn't particularly - the StockRank was a fairly respectable 68 - so sometimes I think man can be one step ahead of the machines!

I do wonder if CVR bit off more than they could chew, in terms of acquisitions? Management have grown the group by about 5-fold, in terms of revenues, through acquisitions. It strikes me that the finance department just couldn't cope, and messed up the forecasting.

The balance sheet was already stretched, and now it looks likely that banking covenants might be breached. That would probably need a refinancing to be done, raising fresh equity.

Is it an opportunity now, after the 59% share price fall? For me, it's a no. My golden rule on profit warnings these days, is to forgive one-off, easily fixable issues, but to run for the hills when something serious has gone wrong (e.g. possible/likely breach of banking covenants).

As mentioned earlier this week, I've recently re-read the outstanding Stockopedia guide to profit warnings, which is available here in eBook, or here in a video. The clear conclusion from that study, was that statistically it has been better to sell immediately. On average companies which have profit warnings tend to under-perform the market for some time afterwards. That's an average mind you, so there are exceptions which do recover quickly.

I suppose it's possible that today's 59% drop might have been due to stop losses & panic sellers. I wonder if in the morning, Institutions might decide to come in and support the share price? There might be scope for some nifty trades, who knows, but personally I'll pass on that - it's too easy to get sucked into averaging down on losing trades, and before you know it, you're left with a thumping great loss, trying to catch the falling knife.

I expect Graham might mention CVR in tomorrow's SCVR, which should be interesting.

As an aside, I think we should all be questioning valuations a bit more. Given that the market as a whole seems expensive, and that share prices are slammed hard when anything goes wrong, then is risk:reward favourable at the moment overall? Possibly not.

Look at this for a horrendous chart. That fall has been so severe, I wouldn't be surprised if there's a partial bounce at some point in the next day or two?

Fulham Shore (LON:FUL)

Share price: 9.0p (down 16.3% today, at market close)

No. shares: 571.4m

Market cap: £51.4m

(at the time of writing, I hold a very small residual long position in this share)

Trading update (profit warning)

This is another one that has put out a profit warning during market hours - at 3:36pm today. This is one of the reasons that I don't personally use limit orders (automated buy orders, which are triggered if a price drops sharply). Companies need to stop doing this. Meetings to review financial performance must be held at the end of the day, so that if a profit warning is to be issued, it can be planned overnight & released at 7am. For goodness sake, get with the program guys!

Fulham Shore owns 2 casual dining chains - Franco Manca, which makes very good wood-fired pizzas, with authentic Italian ingredients. The Real Greek, which is a smaller chain doing nicely presented, but fairly basic Greek-style food & drink.

I like this group - it has experienced management, who know what they're doing. Also, based on my (admittedly small sample) of talking to staff, it treats them well - this is vital because it's not only the right thing to do, but if staff are treated well, they stay put - saving on recruitment & training costs.

There is a big shortage of good chefs at the moment, I am being told by my sector experts. Also, I recently entered the sector myself, having funded a private restaurant startup. It is tough out there! Casual dining is probably the worst sector I can think of at the moment - due to rising costs, and lots of excess capacity. Weeding out the weaker players is likely to take years.

So this share could be a long-term winner, in my view, but at the moment it's difficult to find anyone winning in casual dining, apart from the consumer.

How bad is it? Not good, but not a disaster either;

The Fulham Shore's current financial year ends on 25 March 2018 and the results for that year will be announced in mid-July 2018.

We expect to report an increase in turnover and Headline EBITDA* for the year ending 25 March 2018 over the last financial year ended 26 March 2017.

Whilst turnover for the year ending 25 March 2018 will be broadly in line with market expectations, our Headline EBITDA will, however, be below market expectations.

This is primarily due to trade in our suburban London restaurants which, whilst they are still busy, are serving fewer customers than last year with higher operating costs.

That last sentence explains what is wrong with the whole sector - fewer customers (due to over-capacity) meaning that customers are spoiled for choice. Whilst costs are rising significantly. I think even the best operators can probably only mitigate the effect of these problems, so expect profits to fall everywhere - the only issue is by how much, and can they survive?

As usual, we now have to try to work out the financial impact. I feel less inclined to buy the shares, given that the company can't just give a more straightforward - profit will be down X% to £Y. I get so fed up with the rubbish disclosures of so many company updates, wasting mine & other peoples' time, by partially disclosing the facts, and then creating a trail for us to follow back, so we can work out the actual figures.

It's difficult to avoid the impression that companies and advisers might be deliberately confusing private investors, so that people paying for research can move first, with better information?

In fairness to the company, it did warm us up to the idea of an H2 warning, with this comment published on 15 Dec 2017 with its interim results;

Although we believe our half year figures to 24 September 2017 were satisfactory, our full year Headline EBITDA* to 25 March 2018 will depend on how our suburban estate performs in the second half of the year and also on the timing and performance of new openings.

I visited a number of its new openings, and they were absolutely deserted.

Indeed, without wishing to sounds like a smart-ass, my comments here on 9 Jan 2018 specifically foresaw another profit warning with this share;

The only restaurant chain I'm interested in buying more of (to add to a tiny scrap I currently hold) is Fulham Shore (LON:FUL) . However, having seen how empty several of its new sites are (taking space from Debenhams), I think FUL could have another profit warning in it. Also I'm a little nervous about its bank debt. So I don't think there is any rush at all to go back into this very difficult sector. There are likely to be many casualties, particularly of independent operators, in my view.

My opinion - I've consulted my sector expert today. He and I both agree (and have done for some time) that FUL is the only decent casual dining sector share to even consider buying right now. The rest are dross (see EDIT below for clarification on this).

However, he reckons that this sector is in for a maybe 3-year period of terrible pain, as costs continue to rise (especially staff, and rates), whilst over-capacity means that there's not enough business to go around. It's not consumer confidence that's the problem, it's just that there are way, way too many restaurants. Some will have to close, in order to enable the survivors to rebuild their LFL sales, and margins.

For that reason, much though I would like to buy back into FUL in decent size, it feels far too early. I'd rather just wait, there's no rush here, in my opinion.

EDIT: A reader kindly pointed out that, whilst not a restaurant chain as such, Patisserie Holdings (LON:CAKE) is anything but dross. I agree with him completely, so just want to clarify that I did not mean to include CAKE in my original comment. I was more referring to Restaurant(LON:RTN) (I have a small short position on this) where tired brands are seeing falling profits, and Tasty (LON:TAST) , Comptoir (LON:COM) , and Richoux (LON:RIC) - all three of those are really struggling.

A new broker note on FUL from Allenby has been published today, which is available on Research Tree. It reinforces my view that FUL shares are not actually good value yet, despite recent falls. With the roll-out of new stores almost grinding to a halt, and with cost pressures continuing, Allenby is forecasting profits to flat-line from here onwards. Also, debt is a bit higher than I would like. So this broker update has confirmed my initial view that there's not much appeal right now to buying FUL shares. It's difficult to see much upside in the next, say, 2-3 years. End of EDIT

That's it for today. Sorry I didn't get round to CMS or IDP or TTG, but the profit warnings were more interesting.

EDIT: Graham covered IDP and TTG in the next day's report here. End of EDIT

As you might have gathered, I'm struggling with the workload, pressure & declining motivation, after 5 years writing these reports, so I'll be easing towards a sabbatical in May 2018 onwards. Partly because I want to write a couple of books on investing, and do some travelling. More on that later, but it feels like we're nearing the right time for me to pass on the baton re the daily small caps reports. But that's up to Ed & Dave of course.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.