The SIF portfolio has had very little exposure to the volatile fortunes of housebuilders over the last year. Persimmon had a six-month spell in the portfolio but was sold for a 15% loss in October last year, a casualty of the Brexit sell off.

The portfolio may now get a chance to make up some of these housebuilding losses.

FTSE 250 housebuilder Redrow has slammed into my screen results like a hit single this week, entering at number 3. It’s the top eligible stock in the screen, so is up for consideration as the portfolio’s next buy.

No evidence of a slowdown

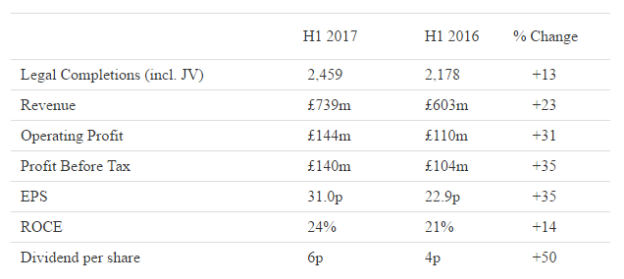

Housebuilders crashed after the EU referendum. However, while the impact of Brexit remains uncertain, Redrow’s results are not. The group’s recent interim results showed that completions rose by 13% to 2,459 during the first half, while the average selling price rose by 12% to £344,000.

Admittedly, much of this price increase was due to Redrow shifting its focus towards the south of England. But there’s no denying the strength of the firm’s results:

Redrow is relatively unusual among FTSE 250 stocks because it’s controlled by chairman and founder Steve Morgan, who has a 29% stake in the firm. Mr Morgan originally retired in November 2000, but rebuilt his stake and took control again in 2009. If he decides to retire again I’d want to sell, but he has certainly presided over a strong turnaround.

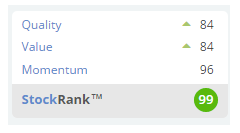

Stockopedia’s algorithms are also keen on this stock. Redrow currently has a near-perfect StockRank of 99:

Redrow is currently the joint top housebuilder by StockRank, alongside Bellway. Let’s take a closer look at the figures.

Is it really good value?

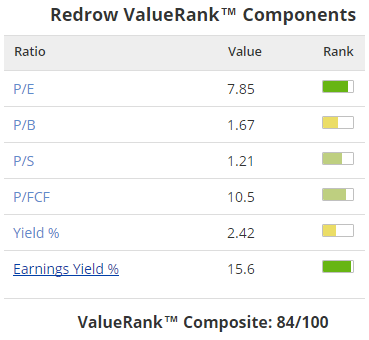

Valued on its P/E ratio, Redrow looks cheap, with a trailing P/E of 7.9 and an earnings yield of 15.6%. The problem is that this valuation has the potential to be misleading.

Although Redrow’s profits are genuine enough, this business is heavily cyclical. Such stocks often look cheap when they’re near the top of a cycle, because the market is discounting the inevitable downturn.

If we take a fuller look at the components which make up Redrow’s ValueRank, we can see clues that suggest this stock may not be as cheap as it first seems:

The main metric I focus on with property stocks is…