Good morning,

There is a crazy supply of results today, I won't be able to cover everything. Let's see how far I get by mid-day.

This is as far as I got:

- French Connection (LON:FCCN)

- Watchstone (LON:WTG)

- Staffline (LON:STAF)

- LoopUp (LON:LOOP)

- Trackwise Designs (LON:TWD)

French Connection (LON:FCCN)

- Share price: 36p (-6%)

- No. of shares: 97 million

- Market cap: £35 million

Interim Results to 31 July 2019

One of the important things to bear in mind with this one is that H1 tends to be very weak, compared to H2.

Last year, FCCN achieved breakeven for the full-year despite an underlying operating loss of £5.5 million in H1.

This year, the company has made an H1 underlying operating loss of £5.3 million. A slight improvement. The company says results are in line with expectations.

Key elements of today's result:

- revenue down 12% due to a reduction in floor space and lower wholesaling revenue.

- number of operated stores and concessions down from 103 to 90

- cash at £10 million (versus £12.8 million at the same time last year).

Retail Like-for-Likes

FCCN reports positive "retail and ecommerce LFL sales in UK/Europe" at 1.4%.

This is a tricky thing to unpack, because of the inclusion of ecommerce sales. Typically, when we look at Retail LfLs, we want the figure as it relates to stores only. Ecommerce is presumed to be available on a full national basis anyway, so the idea of making a "life-for-like" adjustment doesn't apply to it.

The company does report that UK/Europe retail space fell by 8.2%. It also reports that total ecommerce revenue "reduced slightly".

These facts being true, I am inclined to think that the store-only LfL figure for UK/Europe is positive, but it's not quite proven. A pity that we have to play with the numbers, instead of being told in simple terms how the stores are doing

The store on Oxford Street is now closed, as expected.

Remember what the bull thesis says (e.g. Paul in October): that when the worst leases expire, FCCN will be free to make good money from ecommerce, licensing and wholesaling, without the retail albatross around its neck.

But the Chairman never ceases to surprise. Watching FCCN for several years now, I have found it odd that he has been so relaxed about the store portfolio. My impression has been that he likes having a big store portfolio, even if they make losses. Otherwise, he might have been more aggressive about shutting them down!

This impression is confirmed once again today by the fact that French Connection has opened a new store, less than a mile from the Oxford Street store which bled money for years. If I owned shares in this today, that news alone would make me want to hit the sell button.

Here's a link to the blog post in July, announcing the new store. Today's RNS says:

In response to this and the desire to maintain a central London presence in July we opened a new concept store close by in Duke Street, called the Studio, showcasing exclusive merchandise and a curated selection of product. The result so far has been encouraging, but it is still early days.

But whose desire is it to maintain a central London presence? I think it's the Chairman's desire, not customers'!

FCCN's blog post describes the concept store this way:

An on-site photographic pieces, an exclusive product range and an artisan coffee shop - we've completely transformed your shopping experience and we think you'll enjoy exploring our new home.

A gallery and coffee shop in central London don't strike me as lucrative opportunities for shareholders.

Perhaps needless to say, I think this is another sign that FCCN is in serious need of new leadership which might run the company in a realistic way. But the Chairman owns more than 40% of the shares, so it remains his to do with what he wants.

Wholesale

This revenue stream fell by 14% at constant currency. The pre-tax contribution from this division fell by £0.7 million to £3.9 million.

Licensing - up slightly compared to last year.

Sale process - this bit is important. FCCN says:

Discussions are still ongoing with a number of parties... We believe that further time is required to bring the process to a successful conclusion and expect the process to be concluded by the end of our current financial year.

The financial year ends in January 2020.

My view

This remains a very interesting story, and might benefit from a takeover in the next few months. Indeed, a takeover announcement could be released any day.

FCCN is on the hook for £45 million of future lease payments, and prospective buyers will be closely examining their options. What losses will they incur in running off the store portfolio, and how much cash will be left after that?

The Chairman is 73 and has been flirting with prospective buyers for quite a long time now. If we don't get a deal by the end of the financial year, I would start to question whether there is any price at which he will sell, or if he is too attached to the business to actually give it up.

The shares do seem cheap if you focus on the profits in licensing and wholesaling. Where I lack conviction is in the brand itself: will people still be willing to pay a premium for FCCN gear in 10 years? Maybe, maybe not. Or perhaps the cigar butt will have enough puffs left in it to make the shares a bargain at current levels, even if the brand is dead by then?

It's an intriguing share and I look forward to seeing how it works out for shareholders.

Stocko sees some merit, calling it Contrarian - how accurate!

Watchstone (LON:WTG)

- Share price: 99.5p (+7%)

- No. of shares: 46 million

- Market cap: £46 million

This is a good and surprising result.

I previously believed that ptHealth was worth very little, since it had been acquired by Rob Terry in shady circumstances.

It turns out that Watchstone (Quindell) has been able to salvage £22 million through its disposal, along with the disposal of other healthcare businesses in Canada.

All of these businesses collectively earned EBITDA of C$1.5 million last year, so you can understand why I thought they weren't worth much! But their H1 2019 EBITDA improved to C$2.5 million, and a price point of £22 million has been achieved.

Well done to the bankers and advisors who helped push this deal through.

The pay day for Watchstone shareholders will depend on progress in the ongoing litigation with the previous buyer of Quindell assets.

Like FCCN, this is another potential "deep value" situation where the outcome for shareholders will depend on news flow that is not very easy to predict. It's tempting to get involved, but I'm trying to improve my sleep quality these days.

Staffline (LON:STAF)

- Share price: 123.3p (-20%)

- No. of shares: 69 million

- Market cap: £85 million

What a difference a year makes to this blue-collar recruitment firm.

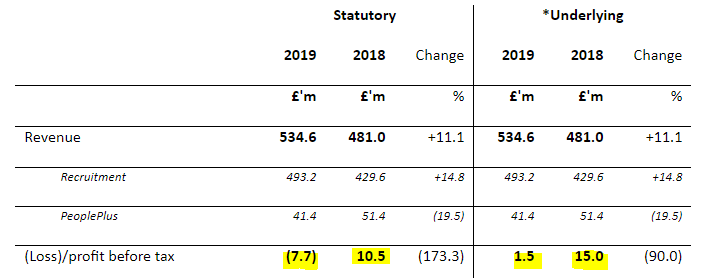

The underlying results exclude the amortisation of acquired intangibles and reorganisation costs.

As readers will remember, Staffline has had a myriad of problems in 2019, and raised new money at 100p.

It's not out of the woods yet, as customers became wary of dealing with a company that didn't have its own house in order:

...there has been a slowdown in new contract momentum in the current financial year, which the Company largely attributes to the impact of the delay in publication of the 2018 full year results.

Staffline points to non-financial KPIs such as net promotor score and "client happiness", but they look a poor substitute for financial progress.

Outlook - the forecast for full-year adjusted operating profit is reduced to £20 million. We can expect the adjustments to be huge. The Board expresses confidence in medium and long term prospects.

Market overview - as mentioned before in this report, Staffline's customers have been suffering from rising wages and a tightening labour market. Wages have been getting more expensive and employees are getting more permanent work, instead of temporary work. Of course there are winners and losers from this process - the employees themselves probably don't mind getting a pay raise and a permanent job.

The company blames Brexit uncertainty for this, which I guess makes sense if there are fewer EU workers available to put into temporary blue-collar roles.

Staffline also says that its customers are worried about the so-called "no-deal Brexit", and are voluntarily reducing their use of temporary labour, so as to avoid a skills shortage in case they lose access to this supply:

This is frustrating as Staffline is extremely well prepared for a tightening labour market, with well-developed strategies that will ensure that we continue to be in a position to supply all our customers' flexible labour requirements.

The economy and consumer confidence are blamed. I note that the UK economy is teetering on the brink of a recession, but is not quite there.

As the article linked to states, "there are a record number of people in work, and pay growth is strong". If you didn't know any better, you would think that this is good news for a company called "Staffline". But it's not the right kind of employment.

Long term ambitions are unchanged:

We do not believe the issues and distractions of H1 2019 have caused any permanent damage to the business, but that we have simply lost time in the development of the Group.

Net debt is £89 million at the end of June, but the company raised about £37 million in new money in July.

Lenders have insisted that there will be no new acquisitions until January 2021, and no dividends until then, either. They are getting an amendment fee for their efforts and will also get an exit fee when the debt facility expires. Good for them. Covenants are being relaxed for now, but will gradually become more strict next year.

Forecasts are slashed. Liberum (via Research Tree) have reduced next year's EPS forecast from 42.6p to 29.5p.

My view - definitely "cheap". Very ugly, too.

The problem that I find with the recruitment sector in general is that firms seem to be undifferentiated from each other. Staffline claims to be differentiated, e.g. in its Recruitment division:

We have developed a unique methodology... to systematically improve worker engagement.

...we have found the long sought-after solution to the previously unanswered question of how to improve the engagement of a large blue-collar workforce. Our proprietary solution has significant applications beyond just the scope of our existing recruitment business.

I am unable to judge the veracity of this.

The main attraction with this share (besides the cheap valuation) is probably the involvement of HRnet, now a 29.9% shareholder.

GBP has strengthened in recent days as markets speculated that the Brexit outcome would be more favourable for the currency, but the combination of weak GBP and a weak share price at Staffline could possibly see HRnet swoop in for the rest of Staffline's shares.

That could create a great result for Staffline shareholders, but if it doesn't happen, would you still be interested to own Staffline shares?

LoopUp (LON:LOOP)

- Share price: 75p (-26.5%)

- No. of shares: 55 million

- Market cap: £41 million

This is one that Paul covers, but in his absence let's see what's going on.

It's a "premium remote meetings company", which says it has a new approach to conference calls.

The top line is certainly growing, with an 86% revenue bounce this year.

But profits are still elusive, and there is no sign yet of any benefits from operating leverage.

The gross margin has fallen and adjusted operating profit is up by only 29% (from £0.9 million to £1.2 million).

Worryingly, the existing customer base has started using LoopUp less. The "macro climate" is blamed, rather than competition or other factors, as users are said to be having fewer meetings.

Does this pass the smell test - are businesses having fewer meetings now, because of the macroeconomic environment? It's hard to say.

The interim results only go until June. LOOP says that since June, the macro headwinds have got worse and that existing customers are now generating 11% less revenue, with "the potential for higher full year average erosion".

A bear on this stock could argue that customers are using the product for a while, but then simply deciding they don't need to use it as much as they did before (rather than not having any meetings because of Brexit/oil strikes on Saudi Arabia/etc).

Outlook - the company admits it has poor visibility:

The volatile nature of the macro environment makes it difficult to project the near term evolution of average usage, which is very much linked to the overall economic activity of our customers.

Revenue growth for FY 2019 is now just 26%. It had previously been pencilled in at 37%.

My view - it's still growing the customer base, but I think it's reasonable to start worrying about whether the existing customers are going to keep using the product after a year or two of trying it out.

The 26% total revenue growth forecast for this year also doesn't scream that this deserves to be rated as an extraordinary growth story.

If the macro climate is really to blame, then perhaps growth will start surging again next year - I can't completely discount that possibility.

Overall, this strikes me as an extremely difficult company to invest in, where even the managers admit that they don't know what usage will be in the short-term. So the average investor will have little to no chance.

If you're willing to do the work to research this one in detail, you might find an investment thesis that adds up. For the average person who likes to keep things simple, this will be just another Story Stock, as categorised by Stocko. On top of having an awful StockRank, it passes two of James Montier's short-selling screens.

Trackwise Designs (LON:TWD)

- Share price: 81.6p (-36%)

- No. of shares: 15 million

- Market cap: £12 million

This small company makes "specialist products using printed circuit technology".

It products an EBITDA of £237k on sales of £1.5 million. Both EBITDA and revenues are down compared to this time last year.

Macro conditions, (Brexit, USA/China) as well as the ongoing delay in the resolution of the T Mobile / Sprint merger in the US, have impacted the RF division, particularly a major customer who supply Sprint.

And the outlook is no good:

Market conditions have not improved since the half year and the Board now anticipates a material reduction in revenue and operating profit for the year in comparison to market expectations. While IHT (Improved Harness Technology) revenues are expected to grow strongly in FY20, the Board expects next year to also be behind market expectations

This company listed in July 2018, at an IPO price of 105p.

My view: I haven't studied Trackwise before, but am mentioning it here as an example of another stock which a) says that macro conditions are no good for business, and b) is issuing a major profit warning in the year following IPO.

Calling for an end to vague headlines

I've emailed the Competition and Markets Authority this morning, asking them to put more information in their RNS headlines.

Perhaps some people would find this petty, but I've noticed that I click on every single "Merger Update" announcement that the CMA releases, just in case it is relevant to a company I am interested in. Most of the time, this is not the case! If they would only put more info in the RNS headline, I wouldn't have to do this.

It's true that this might only save me 30 seconds for each RNS from the CMA, but multiply that by 100x, and now we have a nice saving. Maybe I would save an hour over the course of a year.

Then when you take into account the fact that 1000's of relatively high-earning people are using the RNS service, and might also be losing time due to vague headlines from the CMA, then my email calling for change might be the most value-creating thing that I've done for a while!

General comment

We have had a huge number of profit warnings today and in recent months.

Perhaps I have occasionally been too sceptical when companies blame the macro environment for their lack of profits. When so many companies are saying the same thing, investors should probably sit up and take notice.

That being said, I note that the FTSE is actually up today, with Sterling only down by 0.1% (so I don't think that the market is down on a GBP-adjusted basis).

So on balance, I think today's results help to prove that small companies are extremely risky. This is true not just for the "value" plays which are poor quality (FCCN, STAF) but also for the unproven high-growth stocks (LOOP).

I was discussing the wave of profit warnings with Paul recently, and he made an excellent point: that the internet (and other technological developments, I guess) are making companies obsolete at a faster and faster rate.

When the economy is evolving and changing so quickly, the repercussions on "old" businesses can be brutal. New businesses try to ride the wave of change, but of course it is very hit and miss for them, too.

I hold to the view that the economy of 2019 is creating huge amounts of value, but it's not necessarily getting funneled into the hands of shareholders in small, publicly-listed companies. It instead seems to be going to employees, to consumers, to the shareholders of the tech giants and other large corporations, and to the shareholders of private companies.

Take Mailchimp for example (my own business is one of its customers). Mailchimp has been profitable from day one, enjoys diversified and sticky recurring revenue streams, and has never sought or needed outside funding.

It's the perfect type of business, and it's impossible to buy shares in it, because it never had an IPO. Rather than give away such an attractive asset, the owner is keeping it for himself.

I'm sorry to say that I think many of the best businesses stay private for the very reason that they are the best, and the owners don't want to share their profit streams with the great unwashed. And on the other hand, those small companies which do come to market, more often than not, are being sold because the owners don't see much real value in them.

The moral of the story is a simple one: that we should scale our exposure to small companies in line with the huge risks that accompany them, and that we should be incredibly careful and selective in this sector of the market.

Commiserations to those of you who have suffered losses overnight. As Jesse Livermove said:

Fate does not always let you fix the tuition fee. She delivers the educational wallop and presents her own bill, knowing you have to pay it, no matter what the amount may be.”

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.