Bovis Homes (BVS LN) Price 780p

TNAV ’16e 780p

Mkt Cap £1.1bn

Investment Case

My first thoughts are “how do I not lose money”, rather than looking at upside (which is reasonable in Bovis’s case).

Value emerging?

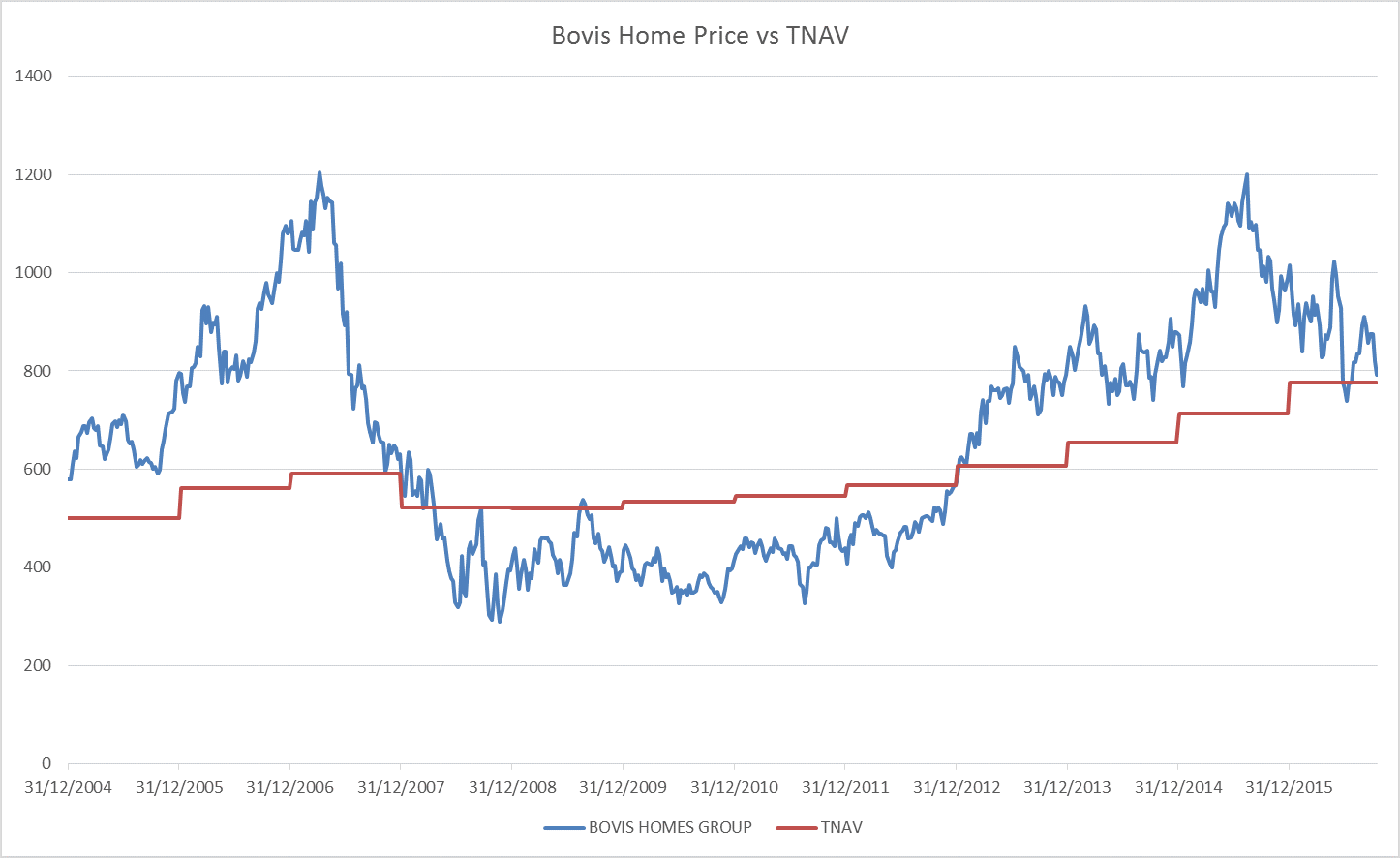

Bovis is trading at 1.0x 2016 P/TNAV (tangible net asset value) 0.9x FY17 P/TNAV, a discount to the sector and to its own non recession history. This TNAV has historically provided a floor to housebuilders in times of non recession. The historic valuation range is 1.0x to 1.4x (excluding recessions). The industry dynamics look reasonable from a supply / demand point of view although affordability remains stretched, especially in London (but Bovis has v limited exposure here) and demand does look to be sustained by Help to Buy, which accounts for c30-35% of industry volumes. A definite tail risk would be that the Govt withdrawsH2B.

Bovis is a national housebuilder, which had 3934

completions in 2015 (2784 in South, 723 in the Midlands and 427 in the North). Of this 2901 were private legal completions,

social housing was 848 units and PRS 185 units.

Only 1 site out of 102 is within

the M25, so extremely limited Central London Exposure. Longer term the

business wants to get to 5-6000 completions pa from 150 sales outlets.

....But not the Best Housebuilder

This is certainly not the best UK housebuilder and has been dogged by operational issues such as build cost inflation.Bovis has lagged its peers in ROCE consistently since the financial crisis delivering 14% against the peer Group average of 20%. This is down to slowerasset turn. Bovis's margins are in line with number of its peers but the sell down rate is slower on a per site basis. The challenge for management is to increase ROCE. ROCE should start to improve this year and next as smaller faster asset turn sites acquired in the last couple of years feed into the mix. Should ROCE improve to 17-18% (but still below the peer group) I would expect the shares to rerate from 1x TNAV to a premium, to say 1.25x. As the TNAV would also be growing this rerating would see over 50% upside on the shares on a 3-4 year view.

Management - not admired

In my opinion FDs moving to CEO have a…