One of the long-term endeavours at Stockopedia is to model the strategies devised by some of the world’s greatest investors. Among the fascinating aspects of the quarterly rebalancing and tracking of those strategy portfolios is to see how they fare when markets take a tumble. Needless to say, given the pull-back in August, the 60-plus strategies inspired by the legends of finance had a rocky ride during the third quarter. But it wasn’t all bad news...

Most strategy styles - including quality, value, growth and momentum - notched up reasonable gains during the first half of the year. Among the highlights after six months, the composite return for the Quality strategies was 12.3%, and for the Growth strategies it was 10.9%. At that stage the FTSE SmallCap index (excluding investment trusts) was ticking along well, up by 10.2%, and the FTSE All Share was up by a more modest 1.0%.

Investors lose confidence

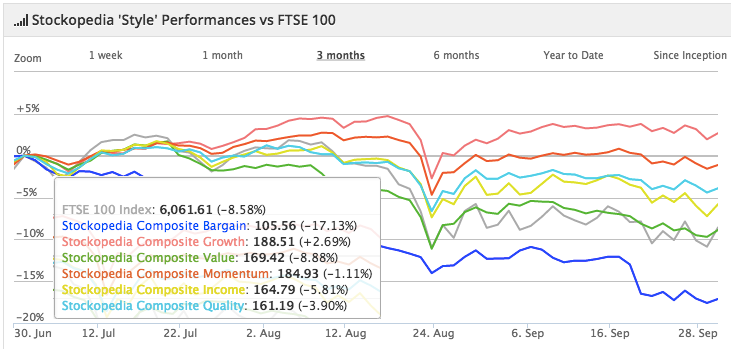

But it was all change in Q3. A short, sharp pull back in market valuations left the FTSE 100 down by more than 7.0% for the quarter. The FTSE All Share fell by 6.6% and the FTSE SmallCap XIT fell by 2.4%.

Naturally, this correction had an impact on the gurus. The Stockopedia Composite Long - which aggregates all the strategies - ended the quarter down by 5.2%, but remains up by 3.3% year to date. But based on investment styles, it was only the Growth strategies that managed a positive return. Their aggregate gain was 2.7%.

Growth strategies also lead the way in the year to date, with an overall gain of 14.9%. That’s followed by Momentum and Quality strategies, which are both up 8.5%.

| Index / Strategy Composite | % Change Q3 2015 | Year to Date 2015 |

| FTSE 100 | -7.0% | -7.7% |

| FTSE 250 | -4.8% | 3.7% |

| FTSE All Share | -6.0% | -5.5% |

| FTSE SmallCap XIT | -2.3% | 7.7% |

| AIM All Share | -4.0% | 3.3% |

| Guru Strategy Composite | 2.5% | -5.3% |

| Income Composite | -5.8% | 1.6% |

| Growth Composite | 2.7% | 14.9% |

| Value Composite | -8.9% | -1.3% |

| Momentum Composite | -1.1% | 8.5% |

| Quality Composite | -3.9% | 8.5% |

| Bargain Composite | -17.1% | -17.8% |

In Europe in the year to date, the Stockopedia Composite Long is…