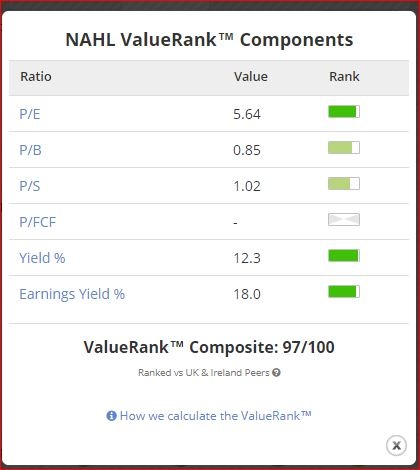

I think NAHL (LON:NAH) looks interesting, especially after recent falls. I am currently a holder. It is cheap (p/e of 6-7) and currently trading on a 9% dividend. The business is also easy to understand.

However, there are a number of risks to the business which is why it will probably only be a small, short-term holding for me. The biggest of these are proposed regulatory changes to minor whiplash injuries. NAHL (LON:NAH) hasn’t been clear about how this will affect the business but in its IPO documentation it did say the group focuses on “higher value” non-road traffic accidents. Even if the changes wiped out 40% of its PBT (see my guesstimates below) the share would still be trading on around 11x earnings at present.

I am not passionate about this share but I think the valuation and dividend looks attractive for a business that has been well run. So I thought I’d share my research. I’d welcome others’ views.

What is National Accident Helpline?

In its own words: NAHL is a marketing business focused on the UK personal injury (PI) market, advertising through its core brand, National Accident Helpline. Established in 1993, the group’s business has become the UK’s largest outsourced marketing services provider to the personal injury market, which generates c £3bn in fees generated mainly by law firms. The group’s core business model is based on enquiry origination through direct response marketing, connecting claimants who have been injured in non-fault accidents with specialist panel law firms (PLFs). It’s main cost is marketing.

The group’s Underdog character, launched in 2010, has helped promote the brand, which – the company claims – is one of the most recognised, most trusted and most searched in the UK. The group has built five panels of rigorously selected law firms, which pay for NAHL’s marketing and overhead expenses on a cost plus variable margin model, based on a predictive enquiry formula for the PLF’s individual geographic area and specialisation. In addition, NAHL receives commission from the sale of third-party products to the PLFs. The group’s brand media spend, marketing experience and PLF relationships are the main competitive barriers to entry. Many law firms do not have the expertise or levels of cash available to do national marketing campaigns themselves.

The…