Sainsbury (366p and 3.0% of JIC) I have bought a holding this morning. I am not a huge fan of food retailers; it’s not quite a zero sum industry with growth only coming by luring customers away from competitors but it is not far off. I do however, think there is an opportunity to make money out of Sainsbury in the short to medium term.

Since releasing its interim results for the 6 months to 30th September 2013 the share price has fallen over 10% which I think has presented an attractive opportunity. Using consensus forecasts it is on a March 2014 PE ratio of 11.1x for 19% earnings growth and is on 10.4x to March 2015 for 7% growth. What’s more the prospective dividend yield is 4.8%.

Interim results weren’t bad with like-for-like sales (ex-petrol) up 1.4%, underlying profits up7.0% to £400m, earnings per share up 9.2% and the interim dividend was increased by 4.2%. It increased market share to 16.8%, its highest level in a decade. Operating margins improved by 7bps to 2.47% and the company said that having made £55m of cost savings in the first half it was on track to reach £100m for the full year. Justin King has certainly done a good job improving its fortunes after it lost out to the relentless rise of Tesco during the 80’s and 90’s.

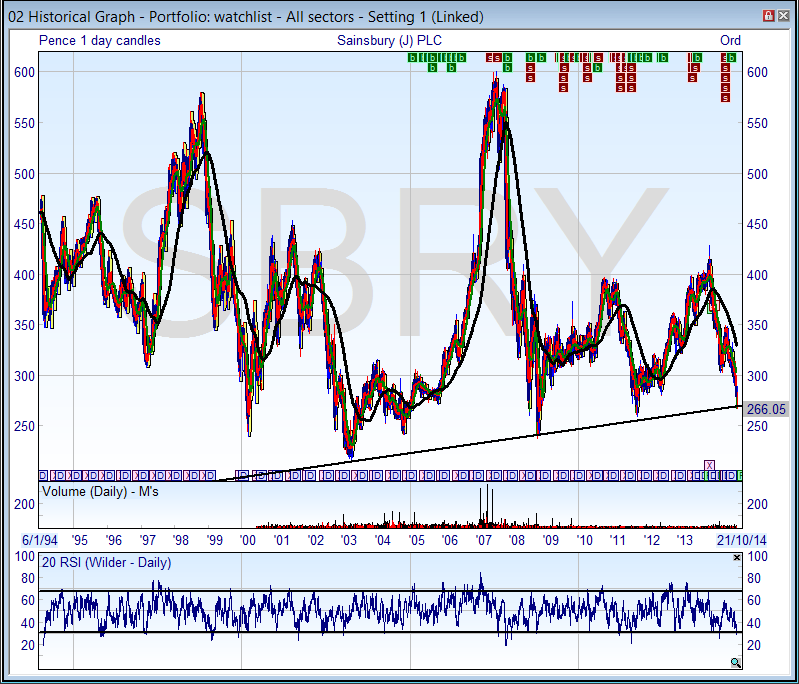

Conclusion; the chart above shows how the stock has come off during the last month and is now very oversold, (as shown in the bottom Relative Strength chart). I could easily imagine the share price recovering back up to the 420p level and if I take a forecast final dividend of 12.6p into account then that gives a return of around 18%. Stocks with defensive characteristics are not flavour of the month at the moment but that could quickly change should the market have a setback. (See transactions)