As the summer ends, results season is drawing to a close. The outcome for the SIF Portfolio has been fairly positive, in my view, with several H1 laggards making up lost ground over the last few weeks.

The portfolio now contains thirteen stocks, so is well on the way towards my target of 15-20 holdings. Monthly rebalancing will start in late October, when my first holdings reach six months of age. Ahead of that, I’m going to review results from some of the portfolio’s biggest movers, and ask how well the SIF portfolio is matching its brief. This was:

Affordable growth. A blend of value, growth, quality and momentum. Hopefully with an emphasis on managing risk through diversification and the avoidance of outliers.

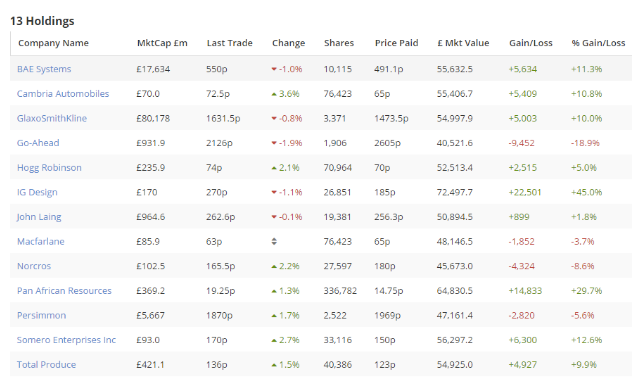

Here’s a snapshot of how the portfolio looked after markets closed on 6 September:

The story so far

Alongside the official Stock in Focus Portfolio fantasy fund, I also maintain a portfolio in the Folios section of my Stockopedia account that mirrors the fantasy fund. The benefit of this is that I get to benefit from a greater level of reporting and analysis.

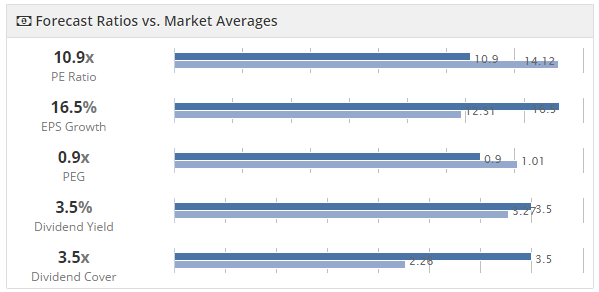

Here’s a screenshot from the Analysis tab of the portfolio, which give an idea of the overall characteristics of the SIF portfolio:

The dark blue lines represent the SIF portfolio, the pale blue is the market. These show that the forecast P/E of the portfolio is below the market average, while forecast earnings growth is above average. These combine to give an attractive PEG ratio of 0.9. I’m also very happy with the 3.5% portfolio yield, which is well covered by forecast earnings.

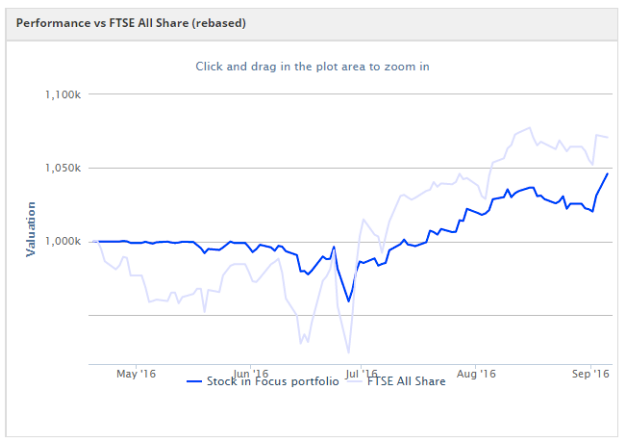

Given my target profile of affordable growth, I’m pretty happy with this profile. Although the portfolio is still too young to draw any conclusions, it doesn’t contain any stocks that make me uncomfortable. Performance so far has lagged the benchmark FTSE All Share, but with so few stocks in the portfolio at first, this was to be expected (in my view).

Results review

Eleven companies have issued trading updates or results since they were added to the portfolio. I’m not going to try and cover them all in the space of one column -- instead I’ll focus on the best and worst performers so far.

Go-Ahead Group (-19%)

My decision to add bus and train operator Go-Ahead to…