Following on from our Quarterly Strategies Review, we thought we’d take a closer look at the recent performance of our Guru income screens. As we’ve mentioned, blue chip dividend stocks were an appealing prospect for investors last year but the blistering pace of the market in the first quarter of 2013 has shaken the yield tree quite considerably.

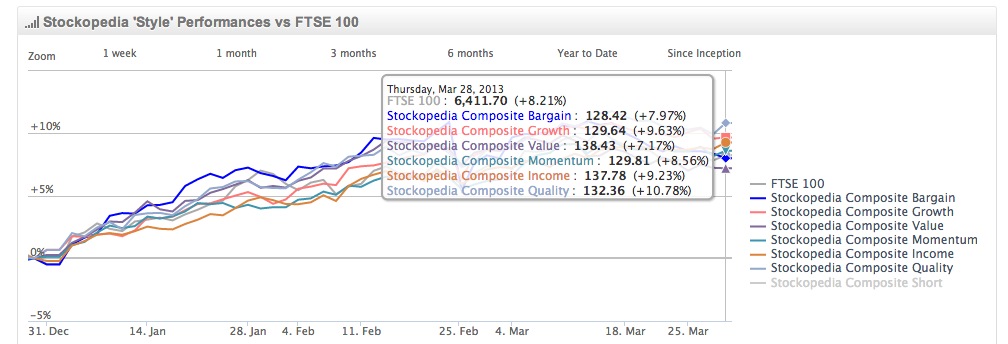

We track the performance of our strategy indices here and, as the following chart shows, income has done well overall as a strategy – but not perhaps in the way you’d expect. With surging prices and increasingly attractive yields, good quality smaller stocks have proved to be most attractive to investors of late.

Sleeping Dogs

For dividend hunters with a pure focus on high yield, going after the largest and theoretically safest stocks in the market have been for many months a useful solution to the limp returns on offer from cash and gilts. Throughout last year, one of the best known dividend strategies tracked on Stockopedia – Dividend Dogs of the FTSE 100 – put in a stellar performance as the index bounced off its spring lows and climbed through the year. Over 12 months, the Dividend Dogs delivered a 25.9% return (before dividends) versus 9.8% for the wider FTSE 100.

We might have expected that strong performance to continue into 2013 but, intriguingly, it hasn’t quite been the case yet. Over the first three months of the year the Dividend Dogs strategy has turned a 5.41% profit against 8.7% for the index. Part of the reason seems to be that despite some strong performers, a small number of the top ten stocks qualifying as Dividend Dogs have seen their share prices dip slightly in 2013, among them RSA Insurance, Aviva and Royal Dutch Shell. For long term income investors, those wavering share prices may not matter. After all, if your hold period is (near to) forever, lower prices ought to mean higher yields for anyone buying up the shares now!

Indeed, when Michael O’Higgins first presented his Dividend Dogs (or Dogs of the Dow) strategy, his primary focus was on picking large and (supposedly) reliable stocks because of their attractive dividends rather than their capacity to deliver capital growth. Still, while it’s a simple strategy to follow, one of the downsides is that its …