It’s now been six months since I added the first stocks to the Stock in Focus Portfolio on 27 April. In this week’s article I’m going to review the portfolio’s progress during its first half year. Has my experience so far suggested any changes I should make?

I’ll also review the SIF Portfolio’s two oldest holdings, Go-Ahead Group and Persimmon. As these are now six months old, both are due for review. If they no longer qualify for my screen, they’ll be sold.

Finally, I’ll tot up the dividend payments for the shares in the portfolio over the last six months, and add this to my portfolio return.

Progress in an odd market

Since April, I’ve added a total of 17 stocks to the SIF portfolio. You can see how things look on the SIF Portfolio page.

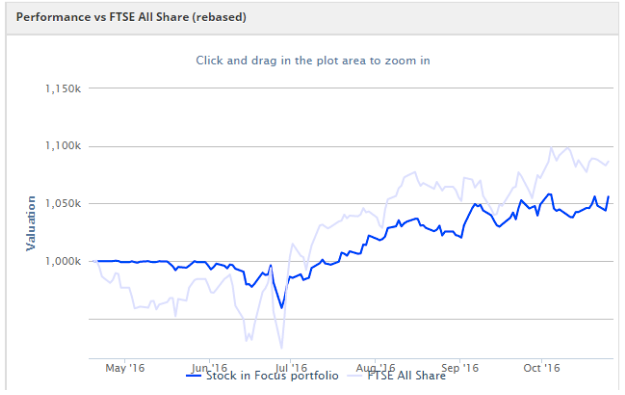

The value of the portfolio -- including uninvested cash but excluding dividends -- has risen by 5.6%. Over the same period, the FTSE All-Share has risen by almost 10%. In other years, a 5.6% gain over six months might have been enough to beat the portfolio’s FTSE All-Share benchmark. But 2016 has been exceptional for the rapid gains seen in certain sectors of the market.

I chose the FTSE All-Share for my benchmark as the portfolio is open to stocks of all sizes. But one downside of this benchmark is that it is very heavily weighted towards the FTSE 100. The big cap index has delivered rapid gains for natural resources stocks and defensive businesses whose earnings are mainly generated outside the UK.

These sectors aren’t proportionately represented in the SIF portfolio, as they haven’t qualified for my SIF screen. I believe this is one of the main reasons why the portfolio has lagged the benchmark over this relatively short period. A second factor limiting potential returns is that the portfolio also contained a high level of cash for the first few months of its life.

I’m hopeful that over longer periods, these effects will fade. In any case, I’m not too distressed by a 5%+ gain in six months.

Go-Ahead Group disappoints

My purchase of Go-Ahead stock was poorly timed. Soon after the bus and train operator joined the portfolio, it issued an update warning that profit margins on its troubled Govia Thameslink franchise would be lower than expected…