It’s hard to overstate just how important the internet has become to individual investors. Over the past two decades, online services have unleashed cheaper trading and better quality tools and information. But not all of these new services are problem-free. With a growing army of investors online, investment discussion boards have proliferated. While these boards can be a source of ideas, they can also be a hazard to both your wealth and your sanity.

We’ve warned before about the way emotions and behaviour cause chaos whenever you get groups of investors talking together (especially when they’re strangers). Last summer - in Can you beat the market reading stock market bulletin boards? (here) - Ed showed how discussion boards can be awash with ‘groupthink’. They become well-protected havens of one-sided information, often with a preference for small, highly speculative stocks that tend to perform badly.

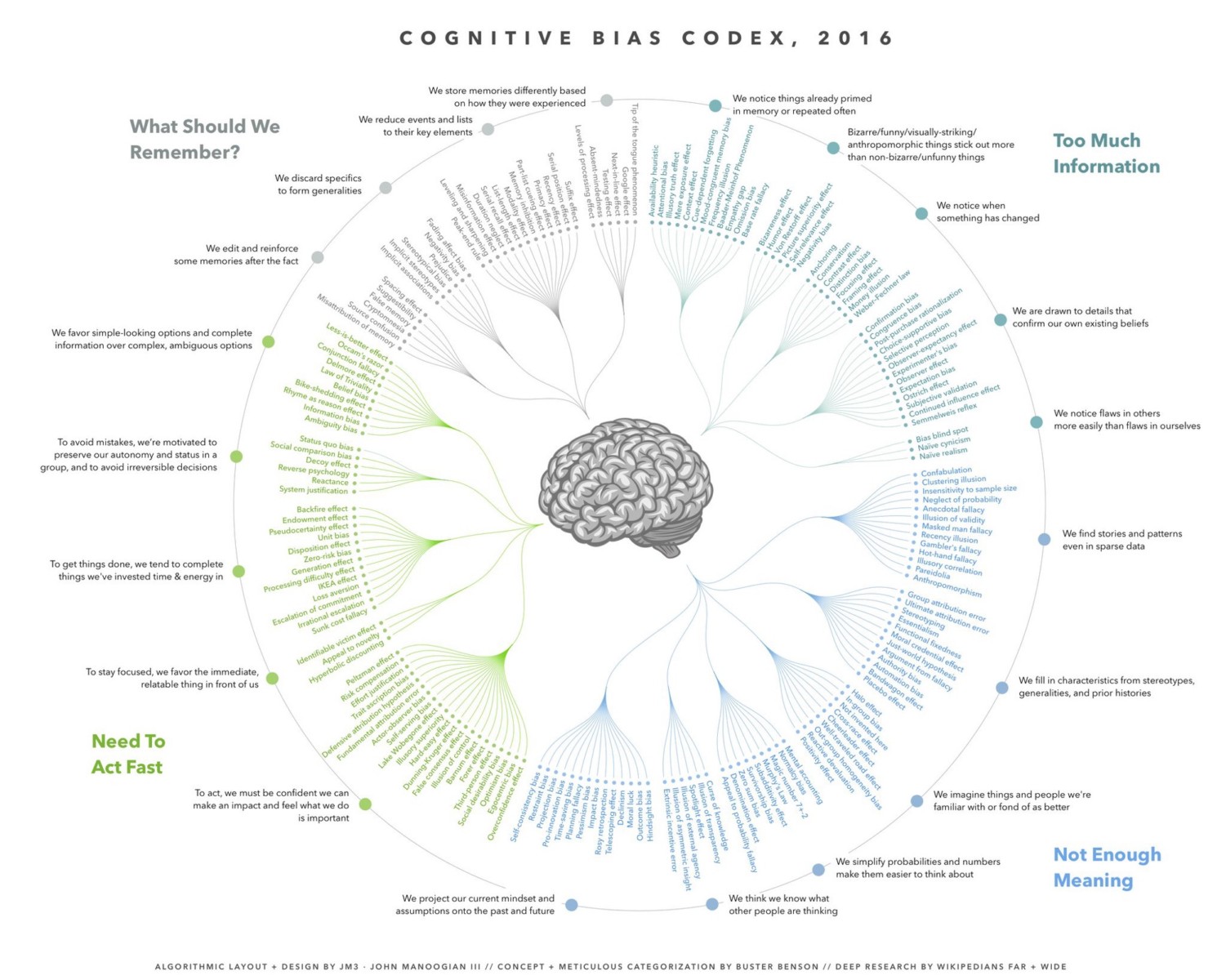

As the excellent Tim Richards has written - in an article that covers the same research I’m about to - the killer cognitive error here is Confirmation bias. Our natural inclination to hear views and opinions that agree with our own give investment discussion boards magnetic appeal.

Until recently, data on the influence of these boards has been pretty limited. We’ve done our own assessments of how popular bulletin board stocks perform - and the answer is often quite badly.

But in reality, many investors don’t need data to know just how aggressive and misleading some bulletin boards can be. We regularly hear from individuals who say they’re rehabilitating from the costly mistake of using forums as a primary source of investment ideas.

Hunting for the facts about investment discussion boards

Earlier this year, a group of researchers in the United States picked up the challenge of quantifying these risks. Their starting point was 34 million message posts across nearly 13,000 boards covering quoted US companies. These came from the Yahoo Stock Message Boards and InvestorHub, which is owned by ADVFN. Between them, they claim tens of millions of visitors every month.

The point of the research was to find out whether investment message boards provide a useful service. Specifically, they were looking at whether user sentiment changed much depending on external information about stocks. In other words, if there was bad news about a company, did the message board reflect it?

They also wanted…